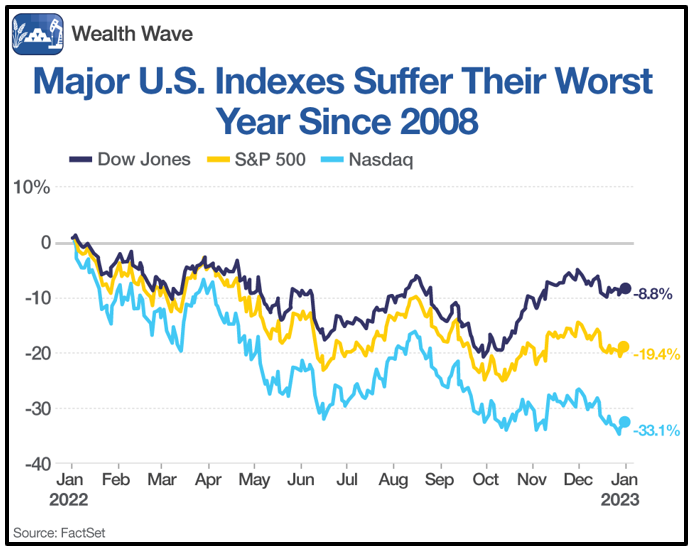

The market just logged its worst year since 2008, with the Dow Jones, S&P 500 and Nasdaq indexes falling 8.8%, 19.4% and 33.1%, respectively. Ouch!

The struggles began in January 2022 and continued throughout the year as inflation, rising interest rates and fears of a recession dominated headlines. The chart below compares performance by benchmark index.

Click here to view full-sized image.

