|

| By Chris Coney |

Look around you. I'm sure most of us have a similar item within arm's reach — a smartphone.

Considering their popularity, how many players do you think are in the smartphone market today?

Well, the answer to that depends on whether we're talking about hardware or software.

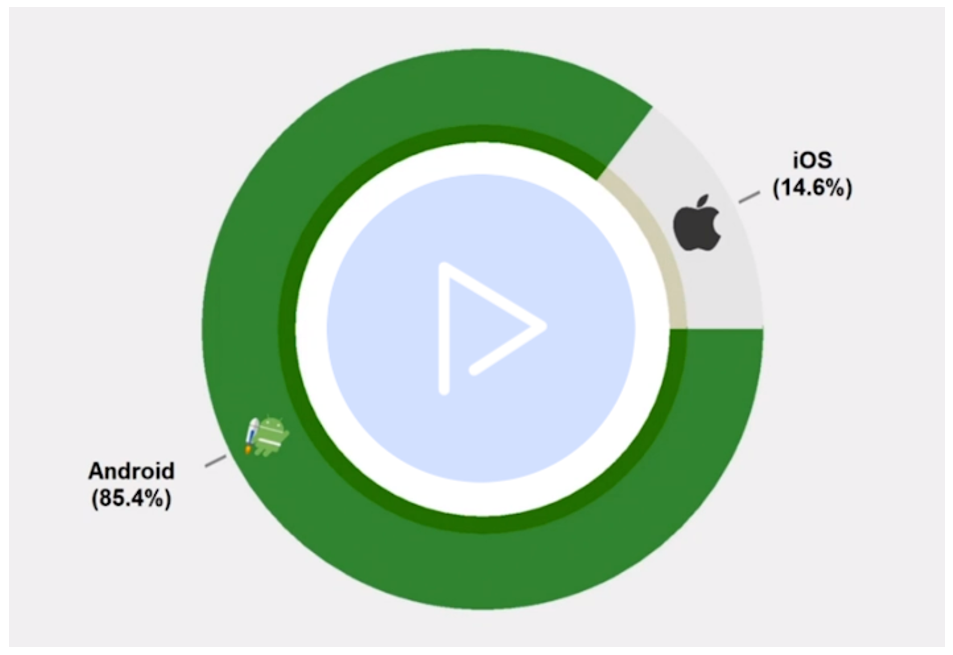

When thinking about smartphones, the first things to pop into most people's minds are well-known phone brands and operating systems, such as Apple's (AAPL) iOS and Google's Android. There's not much competition here, as these two players are the dominators of the software market in the West.

Hardware is less commonly known, but there are many more players in this field, including household names like Apple and Google, which manufacture their own phones. Other companies include Samsung, Huawei, Oppo, Motorola, Alcatel, Doro, Honor, TCL and Xiaomi.

The link between hardware and software today is that there are really only two main operating systems — iOS, which is only available for iPhones, and the Android operating system, which is installed on nearly every other phone.

This makes life easier for phone app developers since they generally only need to make their apps compatible with two different systems.

However, in the past, each phone manufacturer would install their own custom operating system on their phones. That means an app developer would have to make modifications for each type of phone they wanted their app to run on. As such, users wouldn't be able to access their favorite apps if their phone wasn't compatible.

So, you can see the benefits of having a universal operating system that covers many different hardware platforms.

Now let's map this idea over to crypto.

The early days of blockchains worked just like the old days of smartphones: Each blockchain was totally custom, and an app developer would need to decide which blockchain they wanted to build their app on.

After many technological advances, the landscape of modern blockchains closely mimics today's smartphone market.

In the blockchain world, we have around a dozen leading blockchain networks, one universal operating system and a few custom ones.

Similar to Android, the most universal operating system for blockchains is Ethereum (ETH, Tech/Adoption Grade "A").

