The 2021 trading year just started … and markets are already on a wild ride. The good news is that select commodities are looking red-hot.

Opportunity No. 1: Dig That Uranium!

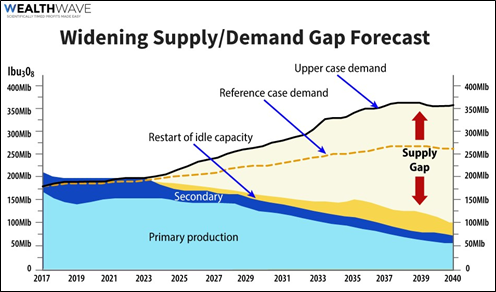

Uranium stocks started to ignite in November, then blasted off. I laid out the reasons why in a string of Wealth Wave articles (examples here and here). But the biggest reason is a basic reason: A worsening pinch in supply and demand.

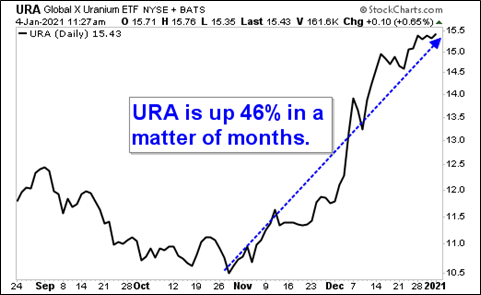

An easy way to play this is the Global X Uranium ETF (NYSE: URA). It has an expense ratio of 0.71%, and it has been on an atomic rocket ride since November …

From where I sit, the move in uranium stocks is just getting started. There’s a lot more to come.

Opportunity No. 2: Cannabis

I can make a list of cannabis-leveraged companies that will likely do very well in 2021. We recently took two rounds of triple-digit percentage gains on GrowGeneration Corp. (Nasdaq: GRWG), and there’s a lot more where that came from.

U.S. multi-state operator (MSO) cannabis companies tend to be better values than their Canadian counterparts, but a lot will depend on what happens in today’s special election in Georgia, where two U.S. Senate races will be decided.

If the Republicans retain at least one seat, Sen. Mitch McConnell will remain Senate Majority Leader, and he will block legalization of cannabis on the Federal level. If the Democrats win both seats, Sen. Chuck Schumer will schedule a legalization vote.

I believe U.S. MSOs can do well without legalization — many are doing great right now. But the market will be watching this election closely.

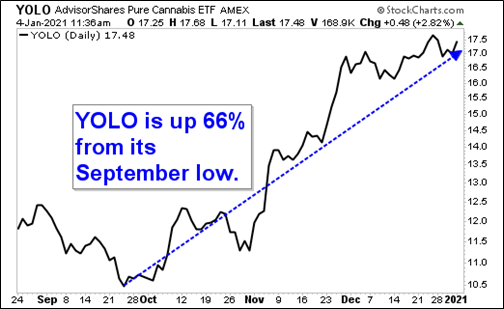

How can you play it? I favor the AdvisorShares Pure Cannabis ETF (NYSE: YOLO). It has an expense ratio of 0.75%.

Like URA, YOLO has already racked up great gains, but it has a LONG way to go. I own YOLO in my personal portfolio and I’m hanging tight.

Opportunity No. 3: Precious Metals

Yesterday saw gold push above its five-month downtrend.

Silver is rocketing too. And select precious-metal-leveraged stocks are already blasting off the launch pad.

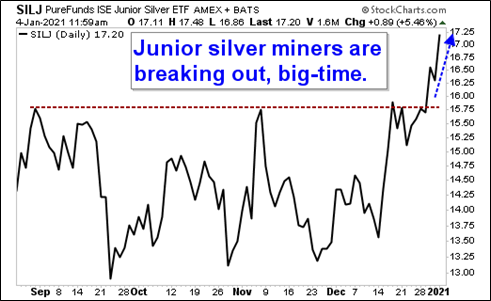

Silver usually outperforms gold in bull markets, and junior miners outpace the senior miners. So, while there are many good choices, one of the better ways to play this is with the ETFMG Prime Junior Silver Miners ETF (NYSE: SILJ). It has an expense ratio of 0.69%.

That’s a strong technical breakout. And by any historical standard, gold and silver miners are dirt-cheap. I know that we’ll be buying the dips.

There are a bunch more commodities looking dirt-cheap right now. But I’ll cover some of those in a future column. For now, these three will get you started.

The starting gun has been fired. Your 2021 fortune awaits. Get to work!

All the best,

Sean