Holy Guacamole: Brace for Even Higher Food Prices!

Food prices are soaring; they’re going to go higher. And there’s nothing we can do to stop this.

But … we can cushion the blow by investing in things that go up with food prices. I’ll give you an idea on that in a bit.

I probably don’t have to tell you the price of food is up. You can feel the pain in your wallet every time you go to the supermarket.

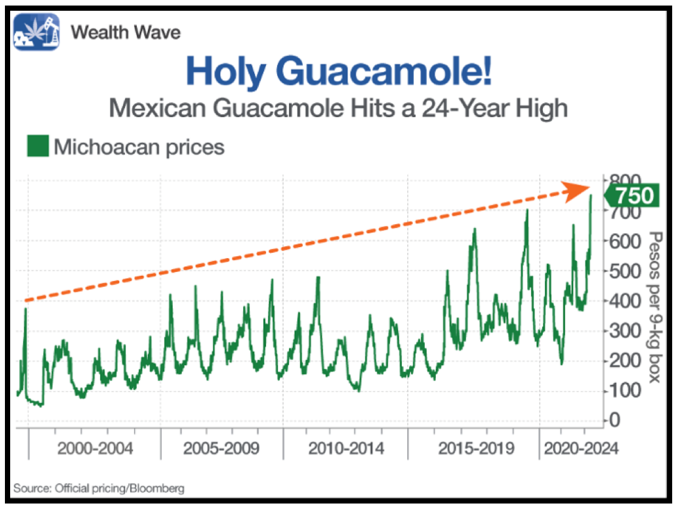

Heck, look at the price of Mexican avocados, the key ingredient in guacamole:

According to official data from the Mexican state of Michoacan, avocado prices jumped to their highest in more than two decades.

It’s not just rising energy inputs. Demand for food is ramping up, as U.S. employment rates rise, joblessness falls and people go out to eat after being stuck at home for two pandemic years.

But it’s not just guacamole, is it?

The U.S. Department of Agriculture (USDA) just issued an alarming report: Grocery and supermarket food prices are already 8.6% higher now than a year ago. Wow!

Sure, the latest data shows that U.S. worker hourly earnings rose an average of 5.6% year over year. But those increases in wage are NOT keeping up with inflation.

Like every government agency, the USDA tries to put the best spin on things. So, it says it expects food inflation to ease in the months ahead.

Yeah, sure. I’ll file that under “transitory” along with all the Fed pronouncements that failed to predict hot and hotter price rises.

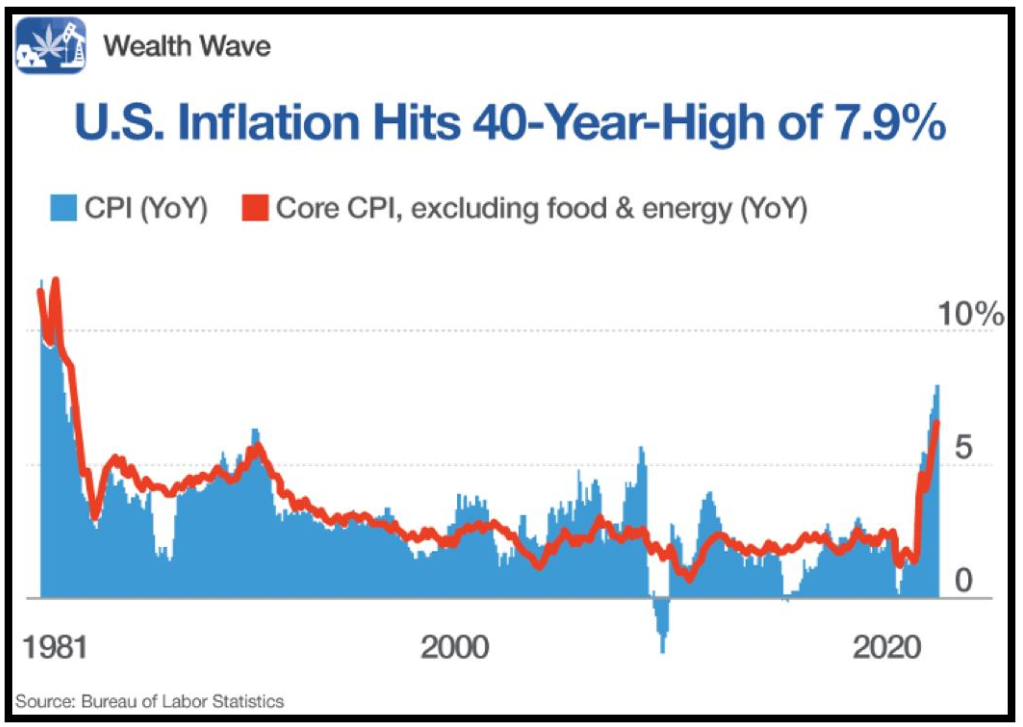

Speaking of which: We know that inflation was running at a 40-year high of 7.9% BEFORE the impact of recent record energy prices.

