If you like the 7.5% inflation print we saw in January, you’re going to love what’s coming down the pike now that commodity powerhouse Russia is moving troops into its neighbor Ukraine, which is also rich in commodities.

The good news is you still have time to protect yourself – and your portfolio – come what may.

Let me start with some charts to help show what I mean.

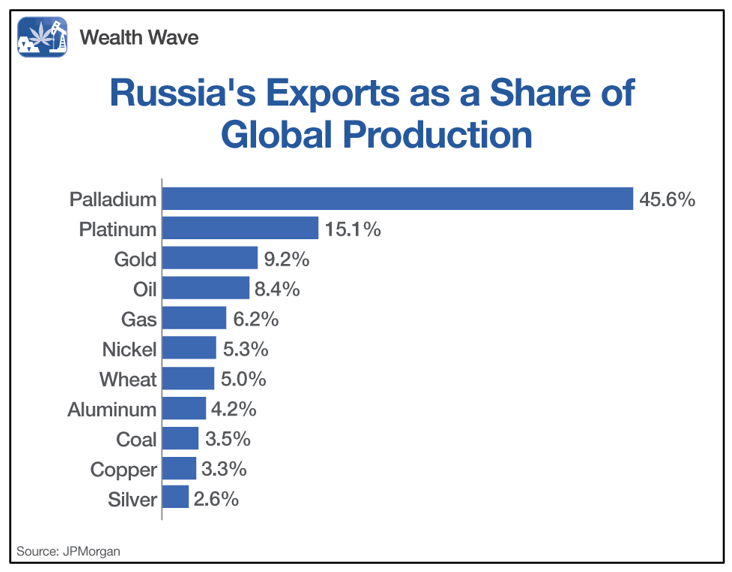

First, I called Russia a commodity powerhouse.

I’m not just talking about oil, though, Russia is an important oil exporter … accounting for roughly a quarter of OPEC+ output, 12% of global crude oil production and 7% of U.S. crude oil imports.

In fact, I’m talking about everything else:

You can see that Russia is the major source of the world’s palladium, as well as a big source of gold, natural gas, nickel and more.

- So, if we impose trade sanctions on Russia, then a major source of all these materials will be cut off.

And yes, that’s inflationary for customers who have to buy elsewhere.

Meanwhile, what about Ukraine? Ukraine is loaded with minerals. It has the largest proven uranium reserves in Europe. It also has massive reserves of titanium, manganese, iron, titanium, natural gas. And wheat. Boy, does Ukraine have a lot of wheat. It also has corn, barley and rye. In fact, Ukraine is the top supplier of corn for China.

It also has corn, barley and rye. In fact, Ukraine is the top supplier of corn for China.

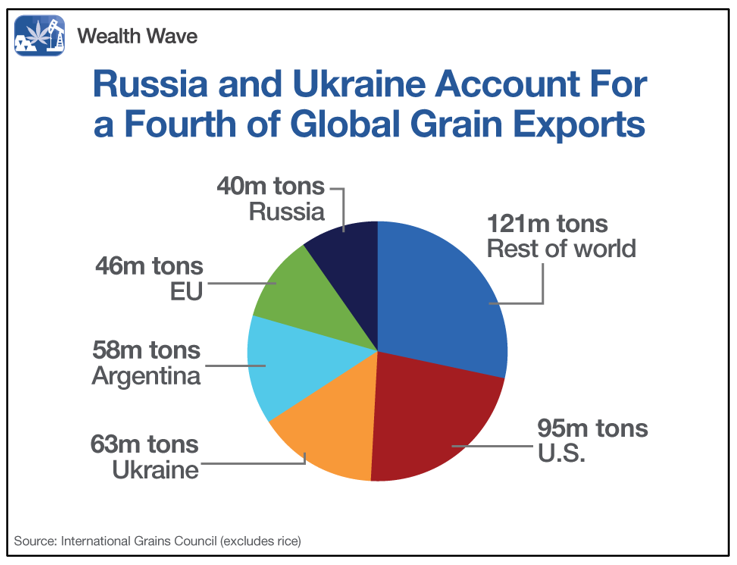

- All this makes Ukraine “the breadbasket of Europe.” Interestingly, Russia is also the world’s top wheat exporter.

