I wrote a column last week about how high gasoline prices were … and how they could go much higher. Sure enough, GasBuddy reports: “For the fourth straight week, the nation’s average gas price has gone up, rising 15.3 cents from a week ago to $4.46 per gallon.”

All the forces I talked about are in play.

But there’s worrisome development, one that leads me to think that prices will stay higher for longer.

And sure, the bears will talk about already-high prices destroying demand, rising U.S. crude oil inventories, China’s COVID-19 lockdowns weighing on its consumption and a general cooling of the global economy.

And you know what? They’re right. All those things are happening.

Now, let me show you why people can have the right facts … but still come to the wrong conclusion. Because MY conclusion is that gasoline is going to stay higher for longer. It will zigzag up and down, but the trend is higher.

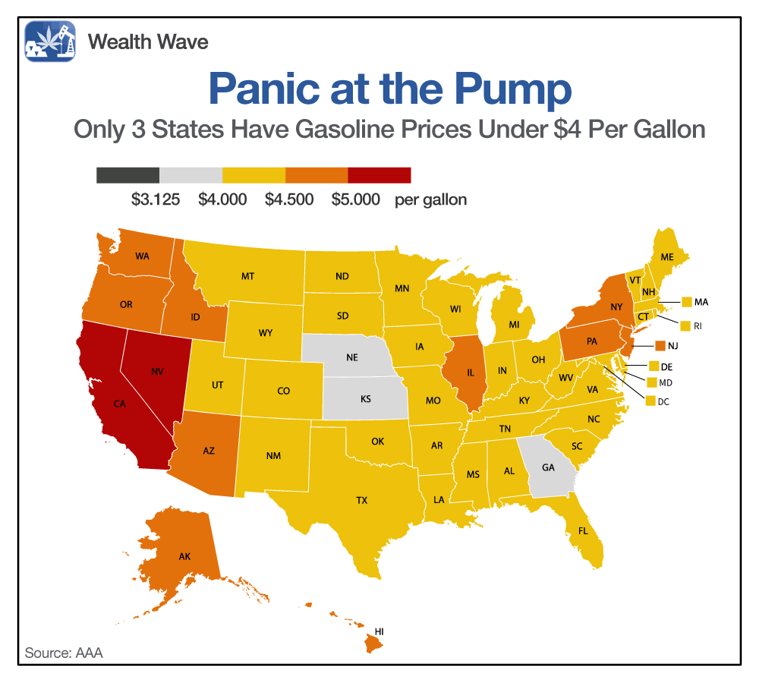

Let’s start with a recent map of gasoline prices:

You can see that only three states — Kansas, Oklahoma and Georgia — have average gasoline prices below $4 per gallon now. And pity those poor folks in Nevada paying an average $5.18 a gallon or California, where the average is $5.95! Sheesh!

Adjust for Inflation: We’re Screwed!

Nonetheless, as I said last week, gasoline prices can go much higher if you adjust for inflation and look at the peaks we hit in 2008.

After all, the average price for gasoline across America hit a peak of $5.51 in 2008. Adjusted for inflation, that would be $7.40 a gallon in today’s money.

To be sure, nothing says prices must go that high. But consider that across the globe, petroleum inventories are low. OPEC+ and U.S. shale producers continue to show restraint when it comes to raising output.

And sanctions on Russia over its war in Ukraine are not only hurting where it can sell oil, but also how much it can produce, because it’s losing access to Western capital and expertise.

Russia’s oil output has already fallen by nearly 10% since the war started. And Russia’s finance minister, Anton Siluanov, said his country’s oil production could fall by 17% this year.

But that’s not the big reason why oil prices will remain high and gasoline prices will remain elevated with them.

What Big Oil Wants

The big reason is because oil companies like it this way.

Don’t believe me? Just ask them.

Last week, Occidental Petroleum (OXY) CEO Vicki Hollub said that oil companies don’t want to spend more money on raising output because it would destroy shareholder value.

“It's almost value destruction if you try to accelerate anything now,” Hollub said during the company's earnings conference call. “Some of the longer-term projects just can't get started because of the cost involved.”

While Occidental did raise capital expenditures by $250 million this year, that’s just keeping up with inflation. And the company abandoned a multi-rig program in Colorado. But Occidental still has plenty of money — $3 billion — to spend buying back its own shares.

I don’t want to pick on Occidental. They’re not the only one.

