Thanks to the soaring nickel squeeze, your nickels now cost more than a dime … and the commodity’s surge could just be getting started!

Looking back at global metal markets from Tuesday, something strange happened.

The London Metal Exchange (LME) suspended the trading of nickel after prices soared 250%, zooming past $100,000 per metric ton.

The LME says nickel trading will be suspended at least until Friday.

While that’s crazy … things could be crazier.

In 1985, the LME experienced the tin crisis. That went so badly, the LME suspended trading in tin for four years!

So … what happened with nickel?

It was already rallying on tight supplies. And it helps that the hard, silvery-white metal is useful for all sorts of industrial purposes.

It’s one of only four elements (cobalt, iron, nickel and gadolinium) that magnetize easily at room temperature.

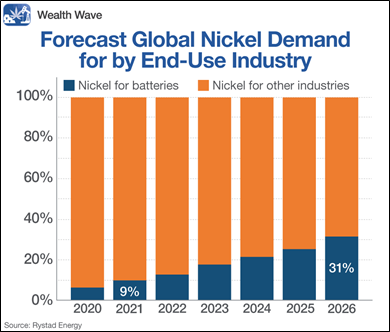

Industrial demand for nickel is also surging thanks to its utility in the cathodes of electric vehicle (EV) batteries.

Nickel helps the energy density of lithium-ion batteries. And as EV sales rise, EV battery makers want more and more nickel.

- Stainless steel currently makes up 70% of global nickel demand ... but requirements for the global EV industry are becoming larger and larger and could more than triple by 2026!

A squeeze turned into a crisis when Russia invaded Ukraine.

As I explained in my Feb. 28 Wealth Wave, Russia is a major nickel exporter, and that’s playing a huge role in this week’s situation.

- Russia produces 17% of the world’s top-grade nickel. With sanctions hitting Russia’s exports, prices went higher, and nickel traders began to panic.

Traders with short positions in nickel were forced to close them out. This added to the price surge.

And the surge squeezed a Chinese tycoon who built a massive short position in hopes of “protecting” the profits of his nickel factory. Yikes!

Big Shot Blows Up

Xiang Guangda — who controls the world’s largest nickel producer, Tsingshan Holding Group, and is known as Big Shot in Chinese commodity circles — held a short position amounting to 100,000 tons of nickel.

- That’s about 4% of total global production.

And Bloomberg reports that in a tight market, that short position became a nickel-plated ticking time bomb that blew up in his face to the tune of $8 billion!

The good news is the short-term squeeze in nickel appears to be over, as short positions are unwound and prices go back down.

On the other hand, the longer-term picture for nickel is tighter than a pinched penny.

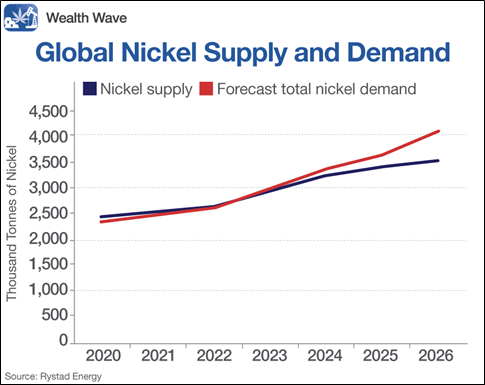

In fact, an analysis by Rystad Energy says that the world is just two years away from a massive supply-demand gap in nickel.

According to Rystad:

“Global nickel demand is forecast to climb to 3.4 million metric tons (Mt) in 2024 from 2.5 Mt (in 2021). Rystad Energy’s analysis of existing mines, projects and development plans estimates that global supply will fall short of demand in 2024, with production of 3.2 Mt.

“The gap between global supply and demand will then widen quickly to a deficit of 0.56 Mt by 2026.”

Looking for Nickel in All the Wrong Places

Part of the problem is supply. The biggest nickel deposits are in some of the worst jurisdictions in the world.

Not just Russia, but places like the Democratic Republic of Congo and other locales of despotism and brutality.

So, the squeeze is on in the short term, and it will probably get worse in the long term.

So … how can you look to play this fascinating trend?

Ideas That Could Possibly Make You Some Jingle

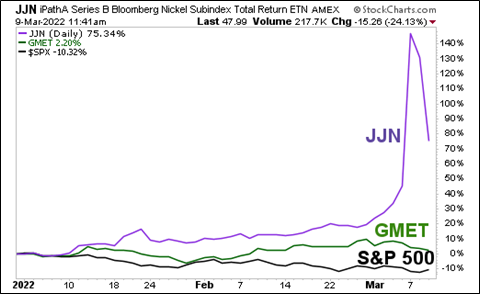

There is a nickel exchange-traded fund (ETF), the iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN).

It averages daily volume of 54,700 shares a day. And it’s OK if you don’t mind wild volatility.

Another way to trade nickel is through nickel miners.

Unfortunately, one of the biggest is Norilsk Nickel … which is in Russia. It was listed on the OTC pink sheets — scary enough — and now has been kicked off the exchange along with other Russian stocks.

Who the heck needs that?!

But … there are some ETFs that hold nickel miners.

One of them — the VanEck Vectors ETF Trust - VanEck Green Metals ETF (GMET) — holds 48 stocks that produce, refine, process and recycle green metals.

This group includes the world’s top nickel producers including Glencore (GLNCY) and Jinchuan Group. However, nickel is just a smaller part of what these big miners produce.

Here’s a chart showing the performance of JJN against GMET and the S&P 500 so far this year:

Wow! Talk about a wild ride.

- And yet, even with JJN’s ups and downs, it still is massively outperforming both GMET and the S&P 500.

Considering we can see a future supply-demand squeeze in nickel, it looks like pullbacks can possibly be bought.

If you’ve got two nickels to rub together, consider picking up JJN or some other way to play the coming price squeeze.

You just might turn nickels into dollars.

All the best,

Sean