Last August, I wrote to you about an industry with enormous potential.

It was, and remains, in its infancy … but it’s made tremendous strides in the past five months.

- I’m talking about the metaverse: a universal online platform that will revolutionize human interaction.

The basic premise? A virtual world where users can interact and own their experience.

The pandemic significantly sped up the shift to online platforms when individuals were unable to interact in person due to lockdowns.

Just think about how popular Zoom (Nasdaq: ZM) meetings have become and the ease of shopping for groceries on Instacart. These things have rapidly become commonplace.

But beyond the adoption of tele-health appointments and remote classrooms, the virtual reality (VR) market is set to explode. And it’s a big part the metaverse.

Many industries are just beginning to embrace VR technology, including healthcare and energies like oil and natural gas. These innovations are useful to make virtual diagnoses and safely navigate hazardous environments.

Massive corporations are looking to establish themselves as market leaders.

And if it wasn’t obvious enough … just look at how Facebook rebranded as Meta Platforms (Nasdaq: FB) to become an early leader. And, other companies have followed its lead.

The $59 billion digital payment company, Square, rebranded to Block (NYSE: SQ) to focus on implementing blockchain technology in its business operations.

Other early corporate adopters like Epic Games and Roblox (NYSE: RBLX) are already operating their own versions of the metaverse.

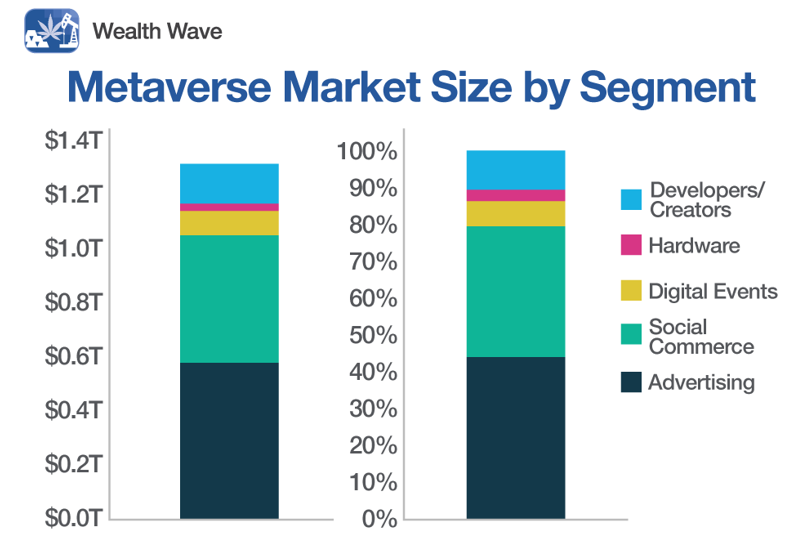

- Grayscale Investments projects that the total metaverse market size could exceed $1 trillion per year!

The market includes many opportunities for companies looking to create hardware, software, payment infrastructure, content and more.

Here are a handful by market segment:

Cryptocurrencies will play a significant role in the development of the metaverse, and funds are pouring into the space.

- The combined fully diluted market capitalizations of the top 10 metaverse-related crypto projects already exceed $43 billion!

By November 2021, over $200 million worth of items were bought in various virtual universes.

Popular brands are jumping in to increase their reach and release virtual products. Notably, Gucci and Nike (NYSE: NKE) both collaborated with Roblox in partnerships to release digital products in its virtual universe.

Metaverse Market Ideas

There are many ways to play the rise of the metaverse across multiple asset classes ... but each comes with varying degrees of risk, though the potential rewards are tremendous.

Here are two approaches:

1. ETFs/Stocks

Exchange-traded funds (ETFs) and stocks are the safest ways to gain metaverse exposure.

As for ETFs — which reduce risk through diversification — the biggest and most established fund is the Roundhill Ball Metaverse ETF (NYSEArca: META), which launched last June. It highlights several key investment areas including infrastructure, computing power, commerce and hardware.

The ETF only holds established, highly liquid companies with greater than $250 million market capitalization and average daily volume over $2 million.

META’s top three holdings are Meta Platforms, Nvidia (Nasdaq: NVDA) and Microsoft (Nasdaq: MSFT).

After surging to a high of $17.11 in November, it has slid down since … largely alongside other tech companies since the beginning of the rotation from growth to value stocks.

However, it’s worth watching for a bottom as META is trading at an all-time low, and the ETF could be a steal given the level of investment and prospects for future metaverse growth.

As for individual stocks, the top holdings of metaverse ETFs are one of the first places to look. These stocks have higher upside potential than a basket of securities, but keep in mind that they inherently carry more risk.

2. Cryptocurrencies/Digital Assets (NFTs)

These investments are the riskiest form of exposure to the metaverse, but they have substantial upside.

Cryptocurrencies will be a main payment medium for digital commerce, and blockchain technology will efficiently validate ownership and provide the metaverse’s infrastructure.

Digital assets and non-fungible tokens (NFTs) can be useful for collectors looking to own assets related to their favorite athletes, celebrities and content creators … but their applications expand beyond collectibles.

NFTs offer exclusive blockchain-verified ownership for anything ranging from concert tickets to digital real estate.

3. Virtual Land Rush

Virtual real estate is an intriguing asset class that could expand if interactions continue shifting online:

- One company is banking on it after spending $4.3 million in virtual land so far.

- Bloktopia, a virtual 21-level skyscraper, has created its own token that can be used to purchase virtual space.

- And NFT project Pavia just launched on Cardano (ADA), the sixth-largest crypto by market capitalization. The metaverse project offers 100,000 NFT land parcels … 60% of which have already sold out.

These asset prices fluctuate wildly based on the supply, demand and perception of utility ... but all investments clearly carry some degree of risk, so always conduct your own due diligence before entering a position.

Timing is important, and a tumultuous market for technology stocks and other riskier assets can increase volatility.

However, with the world shifting online, the metaverse could be one of the biggest opportunities for investors since the beginning of the internet.

All the best,

Sean

P.S. If you’re interested in NFTs and their explosive future earning potential, I highly suggest you check out this video of the NFT Investor Summit.

You’ll learn all about non-fungible tokens (NFTs) and ways you can play the emerging trend. But this video is only available until 11:59 p.m. Eastern tonight ... so act fast.

For more information, click here now.