Energy traders breathed a huge sigh of relief on Friday as Russia indicated it was open to negotiations to end its invasion of Ukraine.

The price of the U.S. oil benchmark, which hit $100 per barrel earlier in the week, fell back below $91 a barrel.

- Natural gas prices plunged, too. So, is the energy bull market over? Don’t bet on it!

In fact, oil and gas prices will likely go much higher.

And I have a great way for you to find your next trade to ride the oil and gas wave.

A Big Bull Market With a Dash of Russian Dressing

First, are oil and gas prices likely to go higher anyway?

- Yes!

We’re in a commodity bull market as the world recovers from the pandemic. Energy use is shifting higher, and prices along with it.

Second, is the conflict with Russia in Ukraine over?

Not likely.

There’s still plenty of fighting happening. And one nation after another is rolling out new sanctions. We haven’t seen sanctions on Russia’s oil and gas exports yet. But if the war in Ukraine isn’t resolved, those are likely.

- Russia exports about 5 million barrels per day (bpd) of oil, some to the U.S., some to other parts of the world … but half of it to Europe.

For its part, the European Union receives about 25% of its oil from Russia — and a whopping 40% of its natural gas.

We’re No. 1!

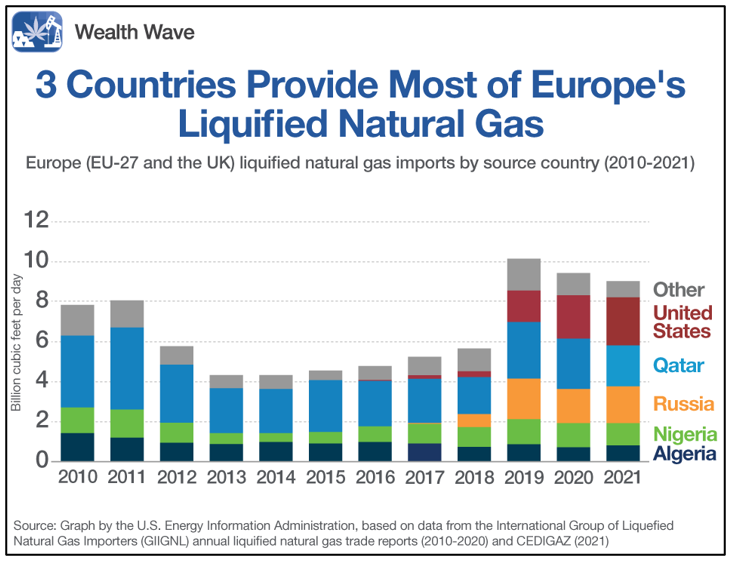

That’s the opportunity for U.S. investors. America is an exporter of natural gas, and we can export a LOT more of it. Higher prices should do the trick. Heck, we’re already the top exporter of liquified natural gas (LNG) to Europe.

The Energy Information Administration (EIA) reports:

A large share of Europe’s supply of liquified natural gas (LNG) originated in the United States, Qatar and Russia. Combined, these three countries accounted for almost 70% of Europe’s total LNG imports, according to data by CEDIGAZ. The United States became Europe’s largest source of LNG in 2021, accounting for 26% of all LNG imported by European Union member countries and the United Kingdom, followed by Qatar with 24%, and Russia with 20%.

And according to the EIA …

- In January 2022, the U.S. supplied more than half of all LNG imports into Europe for the month.

If Europe suddenly had to replace sanctioned Russian gas, it’s going to lean on its other top suppliers more. And it’s likely that natural gas prices will go much higher as Russian supplies are cut off.

For select energy companies leveraged to natural gas, that is a huge profit opportunity.

Similarly, while Russia may not export a lot of oil, prices are made on the margins.

For example, the U.S. imports about 700,000 bpd of Russian oil. If we had to replace that supply, prices would go up as the market adjusted.

For Europe, which uses a larger percentage of Russian oil, the price hikes would probably be larger.

Is $130 Oil in the Cards?

Consultants at Rystad Energy said on Thursday that if the conflict in Ukraine drags on, triggering both sanctions and supply disruptions, the price of Brent crude — the international oil benchmark — could surge to around $130 per barrel.

- For reference, Brent was trading around $96 on Friday. That’s a hike of 35%!

So, where can you find great oil and gas companies? Let me make a suggestion: Weiss Ratings has a Heat Map for its Best Energy Stocks.

Here is a list of the top 5 from that heap map on Friday morning:

That’s a nice list. Click on any of the names on the list and you’ll be brought to a detailed report on the stock.

One of those stocks is now in my Gold & Silver Trader subscribers’ model portfolio, though I’ll keep that card close to my vest for now.

I also directed subscribers to grab some energy gains recently (a nice 38% gain in just over three months) in anticipation of prices pulling back.

- I don’t think that pullback will last for long. I’ll add more picks soon.

The Weiss Ratings are always a good place to start your research. They give investors plenty of ideas for the next leg higher in energy stocks.

As individuals, we can’t do anything about Ukraine. But we can protect our portfolios … and make a decent profit, too!

Best wishes,

Sean