We’re not a month into 2022, but if January is a precursor for the rest of the year, some investors are probably wishing it was already 2023:

- First, a massive market rotation from growth stocks to value stocks rocked the Nasdaq, sending a wide swath of the tech sector into a sell-off.

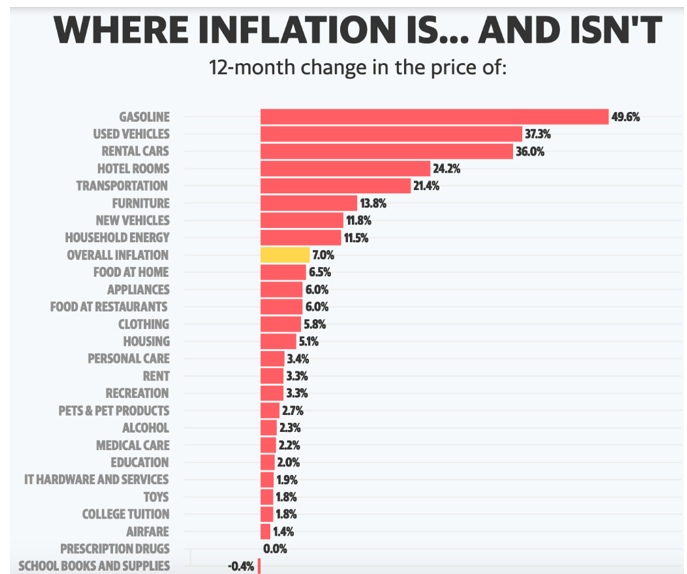

- Next, we were greeted by December’s Consumer Price Index (CPI) data, which shows inflation now sitting at 7% … a 40-year high. (For context, I was in utero the last time it was this bad.)

- And, to compound matters, there’s chatter about the Federal Reserve flirting with the idea of not three interest rate hikes … but four or more.

Happy New Year!

On Sunday, Yahoo! Finance published an interesting chart. In it, they examined inflation by sector.

Take a look:

Hopefully none of you are shopping around for a used car. Or a new one. Or gasoline to fill up that car. Or a vacation to drive it on … because everything from fuel to transportation to hotel rooms is feeling the pinch.

3 High-Rated Inflation Hedges

So, this week, the Weiss Ratings Team set out to make the best of an otherwise bleak situation.

Sectors like energy and commodities historically do well during inflationary periods.

And since elevated CPI numbers are expected to linger longer than consumers would like, we dove into the Weiss stock scanner in search of some top-rated companies in the industries being hit the hardest by inflation.

- We added three industry filters: (1) Automobiles and Components, (2) Energy and (3) Transportation.

- Since small-cap companies are outperforming large- and mid-cap companies amid the rotation from growth to value, we added a filter to search for companies with a market capitalization under $1 billion.

- Lastly, we filtered out any company graded below a “B” to focus on the highest Weiss-rated stocks of the lot.

With the price of oil recently hitting its highest level since 2014 … and the scarcity of microchips affecting new and used vehicle supplies … the results might surprise you.

Three companies came in with “B” ratings. And guess what? All three are in freight. That’s because …

- Inflation in transportation costs — currently at 21.4% — is the fourth highest of all sectors.

Last Friday, Weiss Ratings Senior Analyst Tony Sagami wrote about how the pre-pandemic cost of shipping a container was about $1,300. In September 2021, that amount ballooned to $11,000.

So, let’s dive a bit deeper into those three companies …

1. Global Ship Lease (NYSE: GSL, Rated “B”)

GSL has a market cap of just $831.54 million, but it’s been a powerhouse in growth. The company leases its vessels to organizations looking to rent ships to get goods around the world.

And it’s working.

With ongoing supply chain bottlenecks and clogged ports, companies are looking to secure access to container ships … and the way to do that is by coughing up the money for elevated rental rates from companies like GSL.

Shares recently broke above their 50-day moving average and are up over 69% in the past year.

Add to that a 4.58% annual dividend yield and 25-cent quarterly dividend and investing in GSL could be smooth sailing.

2. Flex LNG (NYSE: FLNG, Rated “B”)

FLNG went public in 2009, and the company specializes in shipping one thing in particular: liquified natural gas (LNG). Due to its inherently clean properties, LNG is projected to overtake oil and coal as the largest fossil fuel energy source by 2030.

Shares recently gapped down to test their 200-day moving average, but the stock is up over 109% over the past year.

Investors should watch for a bottom, which could present a very nice buying opportunity.

With winter temperatures driving demand, LNG inventories could deplete and prices could respond accordingly. In the meantime, FLNG pays handsomely to those who hold it with a 16.24% dividend yield.

3. P.A.M. Transportation Services (Nasdaq: PTSI, Rated “B”)

The last company to make the cut is PTSI.

The over-the-road trucking company’s most recent financial results were in line with analysts’ expectations with revenues of $707 million and earnings per share (EPS) of $6.69.

However, 2022 revenues are expected to increase to $799 million — a 13% improvement in sales that would translate to an EPS of $8.00.

PTSI does not pay a dividend and it has been rangebound since the middle of November … but shares are up over 137% in the past year and its median price target is $85.

Regardless of what your investment destiny holds there’s one thing that remains certain: There are numerous ways to use the Weiss Stock Screener to help you uncover hidden gems during inflationary periods. And as always, remember to do your own due diligence before buying anything.

If you’re not interested in going it alone and want more insight into strong, long-term picks that laugh off inflation, Jon Markman’s The Power Elite provides just that.

His subscribers are currently sitting on open gains of 146.82%, 142.45% and 126.84%.

And I have a strong feeling they’re not worried about filling up the gas tanks in their newly purchased cars. They’re probably booking hotel rooms for long-overdue vacations.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily