Is the Fed Going to Destroy Your Purchasing Power?

If you’re wondering what the single biggest driver of the stock market currently is … I’ll give you a hint.

It isn’t the overall health of the economy — it’s the Federal Reserve. It has taken the reins, and it’s been busy. By the end of May, 40% of U.S. dollars in circulation were printed in the prior 12 months.

As I’ve mentioned over the past couple of months, money printing isn’t the only factor juicing up inflation.

The COVID-19 pandemic disrupted supply chains to where producers couldn’t meet their demand, and the economy reopening launched a wave of all-at-once consumer spending post-lockdowns.

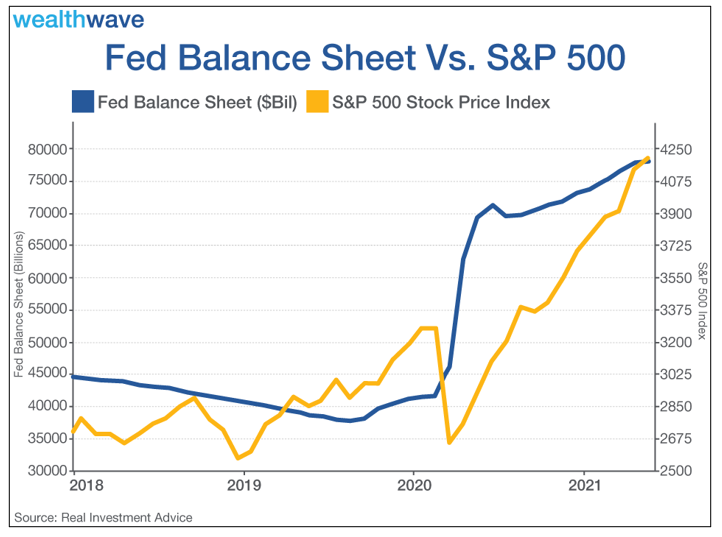

The Fed also has a purchasing arrangement for $120 billion of bonds and mortgage-backed securities per month to increase the money supply. This measure has bloated the Fed’s balance sheet to over $8 trillion for the first time ever.

There have been talks of tapering the bond-buying. It will certainly be gradual. This would be the first step towards taking the economy off of the Fed’s life support, but the market won’t like it.

Take a look at this chart of the Fed’s balance sheet versus the S&P 500 index. It shows the impact of the Fed’s massive-scale asset purchasing, and while providing liquidity for markets, it clearly has a huge impact by inflating equity prices.

This has contributed to the “everything bubble” that we see in real estate, equities, etc., along with interest rates near zero.

What’s more, Federal Reserve Chair Jerome Powell just said that the Fed will not consider raising rates solely because of inflationary concerns, which means they will remain at rock-bottom until the Fed is forced to take action.

Powell has been beating the drum about waiting until full employment before raising rates, but this could be a problem.

The U.S. missed its jobs growth estimates in both April and May, and they weren’t particularly close.

May’s jobs growth of 559,000 came in 116,000 lower than predicted, while April’s report missed decisively by falling 734,000 jobs short of Wall Street’s expectations for a million added!

The stock market has been weighing the effects of higher inflation for months, notably watching after 10-year Treasury rates started climbing above 1% in January.

Since then, investors have weighed the telling signs of inflation against the Fed’s calming voice of “transitory” price increases.

Smart investors won’t wait for the results of the “weigh-in” to take advantage of surging inflation.

Hard assets, energy, precious metals and quality companies with stable cash flows offer better protection than hoarding cash or chasing growth.

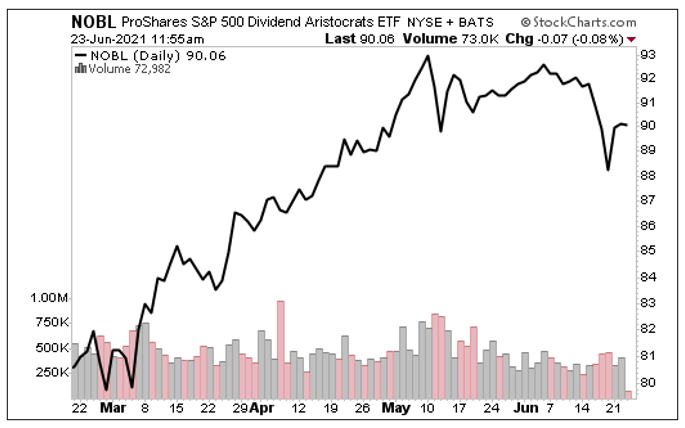

One fund that I’m looking at right now is the ProShares S&P 500 Dividend Aristocrats ETF (BATS: NOBL) which only holds strong companies boasting a minimum of 25 years of consecutive dividend growth.

Its chart has trended higher, and the recent pullback may offer an opportunity to get in at a discount. Of course, always conduct your own due diligence before buying anything.

My Wealth Megatrends subscribers get my best specific stock picks for our changing macroeconomic climate, and I hope to see you there.

All the best,

Sean, with Sam