Growth Stocks Beware, Balance Sheet Reduction Is Here

Most stocks are struggling, and U.S. Treasurys are collapsing. The Wall Street Journal calls it “the worst bond market since 1842,” and the reason should be obvious: The Federal Reserve has been printing money with wild abandon since 2008, and now the inevitable consequence — rampant inflation — has burst onto the scene.

The unfortunate reality for investors today is that this historic bull run we’ve been on is officially out of steam. And the biggest threat could be to your wealth. With the crisis about to accelerate, Weiss Ratings founder Dr. Martin Weiss will be holding a series of three emergency briefings starting next week, exclusively for subscribers.

He will map out what’s likely to happen next, recommend seven urgent steps for portfolio protection and reveal a breakthrough strategy for profit in times of crisis. The deadline for free registration is Monday, June 13. Sign up now.

Everyone is talking about interest rates moving higher, but a quieter hurdle for the market is just beginning.

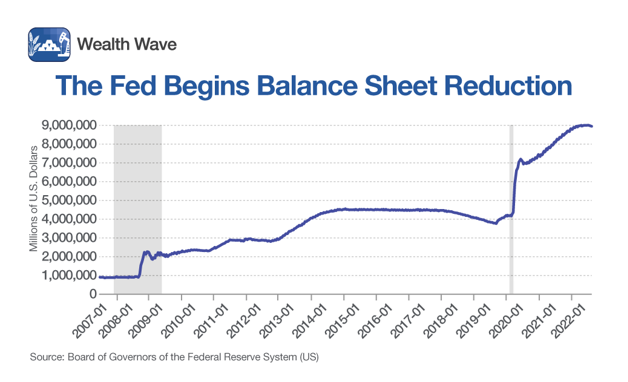

I’m talking about the Fed trimming its balance sheet.

On June 1, the central bank started the process of cutting its $8.9 trillion balance sheet by $47.5 billion per month. In three months, the reduction program will accelerate to $90 billion per month.

Don’t get me wrong, interest rate policy will be critically important for how the U.S. navigates inflation and the threat of a recession ... it just appears that balance sheet reduction is flying under the radar while the talking heads on Wall Street discuss rate hikes.

Last month, I mentioned that this process would drain the market’s liquidity, and that as a result, companies trading at higher multiples would take the brunt of the damage if a selloff took place.

I don’t expect a broad market selloff because the economy has shown to be resilient thus far, but I do expect to see a continuation of the shift from growth stocks to value investments.

The Fed’s balance sheet has more than doubled since the beginning of the pandemic:

I showed you a chart like this last month, but now you can see the beginning of the downward-sloping trend of reducing the Fed’s total assets. As inflation rages on, the Fed has no choice but to tighten the reins.

It’s important to note that the Fed has never trimmed its balance sheet by more than $750 billion at a time before resuming asset purchases.

Last time around, from 2017 to 2019, its program reduced assets by $50 billion per month — about half the expected rate three months from now. There‘s more ground to make up this time around.

To plan for greater uncertainty in the market over the short-term, one exchange-traded fund (ETF) you can check out is the iShares Core S&P U.S. Value ETF (IUSV).

An ETF for the Rebound

The fund aims to track an index containing value-oriented, mid-to-large cap U.S. stocks.

These companies generally trade at lower multiples, leaving them more resistant to sharp valuation changes during potential pullbacks.

The fund’s trailing twelve-month (TTM) price-to-earnings (P/E) ratio is 17.14, which is about 17% lower than the S&P 500’s TTM P/E ratio of 20.76.

IUSV is heavily diversified, holding 742 positions across all market sectors. Its top three holdings are Johnson & Johnson (JNJ), Exxon Mobil (XOM) and Procter & Gamble (PG), which make up 7.5% of the fund.

IUSV manages over $11.8 billion in net assets, and it trades with decent liquidity. It averages about 600,000 shares traded per day.

The fund’s expense ratio is a miniscule 0.04%. In fact, its dividend yield of 2% pays 50 times more than the fees it charges!

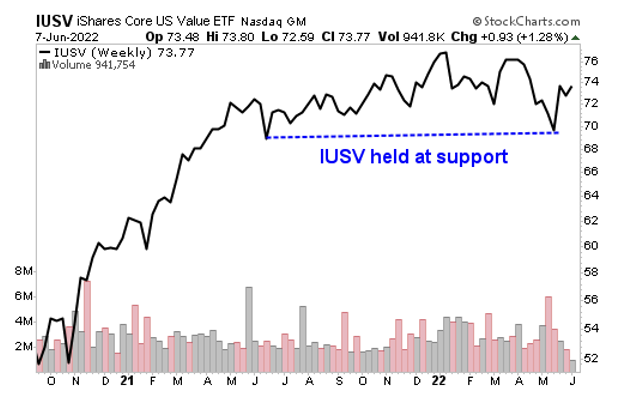

Looking at IUSV’s chart, we see that it mostly held its ground during the pullback that sent the S&P 500 tumbling over 20% from its all-time high:

The fund established $69 as a strong support, and now it should test overhead resistance as it attempts a breakout.

This looks like a very strong investment idea, but remember to always conduct your own due diligence before entering a position.

If the market starts panicking from the Fed’s tighter economic policy, I expect this ETF to huff and puff its way ahead.

All the best,

Sean