Is the Federal Reserve trying to tip America into recession? Man, it sure looks that way. Let me explain why, and what you should be buying — and selling — right now.

Let's start with the fact that the Fed took aggressive action to fight inflation on Wednesday, raising the target rate 75 basis points (bps) to 1.5%-1.75%.

That's the Fed's largest hike since 1994.

The Fed made its outsized move after the Bureau of Labor Statistics (BLS) reported May's Consumer Price Index (CPI) data, which showed 8.6% inflation over the prior 12 months. Inflation roared to a four-decade high due to soaring energy, food and housing prices.

Even though U.S. economic growth is expected to slow this quarter, the central bank seems to think its hands are tied, and that it must lower inflation before rising prices worsen households' standard of living.

But the Fed has limited weapons to fight inflation. It can squeeze the money supply through (1) hiking interest rates and (2) quantitative tightening — reducing the amount of Treasurys the Fed buys from banks. This means banks have less money to invest in other things like stocks.

The Fast & Furious … Financials

The Fed has embarked on a fast-and-furious hiking campaign. Currently, futures data from the Fed Funds Rate points to an 86% chance of another 75-bps rate hike in July and a 92% probability of at least another 50-bps hike in September.

By the end of the year, there is a 96% chance that interest rates hit at least 3.25%-3.5%. That means at least seven more rate hikes in six months!

The following chart shows the Fed Funds Rate futures breakdown for the target rate by December:

Notably, the market is pricing in a target rate of 3.5%-3.75%. That should send mortgage rates skyrocketing and make debt less affordable.

At the same time, investors can't forget about the Fed's balance sheet reduction, which is pulling liquidity out of the market.

At the beginning of June, the central bank began rolling off $47.5 billion per month by not repurchasing U.S. Treasurys and mortgage-backed securities. By September, the rate will double to $95 billion.

The Federal Reserve Bank of St. Louis is planning on reducing the Fed's balance sheet from an unprecedented $8.9 trillion. If all goes according to plan, by the end of 2023, the Fed will cut down the balance sheet by nearly $1.7 trillion.

While that's less than 20% of its total assets, the real risk is what the drying up of "free money" means for the stock market and the broader economy.

According to a Wells Fargo (WFC) analysis, this balance sheet reduction "could be equivalent to another 75–100 basis points of tightening" in addition to Fed rate hikes!

And that's a big reason why market sentiment is in the toilet recently. Wall Street is worried that the Fed's decisive action could tip the U.S. economy into a recession.

The Fed says it wants to avoid a recession … but a recession may be the only way for the Fed to bring prices down. After all, its tools are limited, and investors and consumers alike are screaming about high prices.

For the Fed, it won't be the worst thing in the world if it takes a recession to cool prices down.

We aren't in a recession … yet. But just the threat of one is spooking investors into selling their stocks. Of course, some stocks will be hit harder than others.

And that brings me to what you should be selling. Former high-flying tech stocks with not enough cash flow to cover the bills have already been hit hard. They're going to be hit harder!

Why? Because they have to keep borrowing money at higher and higher interest rates.

As for what you should be buying: I've told you that value investments act as a relative safe haven because their fundamentals are stronger, and their valuations are less aggressive.

Specifically, I'm looking for companies that pay fat dividends. These cash flows are paid immediately instead of relying on future growth, so they are less susceptible to inflation. And they'll likely rally higher and faster when the next leg higher comes around.

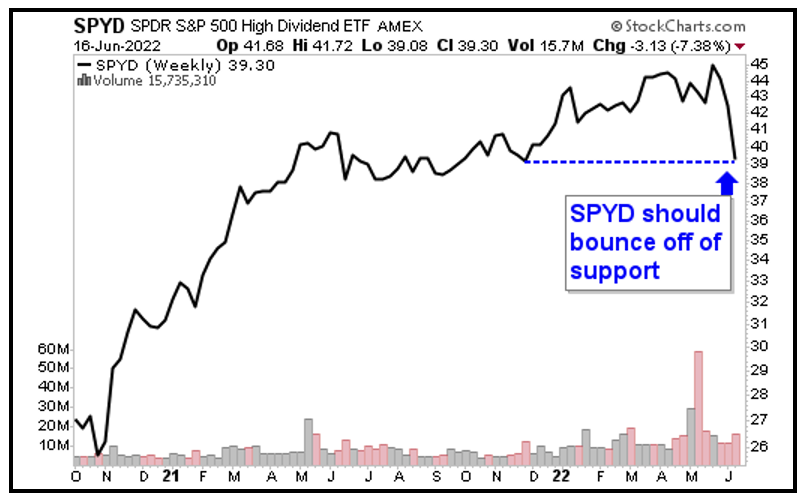

One fund you can look into for strong dividend payers is the SPDR Portfolio S&P 500 High Dividend ETF (SPYD).

SPYD looks to mirror an index containing the top 80 dividend stocks in the S&P 500. The fund's main objective is to offer solid dividend income while targeting capital appreciation. It currently yields 3.7% at current prices.

SPYD's top three holdings are Valero Energy (VLO), Marathon Petroleum (MPC) and Exxon Mobil (XOM). They make up about 6% of the fund.

SPYD trades with average daily volume of over 3 million shares, and it charges a minimal expense ratio of 0.07%. It currently holds about $7.9 billion in assets under management.

Looking at SPYD's weekly chart, we see that the fund could be due for a relief bounce off of support:

The recent market pullback has swept up the quality stocks, which could offer an opportunity to get in at a discount.

Always make sure to do your own research before entering a position, but the timing looks right to capitalize on strong stocks looking increasingly oversold.

All the best,

Sean