And that brings me to my next chart:

Together, Russia and Ukraine ship one-fourth of global grain exports.

So, if you’ve been looking at Russia’s incursion into Ukraine, consider that if Putin can just bully that country into following his lead on grain exports, that’s going to give him incredible power.

And agriculture prices? U.S. wheat and corn prices are already soaring. That inflation will be passed along the food chain and end up on your dinner table. But ...

Don’t Fret This Inflation Intimidation

I’ve clearly given you reasons to worry … but I wouldn’t panic.

First, the U.S. and its NATO allies haven’t imposed strict sanctions yet. Indeed, the sanctions have been very light.

As UBS Chief Economist Paul Donovan said:

Germany closed a pipeline that wasn’t open. Japan banned sovereign debt issuance that doesn’t take place. The U.S. pledged to stop the Russian government accessing international finance they don’t really need.

Second, President Biden’s team is hurrying to work out a deal with Iran on the nuclear arms deal that was wrecked by President Trump.

If a deal gets worked out — probably in the next week — Iran will surrender nuclear material it’s been enriching since 2018 in return for the lifting of sanctions on its oil and gas exports.

Iran has between 60 million and 90 million barrels of oil in storage. In the short term, it can increase its production from 600,000 barrels per day (bpd) to 1.5 million bpd. It can crank up natural gas production, too.

Come to think of it, a deal with Iran may be why the NATO allies haven’t rushed ahead with sanctions on Russia’s energy industry yet. They may want to get that supply from Iran in place BEFORE they cut off Russian oil and gas exports.

But there’s no “Iran” to step up and replace Russian wheat exports — never mind the combined agricultural might of Russia and Ukraine.

- My recommendation would be to look at some of the exchange-traded products (ETPs) that allow you to play the move in agricultural commodities.

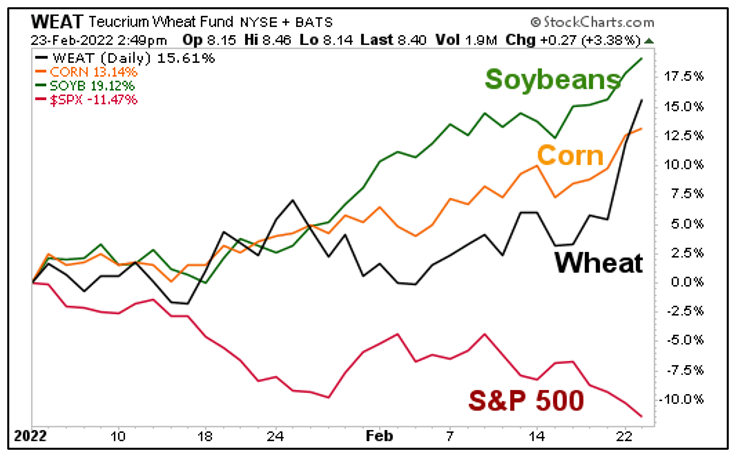

Three I talked about in early January were Teucrium Wheat (WEAT), Teucrium Corn Fund (CORN) and Teucrium Soybean (SOYB).

These are commodity pools regulated by the Commodity Futures Trading Commission. Unlike futures, these funds can be traded in an ordinary brokerage account.

And since I last talked about them in January, all three funds have been ramping up:

Wow!

- We’re looking at a 13.1% gain for CORN, a 15.6% gain for WEAT and a 19.1% gain for SOYB.

Compare that to the 11.5% loss in the S&P 500 over the same period.

Do you think the conflict with Russia over Ukraine is going to end anytime soon? Do you think we’ll see new sanctions going forward?

If you believe — as I do — that it’s likely going to get worse before it gets better, then these funds will help armor your portfolio against inflation … and potential bad times in the market.

And if you’d like more specific trade recommendations, I highly recommend you check out my Wealth Megatrends service.

Remember to always do your own due diligence before entering any investment.

Best,

Sean Brodrick