Coming out of the worst year for stocks since 2008, all eyes are on the Federal Reserve and how it will approach raising interest rates this year.

I have an idea for something that offers you protection and potential outperformance at the same time. And you get paid all the way.

After four consecutive 75-basis-point rate hikes, central bankers finally slowed down to a 50 bps increase in December. It was expected, but the market was spooked when Fed officials called for a peak interest rate of 5.1%.

That’s bad news for tech stocks and other risk assets that rely on low rates, but I’ve been pounding the table about value stocks for the past year now.

It’s no secret that the Fed’s top priority is taming inflation. It’s willing to let unemployment spike under higher interest rates if that’s what it takes. Solid jobs figures undermine rationale for a Fed pivot. That’s why the market heads lower after positive reports.

Thursday’s inflation reading from the U.S. Bureau of Labor Statistics should shed more light on the Fed’s direction, and it may be out by the time you read this.

Regardless, investors will have to navigate greater volatility.

Wall Street continues pricing in a recession this year, but the potential severity is up in the air. The market likely heads higher if it can avoid the worst, but investor optimism could be punished if interest rates stay too high for too long.

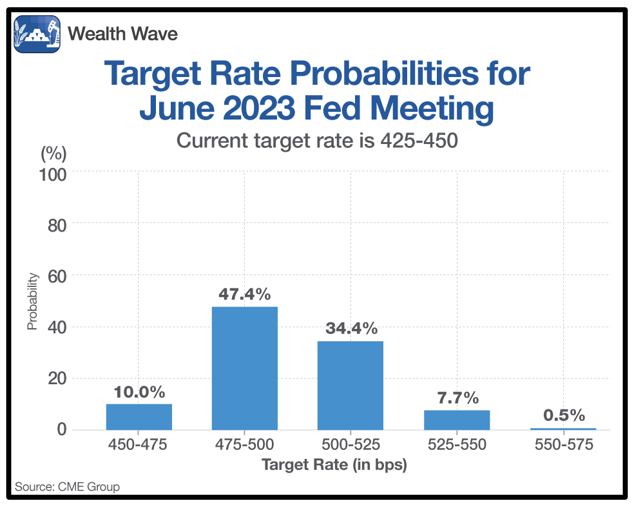

The chart below shows the implied interest rate probabilities for June, when it’s expected to peak.

Click here to view full-sized image.

Fed fund futures currently price in about a 43% chance for a peak interest rate of 5% or higher, meaning traders aren’t necessarily buying Powell’s increasingly hawkish warnings.

Even if rates do stay high, one sector that should see capital inflows is utilities. Utilities stocks are generally seen as safer because their multiples are less aggressive, cash flows are generated right away and contracts are often locked in long term.

Last week, I included a chart outlining the market’s performance in 2022 by sector.

The utilities sector was one of only two that managed to finish the year higher. Demand for utilities stocks should increase as investors target a safer portfolio allocation in a volatile environment.

With macroeconomic uncertainty here to stay for now, I expect the sector to continue outperforming.

How You Can Play It

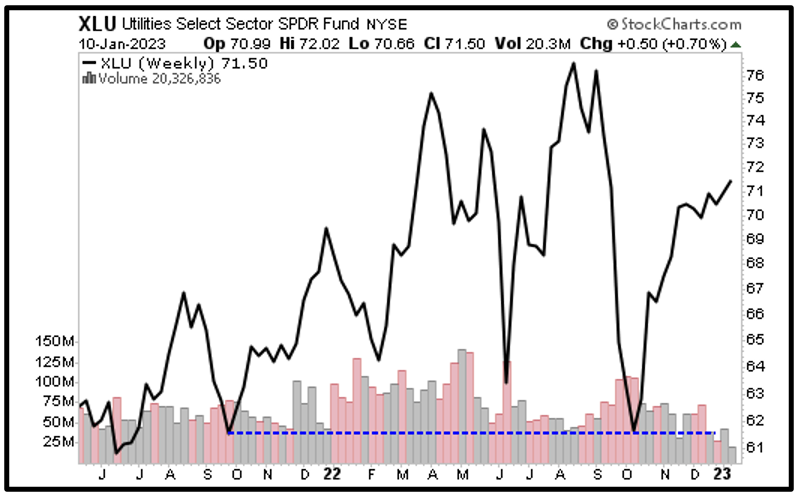

As investors rotate into the utilities sector, one ETF to look into is the Utilities Select Sector SPDR Fund (XLU). These stocks should follow the market higher in an uptrend, but they should also provide greater protection if conditions worsen.

The XLU is the largest and most liquid utilities ETF, covering strictly the utilities sector of the S&P 500. The fund includes electric, water, gas and renewable utility providers.

The XLU holds 30 companies, but the fund’s top three positions are in NextEra Energy (NEP), Duke Energy (DUK) and Southern (SO). They make up about 32% of its $16.5 billion in assets under management.

The fund’s recent dividend yield of 2.8% is 28 times greater than its expense ratio of 0.1%. It trades with average daily volume of 12.5 million shares.

The XLU’s weekly chart, below, shows that it continues setting higher highs in a volatile environment:

Click here to view full-sized image.

The fund tumbled back from its high in August, but it staged a nice rally after bouncing off of support. I expect XLU to challenge overhead resistance again as more investors flock into the sector this year.

Always do your own research and due diligence before buying anything, but the utilities sector could be in line for another strong year amid market panic.

That’s it for today. I’ll have more for you soon.

All the best,

Sean

P.S. If you haven’t yet joined my Wealth Megatrends service, right now is the perfect time to do so. In fact, members of my service are currently sitting on open gains of 50%, 33% and 21%! To receive my tailored picks in the utilities sector and others, sign up today.