With Russian tanks rolling into Ukraine, many investors are turning to gold … and that makes sense.

Throughout history, gold has proven itself to be the ultimate safe harbor.

However, there is a metal poised to outshine just about every other metal in this crisis.

And it ain’t gold.

- I’m talking about palladium, which on Wednesday rose to a seven-month peak.

The immediate driver is the worsening Russia-Ukraine crisis, and palladium prices look poised to go a lot higher.

You probably know that palladium is — among other things — used mainly by automakers in catalytic converters (about 85% of palladium used) to curb car exhaust fumes.

- But did you know that Russia is a major exporter of palladium, accounting for 40% of global palladium production?

I touched on this in a Feb. 24 column. Now, here’s the rest of the scoop ...

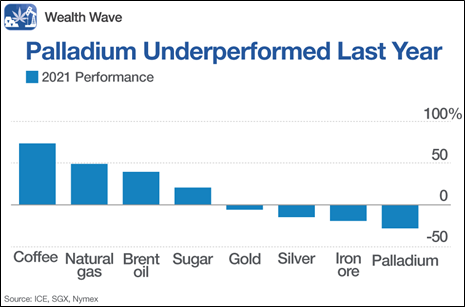

First, palladium had a TERRIBLE year in 2021. The metal underperformed just about every other commodity, losing 19.6% of its value.

Compare last year’s drop in palladium with the 55% rise in oil or the 80% rise in coffee.

If you’re thinking this is because of the pandemic, you get a star. But now the global lockdown is in the rearview mirror.

- Car manufacturers need more palladium, not less. And one of the big suppliers is Russia.

Russia produced 2.6 million troy ounces of palladium last year, or 40% of global production.

Sanctions & Flight Bans

As the tanks rolled into Ukraine, the West slapped sanctions on Russia.

Palladium shipments haven’t been sanctioned … yet! But the U.S. and its allies did ban Russian planes from their airspace. In retaliation, Russia told western airlines they couldn’t fly over Russia’s skies.

Why does that matter?

- Because almost all the palladium Russia exports is transported by plane!

So, even though there aren’t sanctions on palladium exports yet, the fracas over Ukraine is already hitting supply.

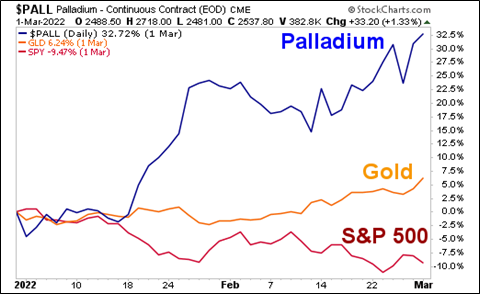

No wonder the price of palladium is soaring, up more than 32% this year alone!

That far outperforms the 6.2% climb in gold. And it leaves the slumping S&P 500 — with its 9.4% decline so far this year — in the dust.

There will be more Russia sanctions to come. And experts are expecting the sanctions WILL affect palladium supplies.

- What’s that mean for prices? They’ll shift into even higher gear!

Now, some things could slow palladium prices down. For example, car sales are projected to slow in February from a year ago.

On the other hand, there are other bullish forces besides Russia. Palladium is a catalyst for many chemical reactions, and China keeps building more chemical plants.

According to an end-2021 market report by specialty-metals refiner Johnson Matthey …

- Last year saw a deficit in palladium supply of 829,000 ounces.

This year, Johnson Matthey expects the deficit to increase. And that’s BEFORE any sanctions hit.

How to Play It

Russia’s Norilsk Nickel (NILSY) is a major producer of palladium and platinum, both of which are used in catalytic converters to clean car exhaust fumes … which makes it seem enticing, but I WOULD NOT consider buying it.

Why? Well, we don’t know what sanctions will land squarely on the company’s doorstep.

A better way to potentially play the metal would be the Aberdeen Standard Physical Palladium Shares ETF (PALL).

It’s liquid, it has an expense ratio of 0.6%, and it tracks the price of palladium closely.

An alternative would be the Sprott Physical Platinum & Palladium Trust (SPPP), which also holds physical bullion.

Like the name says, it holds palladium and platinum. It has an expense ratio of 1.01%.

Hey, Russia also produces 15% of the world’s platinum. Could prices of that metal be headed higher?

I believe so.

I’ll explore that in more detail in a future issue, but if you’d like the inside scoop, join my Gold & Silver Trader service. Subscribers are currently sitting on open gains of nearly

48%, 37% and 27% as of this writing.

Bottom line? While gold is a good metal to hedge Russia risk, palladium could very well be a better choice.

It’s already shifting into higher gear. However, you don’t have to chase it. There are always pullbacks, and pullbacks can be bought.

As always, remember to conduct your own due diligence.

All the best,

Sean