And this isn’t just a problem for the U.S. We’re protected by having a currency that is stronger compared with other currencies. In other parts of the world, food inflation is approaching crisis levels.

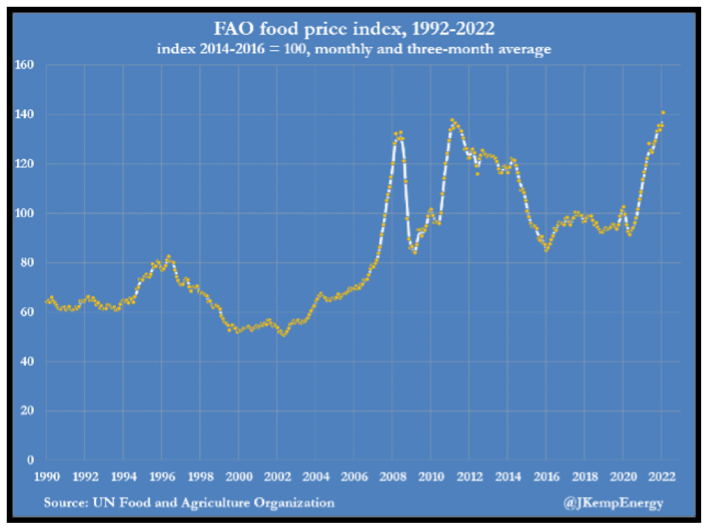

Here’s a chart from John Kemp at Reuters:

Globally, food prices hit a record in February, and were up 20% compared with a year earlier. TWENTY PERCENT!

Well, it’s a good thing that the U.S. is a food producer, right? Except food markets are global. You’re competing with consumers in China for every ear of corn you buy.

Thanks to Russia’s invasion of Ukraine, corn exports from both countries are being taken off the table, along with their grain exports generally. I warned you about this back in February. I hope you listened.

Add to that the soaring cost of fertilizer. You know that Russia is a major source of nitrogen-based fertilizer, right? That’s only driving the cost of wheat and corn up higher and higher.

Guess what feedlot livestock eat? Wheat, corn and other grains! That’s more food inflation.

Now, if you’re one of my Wealth Megatrends subscribers, you’re already riding this trend. If you’re not, I’m going to share an idea with you.

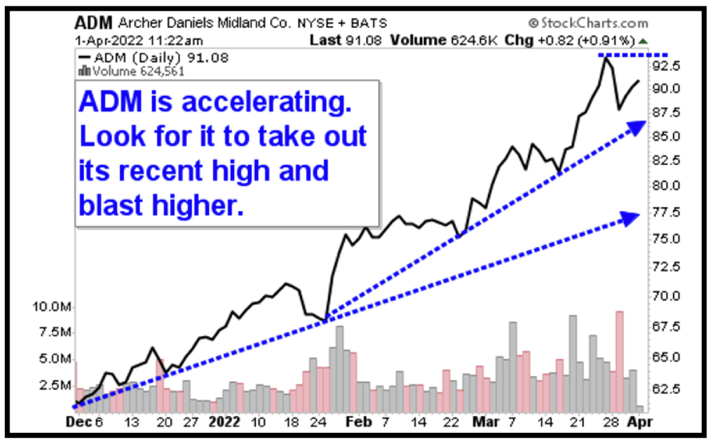

Wealth Megatrends subscribers have owned Archer-Daniels-Midland (ADM) since December. ADM is one of the world’s leading producers of food and beverage ingredients as well as stuff made from agricultural products.

That ADM position is up about 36% since I recommended it, beating the pants off the S&P 500 AND inflation.

I always say to “buy the pullbacks.” And ADM just experienced a pullback when Russia said it was open to a peace deal in Ukraine.

Sure, Vladimir. Do you have a bridge in Moscow you want to sell me, too?

Regardless, I expect ADM to push through that old high and keep on truckin’ higher. Hey, this stock pays a nice — and growing — dividend, too. So, if I’m wrong in the short term, you’ll be paid to wait.

But I’m not wrong. The energy crisis is not over … the food crunch is going to get more severe … and prices will go higher.

You can’t stop that. But you can make a tidy profit as a cushion against food inflation.

Another way to combat inflation? Using options to aim for a 98% win rate on recommended trades.

My colleague Mike Larson is featuring an options MasterClass, and availability is only open until this Monday, April 4. With this strategy, Mike aims for up to $1,000 on an almost weekly basis. If you’d like to learn more, check this out.

All the best,

Sean

P.S. We recognize that our readers are also listeners. So, we've added a brand-new feature at the top of each post enabling you to listen to the article. This is for portability, accessibility and for those of you who love to multitask and listen to the trade while you place it.