One of the most lucrative commodities is sugar, and there are some easy ways to add positions to your portfolio that can potentially sweeten your returns.

First, a little background …

Sugar was once so valuable, people locked it up in a “sugar safe.” That’s why Europe’s monarchs — who could more easily afford it — often wound up with rotten teeth!

It’s one of the world’s oldest commodities. In fact, the indigenous people of New Guinea chewed raw sugar cane as far back as 8,000 B.C. Its cultivation spread throughout Southeast Asia, China and India over the next several millennia.

By the first century, crystallized sugar was found in medicinal records of both Rome and Greece and was used to treat indigestion and stomach ailments.

In the 11th century, crusaders returned from the Holy Land bringing caches of “sweet salt” with them to Europe.

Then came large-scale cultivation.

For the first time, sugar refinement was documented in Madeira in the late 1400s. Eventually, 70 ships were involved in the Madeira sugar trade, and Antwerp (think Belgian chocolate) became the main center for refining and distribution.

The Portuguese brought sugar to the New World (Brazil) between 1480 and 1540. Dutch colonists introduced sugar cane to South America and the Caribbean in 1658. And, ultimately, sugar cane cultivation came to the U.S. (Louisiana) in 1751.

- By the 1700s, sugar represented 20% of all European imports, and Cuba became the richest island in the Caribbean.

2 Ways to Play the Sugar Rush

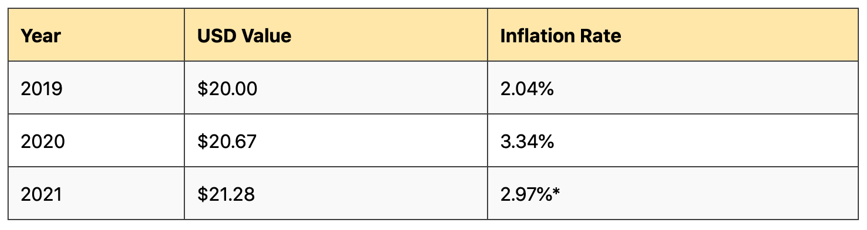

Sugar, like other commodity crops, is a steady riser during inflationary periods.

Though it’s not going to beat the 7% inflation we saw from December’s Consumer Price Index (CPI) … commodity crops offer a safe way to diversify investments as the price of goods continues to increase.

One of those investments is the Teucrium Sugar Fund (NYSE: CANE), an exchange-traded fund (ETF) that provides an easy way to gain direct exposure to the price of sugar.

Volume can be light, averaging just 75,801, and its expense ratio of 2.13% might be off-putting to some.

But the ETF is sitting just off its 52-week high of $9.87 and recently tested its 200-day moving average as support.

You can also invest in companies that rely heavily upon sugar for their products … namely, candy makers like The Hershey Company (NYSE: HSY).

Hershey’s grown from a single factory in 1894 to a snacker’s paradise, ringing up more than $8 billion in sales annually.

Notable brands include Hershey's (of course), Reese's, Kit Kat, Jolly Rancher, Twizzlers, Breath Savers and more.

The company also makes meat snacks, snack bites, mixes, popcorn, protein bars, cookies, baking ingredients, toppings, beverages and sundae syrups.

And all of that requires sugar … sugar … and more sugar.

The cherry on top?

Hershey has increased its dividend every year since the Great Recession, and it currently yields a respectable 1.83% annually to go along with a 90-cent quarterly payout.

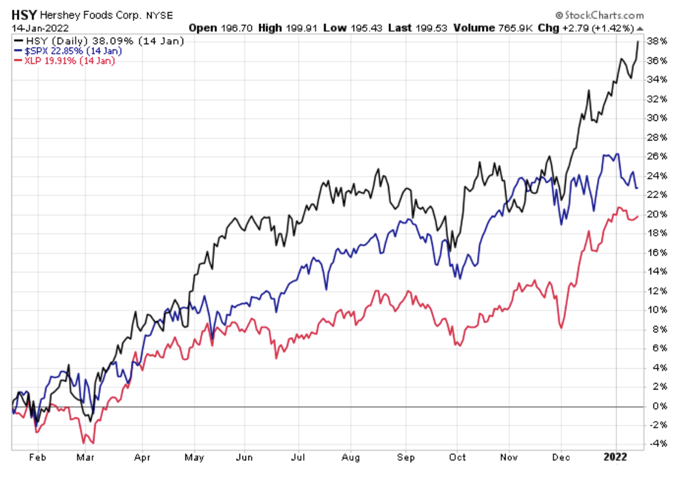

And to ice the cake, HSY has outperformed — by a large margin — the SPDR S&P 500 (NYSE: SPY) and the Consumer Staples Select Sector SPDR Fund (NYSE: XLP) over the past year.

And unlike many other crops, sugar production and consumption are quite stable (even though we should probably eat a bit less of it).

Always remember to do your own due diligence ... but don’t overlook this potentially sweet addition to satisfy your sweet tooth and your portfolio.

All the best,

Sean

P.S. If you’re interested in other ways to diversify your portfolio with the aim of beating runaway inflation, I highly suggest you check out this video of the NFT Investor Summit.

You’ll learn all about non-fungible tokens (NFTs) and ways you can play the emerging trend. But this video is only available until 11:59 p.m. Eastern on Thursday, Jan. 20 ... so act fast.

For more information, click here now.