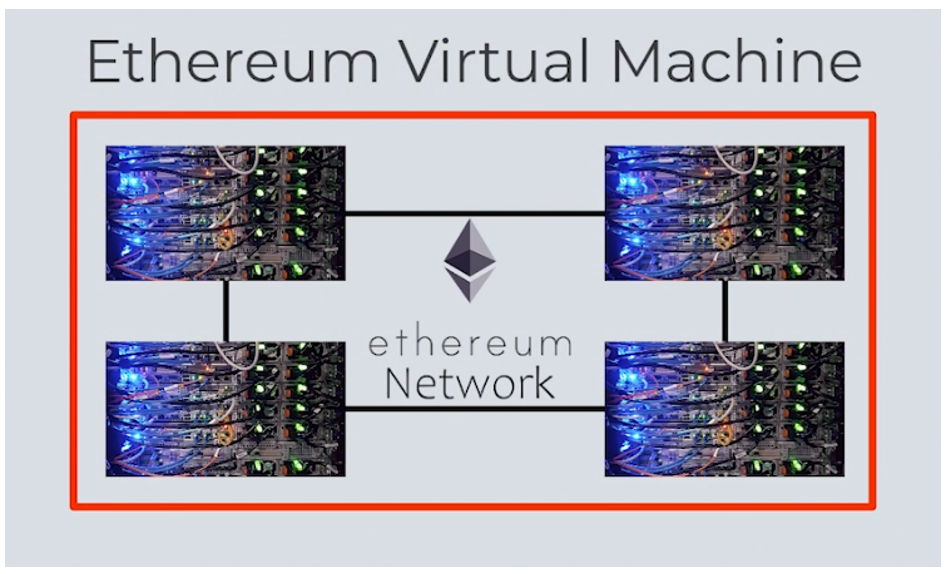

What's confusing about this is that Ethereum is both the name of the blockchain and the operating system that runs on it, referred to as the Ethereum Virtual Machine.

So, the Ethereum network is all the computers running the network infrastructure, illustrated by the connecting black lines, as seen below. The EVM is the operating system they're running to create one big supercomputer that apps can be developed on, which is outlined in red.

The distinction between the two didn't matter in the past because the Ethereum network had zero competitors. Fast forward to the present, and now there are several prominent competitors.

Some have decided to run their own operating system, like Cardano (ADA, Tech/Adoption Grade "B"), but even those are finding ways to incorporate cross-chain operability by allowing EVM-enabled sidechains or similar solutions.

That's created a crypto environment similar to the smartphone market. We have roughly a dozen leading blockchains, but many of the most prominent are running the same operating system, the EVM.

Now, app developers can rejoice because they're able to develop an app to run on the EVM, and they could technically deploy it on any of the other leading blockchains … or almost all of them!

How would that benefit you and I, the app users? We wouldn't have to relearn an entirely new operating system every time a new app is released.

Like I teach in my DeFi MasterClass course, once you're set up in the recommended way, you can generally interact with all the leading blockchains from a single wallet. You can even use the same wallet address across all the different networks.

Now it's not as consolidated as the smartphone market, because Apple's iOS is pretty much the only significant custom operating system. And Apple has enough users to make that specialization viable.

In comparison, there are still quite a few attempts being made to innovate at the operating system level in crypto, giving us a few unique set ups. However, if more networks adopt the EVM — or incorporate solutions like Cardano's side chain or the new zkEVM rollup announced by Polygon (MATIC, Tech/Adoption Grade "B") — it inches closer to becoming the universally accepted standard.

So, how exactly can you apply this to your crypto investing endeavors?

Generally speaking, you want to invest in projects that have the highest chance of success.

And a project has a higher chance of success if it's compatible with an already established ecosystem.

Since the EVM is currently the predominant operating system across the leading blockchains, in my opinion, anything that's designed to run on it automatically has a higher chance of success.

That's because typically, people are most comfortable with what they already know. So having to install a brand-new wallet or some other special software just to hop on an exciting new DeFi opportunity can drive away a lot of potential new users.

I'm not saying that means a new project won't succeed. But the less friction that new users encounter, the more likely they'll support a new project.

This is a major trait to look for when assessing a crypto project investment. If it's running the EVM or if it runs on the EVM, that's a big plus for its adoption.

That's all I've got for you today. Let me know your thoughts on the growth of EVM by tweeting @WeissCrypto.

I'll be back next week with some fresh new crypto content.

Until then,

Chris Coney