In the first two installments of this three-part series, I talked about five forces pushing gold higher and four traits I look for in gold miners.

Today, I want to give you the outlook for other metals: specifically, silver, copper and platinum.

Beyond gold, these are metals that are producing big, double-digit open gains for members of my trading service, Resource Trader.

Silver

I’m very bullish on silver because it has many of the same forces that drive gold, but it has its own drivers.

Silver often acts like gold on steroids — it exaggerates the same moves, both up and down!

Here are three fundamental forces helping silver reach lift-off:

No. 1: Silver mines are rare. Pure-play silver mines are precious indeed. Most silver comes as a byproduct of other metals. That means silver production can't be cranked up to meet rising demand.

2: Industrial demand is surging. Silver is an industrial metal as well as a precious metal. Industrial fabrication makes up about 50% of silver demand each year versus less than 10% for gold demand. Silver is used for all sorts of things, from wiring in cell phones, to chemical reagents and the paste used in solar cells.

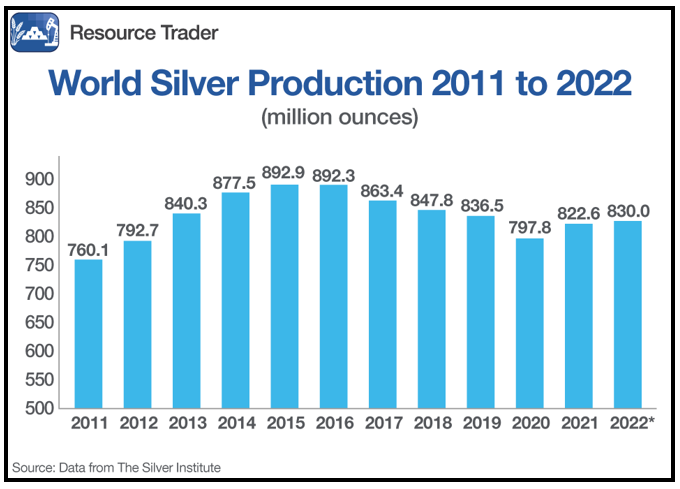

3: Like gold, the world hit peak silver. It's like peak gold, only worse, because we passed the peak in global silver production in 2015.

Click here to view full-sized image.

You can see that for the last two years, silver production went up. But it’s still below the peak. And where is more production to come from? As I mentioned, most silver production comes as a byproduct of other metals.

And then there’s demand. The Silver Institute reported that in 2021 year-over-year demand increased by 19% versus a 5% increase in supply. Through the third quarter of 2022, demand outpaced supply by a little under 2%.

The final numbers for 2022 aren’t in yet. But the forecast is for global demand for silver to rise to a new record high of 1.21 billion ounces.

Platinum

Platinum is another precious metal that might have an exciting 2023. Platinum is used extensively for jewelry, but 50% of platinum demand comes from catalytic converters for cars, trucks and buses.

Platinum spiked in February last year when Russia invaded Ukraine. That’s because Russia accounts for 11% of global platinum mining output. But after the spike, platinum quickly sold off.

Starting in September 2022, platinum began shifting into high gear.The World Platinum Investment Council issued its 2023 forecast, saying the market will shift to a deficit after two years of substantial surpluses while global demand grows by 19% compared with a 2% increase in supply.

Fueling next year’s demand is industrial demand — 34% of the total — which is projected to rise 10% this year. Platinum is also in demand as an auto catalyst, which accounts for 38% of total demand. That grew by 12% last year and should grow 11% this year.

There’s also demand for platinum as an investment in bar and coin form. That’s forecast to jump by 49% in 2023 to a three-year high!

On the production side, South Africa — which produces 70% of the world’s platinum — is wobbling under power grid problems. Maintenance at those old mines is also an issue. As a result, we’ll probably see more disruptions to South African platinum mining in 2023.

Add it all up and not only do I expect platinum to break out to the upside in 2023. My target for the year is $1,352, but that may just be a signpost on the way to higher prices.

Copper

We call this metal Doctor Copper because it takes the temperature of the global economy. Despite all the hand-wringing and gnashing of teeth over an impending recession, Doctor Copper says the global economy is just fine.

The weird thing is there’s no consensus on what happens to copper prices this year. The most bullish case sees copper prices rising more than another 30% by Q2, to 12,000 per metric ton.

The key is China. That country is reopening for business after nearly three years of a COVID-19 lockdown. Metal strategist Nick Snowdon told the press, “If China were to return its copper stock to consumption ratio to pre-2020 levels, that would imply as much as a 500,000 metric ton boost to physical demand.”

Meanwhile, a surplus that many analysts expected last year just didn’t pan out. The latest data shows 2022 ended with a 178,000 metric ton deficit of copper supply in the market.

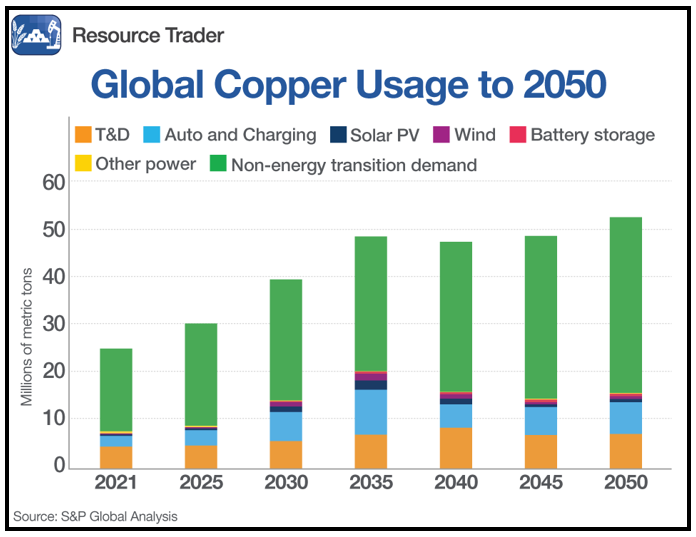

According to an S&P Global study published in July, copper demand is projected to grow from 25 million metric tons today to about 50 million metric tons by 2035. That’s a record-high level that will be sustained and continue to grow to 53 million tons by 2050.

Click here to view full-sized image.

Copper demand from the green energy transition will accelerate steeply through 2035. That’s longer term. In the short term, copper stockpiles around the world ended 2022 at low levels. In fact, copper in storage for the London Metal Exchange fell by 40% in November alone.

Copper miners and analysts have forecast growing deficits starting in the mid-2020s, driven by rising demand for the metal in wind and solar farms, high voltage cables and electric vehicles.

That’s a wrap on our three-part metals series. I hope you enjoyed it. Consider adding some picks in this space before the bull run in metals leaves you in the dust.

Best wishes,

Sean