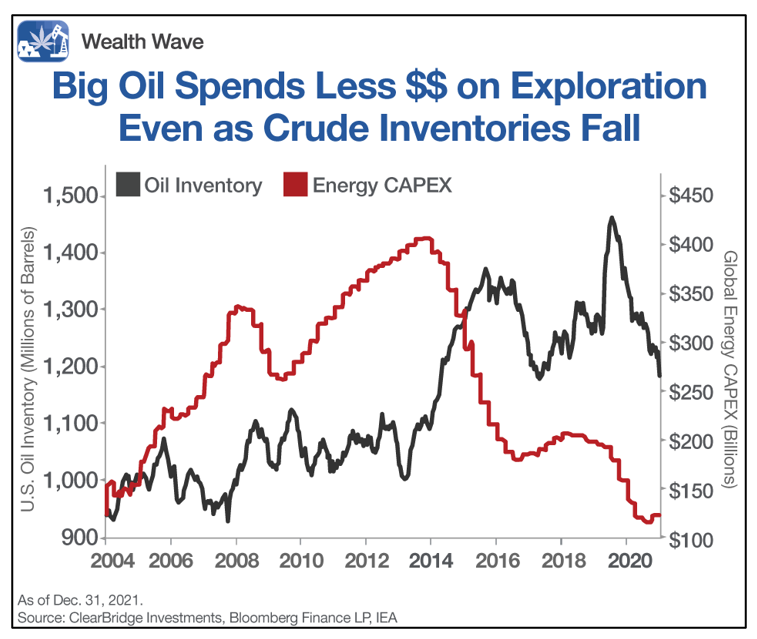

In fact, as a rule, oil companies are cutting back on capital expenditures (which would raise oil production) while pumping up share buybacks. And that’s leading to a dire picture for future oil flows:

The last time crude was consistently over $100 a barrel in 2013, Big Oil’s combined capital expenditure was $158.7 billion. That’s about DOUBLE what the Big Five of oil companies are spending now.

Those companies include Exxon Mobil (XOM), Chevron (CVX), BP (BP), Shell (SHEL) and TotalEnergies (TTE).

Mind you, this decrease in capital expenditures is coming not only when global oil inventories are dropping; it’s happening when the Big Five are making record profits.

Is this profiteering? Maybe. But I don’t expect the government to do anything about it, which is why my paying members are long so many oil companies. Because …

If You Can’t Beat ‘Em, Join ‘Em!

Last week, I talked about a trio of refiners that would ride this wave of higher-for-longer gasoline prices. And yeah, they’re all more expensive this week. But they can get a lot more expensive.

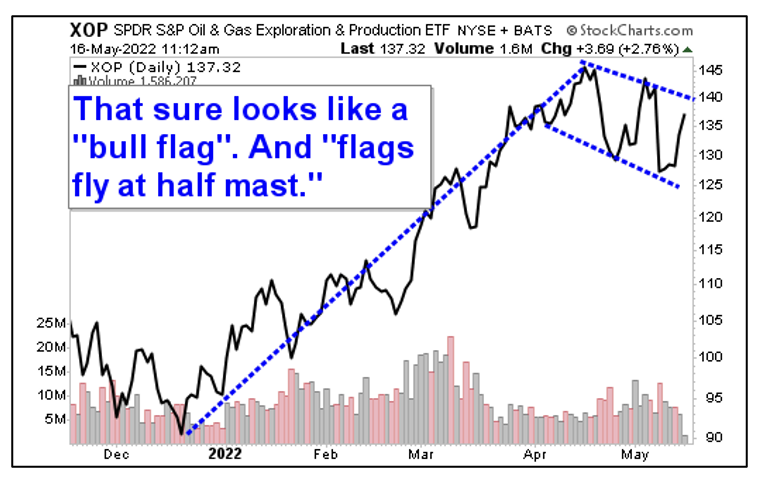

If you’d rather play this from the production side, you can always consider the SPDR S&P Oil & Gas Exploration and Production ETF (XOP). It’s offering you a decent entry point now:

Despite the recent surge in crude oil prices, the XOP is still below highs it hit in April. It seems to be making what’s called a bull flag pattern. And the old saying on Wall Street is that “flags fly at half-mast.”

We won’t know until this pattern resolves. But I’m working with a target 60% higher from recent prices. And that would be a heck of a ride. The kind of ride that would help cushion the pain every time you fill up at the gas pump.

Best wishes,

Sean