Tomorrow, Wednesday, May 4, the Federal Reserve Open Market Committee (FOMC) will make its latest policy statement. The market is all but sure that the Fed will hike its benchmark interest rate by 50 basis points.

At the June meeting, traders are pricing in an even-odds chance that the Fed will hike by 75 basis points.

On top of that, a related agenda item for tomorrow's meeting is discussing how to slash the Fed's $8.9 trillion — TRILLION — balance sheet.

And THAT is why Wall Street is selling off and running blood-red recently.

As the old nursery rhyme says, "Wednesday's child is full of woe."

I've already added bearish positions. I'm ready for any sell-off.

But I also have my eye on potential opportunities. Because let me ask you this: What if the market has it wrong?

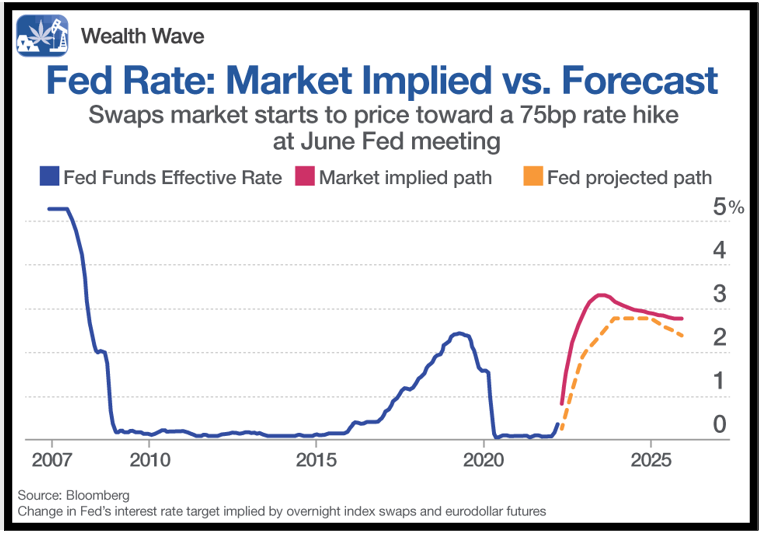

Let's start by looking at the forecast for the Fed rate hikes:

As you can see, the market is pricing in a hike in the benchmark federal funds rate to 3% in early 2023 — and then going even higher before tapering lower.

In Fed rate terms, this is massive acceleration. That scares the bejeezus out of traders, who believe that no-earnings tech stocks (and the broader, debt-dependent economy) will get hammered by such a move.

They're not wrong. However …

To me, it sure looks like the Fed is getting a lot done just by jawboning rate hikes.

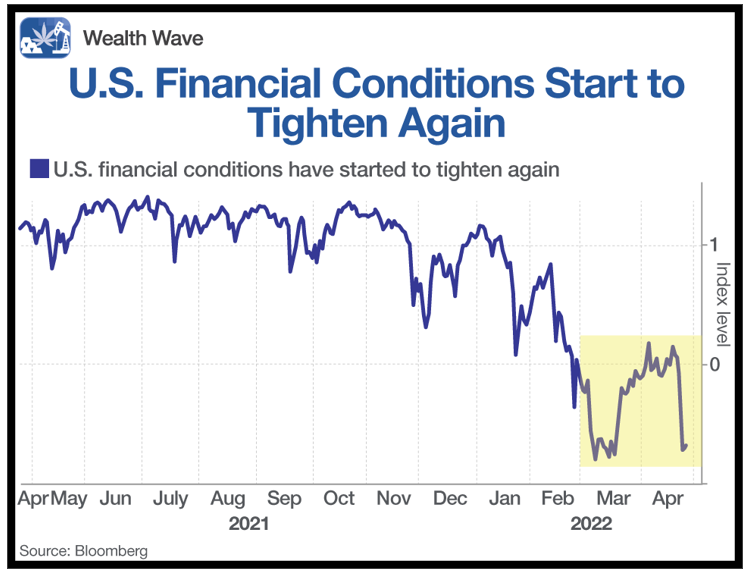

Remember, they've only hiked rates by 25 basis points so far. And yet, financial conditions — the whole point of the rate hikes — have tightened considerably.

In fact, about a week and a half ago, Cleveland Fed President Loretta Mester, one of the Fed's most hawkish governors, told CNBC that "there's no need to go there" concerning a 75-basis point hike.

So why is the market panicking? Three reasons:

1. Wall Street is filled with crybabies who've suckled on the government "free money" teat for years. They're throwing a tantrum now that the Fed is tightening financial conditions.

2. Fed Chair Jerome Powell, a long-time interest rate dove, said he was fine with a 50-basis point hike and would be open to "front-end loading" the U.S. central bank's retreat from loose monetary policy.

3. Finally, the U.S. economy is so dang strong. Jobless claims are at a 52-year low. As a result, wages are booming too. The employment cost index rose 1.4% in the first quarter, according to Labor Department. That was the fastest rise since the early 2000s and followed a 1% advance seen in the final months of 2021.

So that's why we're seeing stocks sell off day after day, week after week.

Now, let me make the case that the Fed's jawboning has already done its work. According to a Bloomberg index, U.S. financial conditions have dropped to -0.73. That's near the tightest levels since 2018.

The markets for newly public stock and corporate credit have tightened. In fact, corporate bond issuance has switched from a flood to a trickle.

And have you seen what's going on in the housing markets?

The average 30-year fixed mortgage now has a rate of 5.37% — the highest since 2011. As a result, mortgage applications fell last week, down 17% from a year ago.

In fact, applications hit the lowest level since May 2020, according to the Mortgage Bankers Association's weekly Purchase Index.

The index is down over 30% from peak-demand in late 2020 and early 2021. Refinancing is down 68% from a year ago!

To me, that sure sounds like the housing bubble is losing air fast.

And that tells me that soon we'll see the Fed change its tone to become neutral at the very least.

The Bad News Is Already Priced In

What might happen to equities then? With all the bad news priced in, they'll likely go higher.

So, what does that make this pullback? An opportunity to make your shopping lists for what to buy when the market rebounds.

If you're nimbler, you can add a bearish hedge for if/when the market goes lower. For example, my projections tell me the Nasdaq 100 could go as much as another 16% lower.

I'm not in a rush to sell anything, though, because I know the next rally is coming. Indeed, I'm making my own shopping list of what I want to buy at the bottom.

Energy names. Metals. Materials. Agriculture.

We're in a big commodity bull market, and we're going to make the most of it.

The old nursery rhyme says, "Wednesday's child is full of woe." Tomorrow will likely be just that. Just remember the next rhyme of the line: "Thursday's child has far to go." The next rally could be awesome.

If you're doing this on your own, be careful and always do your own due diligence. These markets are treacherous. But the profit opportunities can also be extraordinary.

Best wishes,

Sean

P.S. No matter what the markets are doing, the potential to succeed in cryptocurrencies is real. Consider tuning in to Crypto Profit Challenge, a three-part training with Dr. Weiss and crypto expert Juan Villaverde demonstrating how their Crypto Timing Model can be used to outperform Bitcoin by 27-to-1. To learn more, click here.