The headline inflation number this week was 6.3% — the highest in 31 years. America collectively just about fell off its comfy chair when the numbers rolled out this week.

• Well, brace yourselves. Inflation is about to get a LOT higher.

I’ll tell you why and I’ll show you how to prepare — and profit — from the looming increase.

I’m not talking about Weimar-Germany hyperinflation. I AM talking about the kind of inflation we haven’t seen since the 1970s, running in the high teens or over 20% — maybe even higher.

The reason we know this is due to data from the Bureau of Labor Statistics (BLS), which tracks official inflation and has a bunch of numbers behind the scenes. Specifically, I’m talking about prices for intermediate demand.

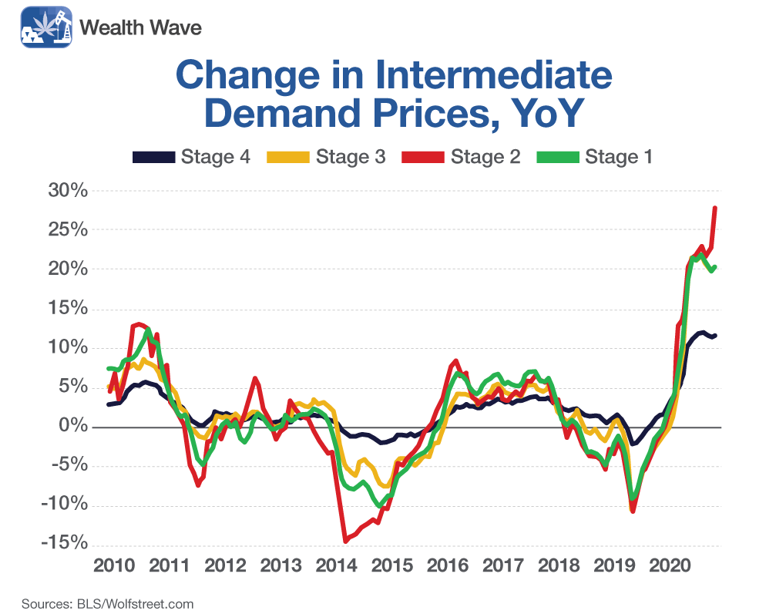

The BLS measures four stages of intermediate demand, tracking the prices in the pipeline of products moving from producers to consumers:

1. Stage 1 Intermediate Demand tracks price changes in products purchased by industries that sell output to other industries. Examples include industrial electric power, wholesale paper and plastic, wholesale metals and minerals. This is where inflation starts.

2. Stage 2 Intermediate Demand tracks the next stage of metals, minerals, paper and plastics, as well as corn, prepared animal feeds, investment services and related services.

3. Stage 3 Intermediate Demand follows the next stage of distribution, including package delivery, slaughtered chickens, staffing services and so on.

4. Stage 4 Intermediate Demand entails prices paid by those companies that buy products to sell to consumers, including truck transport, jet fuel and other things added in.

What it all boils down to …

• There is MASSIVE inflation in the pipeline, and it’s coming our way.

|

As you can see in the chart, Stage 4 Intermediate Demand (prices paid for goods just before they get to consumers) was up 11.8% in October year over year.

I believe it’s likely that most of that price jump will be passed along to you and me. And that’s the good news:

• The black line, which tracks Stage 4, is the lowest line.

• Stage 3 Intermediate Demand prices jumped 20.2% year over year in October.

• Stage 2 demand prices soared a stunning 27.8% year over year.

• And Stage 1 prices jumped 20.4%.

Now, some of these costs MAY be absorbed by industries along the way … but it’s a fair bet that much of these price increases will make their way through the pipeline. That means you can expect price jumps of 18%, 19%, 20% or more year over year when that inflation hits the consumer.

Part of this is because we’re coming out of the pandemic and prices fell in the early part of last year. So, comparisons are part of it.

But also, the global economy has kicked into higher gear, people have money in their pockets and last year’s pandemic destroyed supply of energy and other industries. Tighter supplies mean higher prices.

Wall Street and the White House have clung to the fig leaf of “transitory” inflation for a long time. I’ve been saying the emperor has no clothes since May.

But I’m not here to say, “I told ya so.” What I am here to do is offer a few ideas to protect yourself from inflation — and potentially profit.

Idea No. 1: Gold

Historically, precious metals proved their worth as a refuge from inflation. And sure enough, when those latest headline numbers came out, gold took off like it was running at the Kentucky Derby. There will be pullbacks, so consider buying at those opportunities.

Idea No. 2: Energy

History also shows there is no industry more leveraged to inflation than oil and gas. After a big run-up, leading oil and gas stocks have consolidated, giving back some of their gains. This pullback can be bought, too.

Idea No. 3: Treasury Inflation-Protected Securities (TIPS)

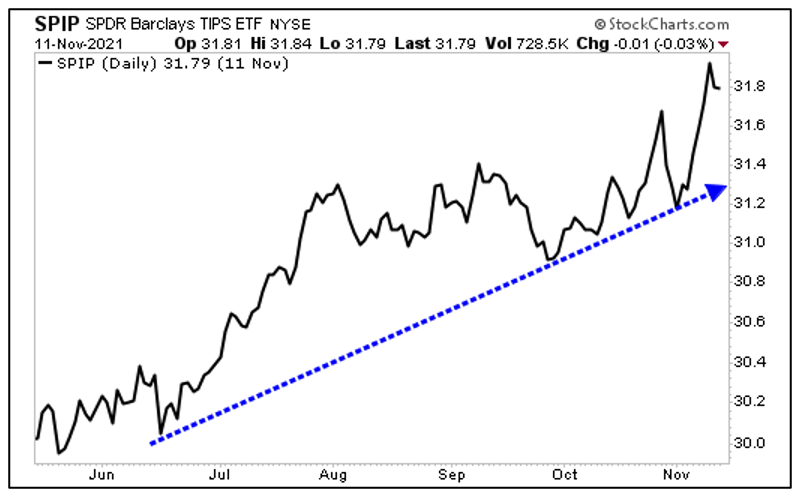

These are Treasuries that are indexed to inflation. In times like these, TIPS are the ONLY Treasuries I want to own or recommend. In fact, I recommended a TIPS fund, the SPDR Portfolio TIPS ETF (NYSE: SPIP), to my Wealth Megatrends subscribers months ago.

|

As you can see, it’s doing well AND paying investors a dividend every month.

Whatever you buy, make sure you do your own research. But higher inflation is coming. Prepare yourself … and get ready to profit, too!

Best wishes,

Sean