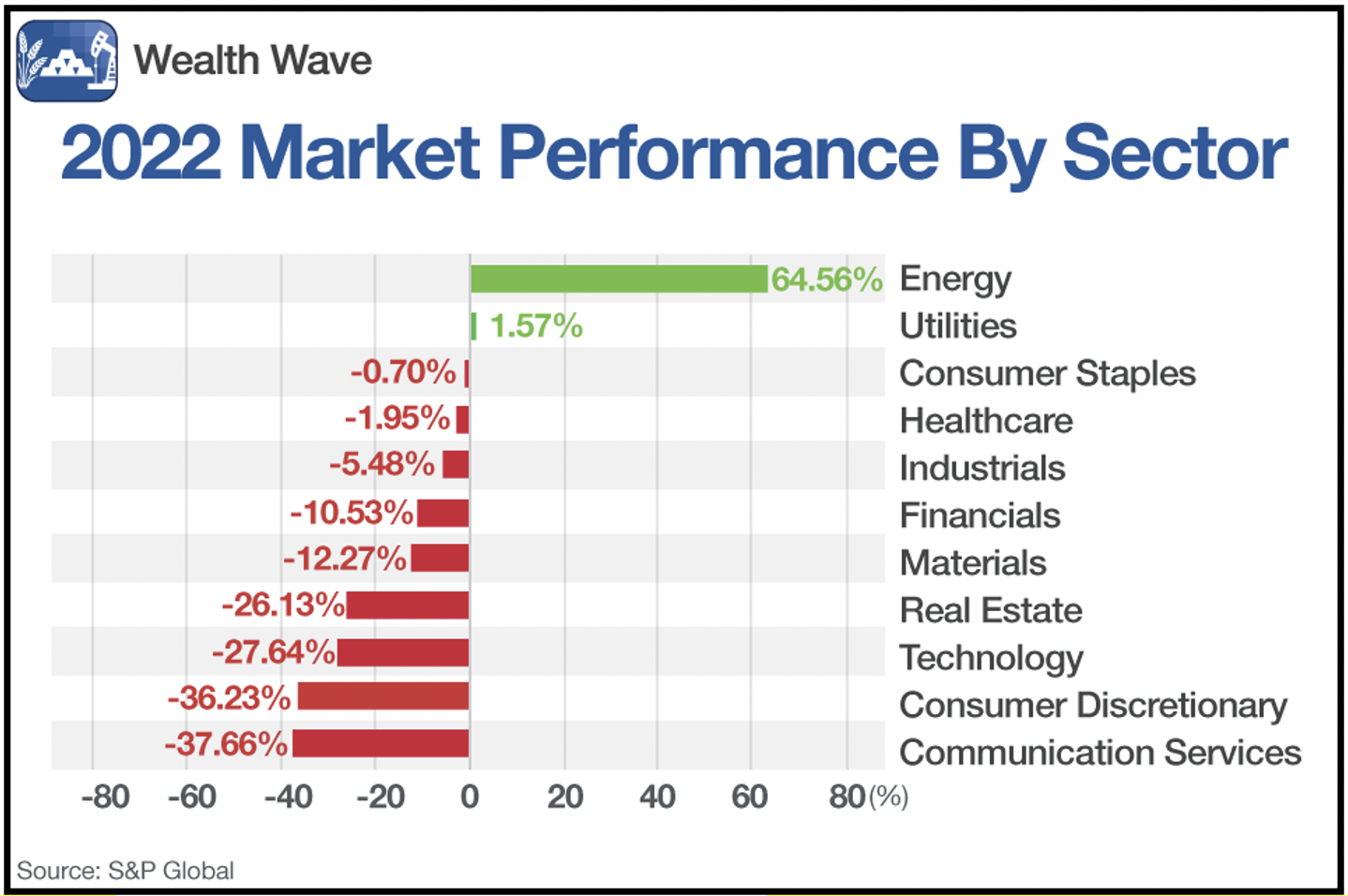

Of course, not all sectors felt the brunt of the pain. Generally, value-oriented investments hold their ground during periods of market turmoil.

This is largely because growth stock cash flows are projected into the distant future while value stocks are generating them today. When discount rates are greater due to inflation and higher interest rates, the disparity widens.

The tech-heavy Nasdaq index suffered the most out of the major indexes since high-flying growth stocks came back down to Earth. With investors preparing for a recession, the trend could extend well into the New Year.

The following chart shows market performance by sector in 2022.

Click here to view full-sized image.

Energy stocks were the big winners as oil prices soared. But utilities, consumer staples and healthcare stocks each ended the year within 2% of where they started.

The broader market was weighed down heavily by the consumer discretionary, communications services, technology and real estate sectors, which each lost at least 26%.

I expect more volatility to come, considering Fed Chair Jerome Powell looks eager to drive the economy into a recession to fight inflation. Given the Fed’s willingness to keep rates high, I expect the leading sectors from last year to continue outperforming.

In the case of a recession, it helps to position your portfolio with companies that have stable demand. I recently mentioned how energy could be on the verge of its next bull run, but another sector should benefit as investors prepare for the worst.

Healthcare companies should benefit because their goods and services are usually among the last things consumers compromise on when tightening their belts.

Health is a top priority for most people, leading them to make concessions elsewhere. It also helps that the U.S. spends more on healthcare than any other developed nation.

How You Can Gain Exposure

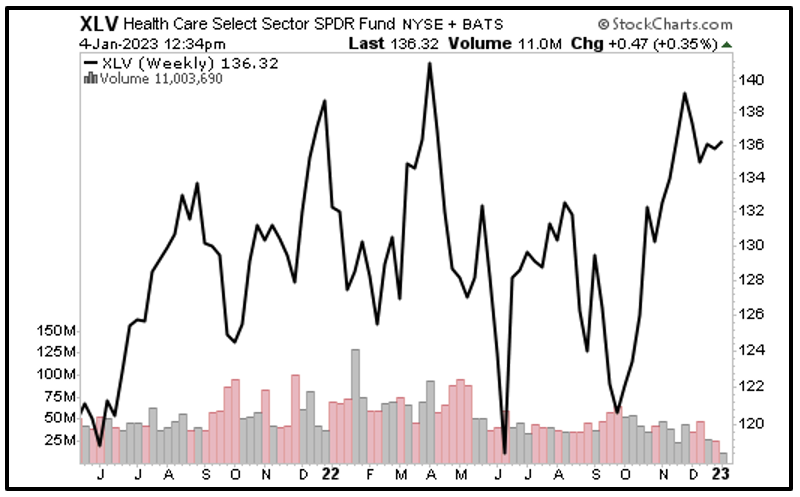

With the healthcare sector likely to see inflows as investors target recession resistance, one ETF to consider is the Health Care Select Sector SPDR Fund (XLV).

The fund mirrors the performance of healthcare stocks within the S&P 500, focusing on subindustries including equipment and supplies, providers and services, pharmaceuticals, biotechnology and more.

XLV’s top three holdings are healthcare giants UnitedHealth Group (UNH), Johnson & Johnson (JNJ) and Eli Lilly & Company (LLY). Together, they account for nearly a quarter of its $41.9 billion in assets under management.

The fund has a low expense ratio of 0.10%, compared to its dividend that recently yielded 1.4% annually. XLV averages nearly 8 million shares of daily trading volume.

XLV’s chart shows that the fund staged a strong rally since the end of September.

Click here to view full-sized image.

XLV has consolidated following the positive move, but it should look to retest overhead resistance past $140 once it’s finished.

The companies XLV holds should continue trading resiliently even in the case of a recession due to inelastic demand for their goods and services.

Make sure to conduct your own due diligence before entering a position, but it usually helps to position your portfolio in sectors gathering momentum.

All the best,

Sean

P.S. It’s a new year, and with it come new prospects. I’ve identified what I think is the best opportunity in decades. I’m calling it the Made-in-the-U.S.A. Superboom, and it could be the biggest financial trend of the year. Click here to find out more.