1 Out-of-the-Box Way to Target Outsized Profit Opportunities

|

Editor’s Note: The cornerstone of crypto investing is targeting opportunities the TradFi markets could never dream of. But it isn’t the only way to go for outsized profits. Another avenue is angel investing. Angel investors are individuals who invest in startups in exchange for a stake in the business and/or other potential rewards, such as royalties. Just like when targeting small-cap cryptos — as Juan Villaverde and Dr. Bruce Ng do in our New Crypto Wonders newsletter, the risks are higher investing in companies that are still building their businesses. But for the ones who get it right, the potential rewards for their earliest backers can be quite memorable. That’s why today, I’m turning the floor over to Weiss Ratings’ early investment expert, Chris Graebe, to explain a bit more about angel investing … and an opportunity you don’t want to miss out on … |

|

| By Chris Graebe |

Mr. Shawn Corey Carter is a world-class rapper and music mogul from New York. But you probably know him better as Jay-Z, the world’s first hip-hop billionaire.

Mr. Carter has a sterling reputation as a businessman, both within and beyond the entertainment industry.

But it’s the way he’s invested his massive earnings that should soon earn him more money than all his businesses combined.

Early Success to Build On

Back in 2005, Jay-Z jumped into the deep end of the angel investing swimming pool. By this, I mean he put money into the multicultural cosmetic brand Carol's Daughter.

Since that year, the rapper has invested in close to 66 startups through his personal portfolio and his venture arms Rock Nation and Marcy Ventures, according to Crunchbase.

Of those startups, Jay-Z has had the pleasure of seeing nine exits or IPOs across a wide range of sectors including cosmetics, applications, ride sharing, even alternative food and allergy companies like Impossible Foods.

He’s also jumped into developer platforms and retailers like the brand Fanatics to diversify his portfolio.

So, let's take a look at those startups he invested in that were acquired or went public through an IPO.

Millions to Billions

I think you’ll be surprised with the last company I share with you, but first up is … Carol's Daughter. As I mentioned earlier, it’s the very first investment that Jay-Z jumped into.

The startup sold to L'Oreal in 2020.

Another company, JetSmart, was coined the “Uber of private jets” at one point and eventually acquired by Vista Global.

Lastly, came the granddaddy of Jay-Z's investment portfolio: Uber.

Based on Crunchbase’s data, it appears that he invested in a series C round in 2013 when Uber’s value stood at $363 million. Today, the ride-sharing company that went public in 2019 boasts a market cap of roughly $162 billion. That’s right, billion with a “b.”

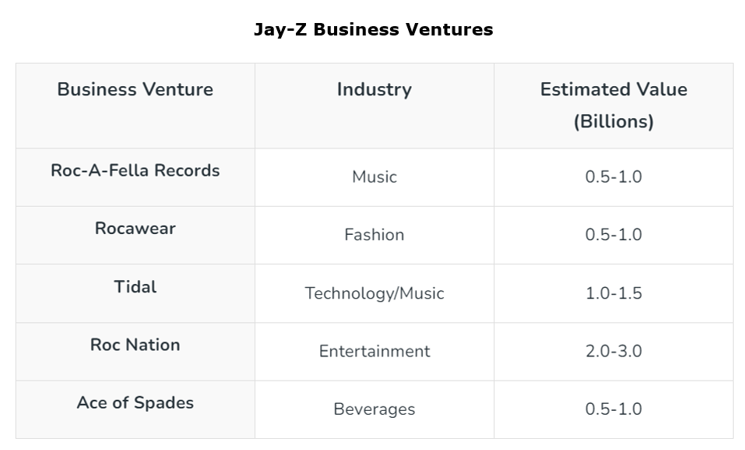

Let me be the first to say, “Congrats and nice work” to Mr. Jay-Z — who, based on the below list of his business ventures, obviously didn’t stop his startup investing journey with Uber.

Valued at more than $2.5 billion, Jay-Z is one of the most influential figures in the world of music, business and philanthropy.

With a net worth that has soared to new heights, Jay-Z’s financial success can be attributed not only to his iconic music career … but also to his shrewd business ventures.

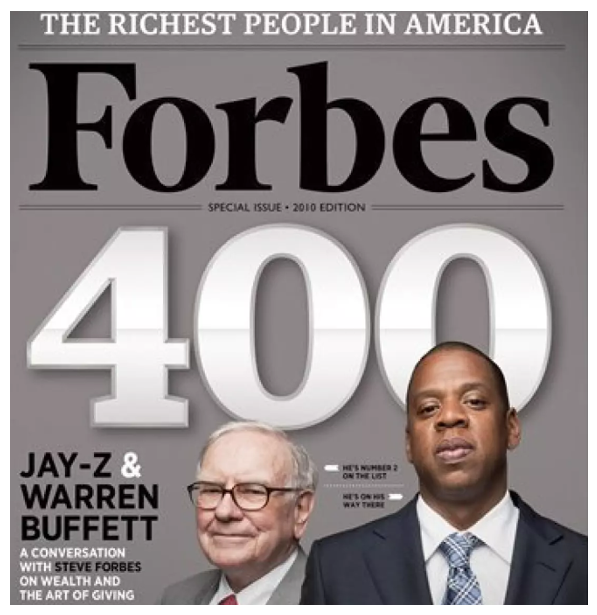

Jay-Z also leaned heavily into the advice he heard from Warren Buffett years ago: “Just invest in things you believe in and understand.”

I couldn’t agree more.

While you might not be starting companies from scratch, you can still invest in things you know and love. For example, you can invest in private companies whose products you personally use and that haven’t yet been discovered by Wall Street.

While exits are the Holy Grail of the startup investing world, that simple but powerful advice from Buffett about investing in things you understand and like also holds a lot of merit.

If you understand a company’s business and goals well enough, you’ll feel confident enough to take the next step and invest in that startup.

That’s true for folks new to startup investing or those who don’t even realize that everyday investors can access these opportunities.

So, take a page from Buffett’s book of wisdom: Invest in what you know and understand.

I know I’ve learned plenty from both. And from other billionaires like Mark Cuban and Kevin O’Leary, whose names are practically synonymous with angel investing.

That’s why I’ve recently put together an urgent summit revealing details about a private company that’s looking to transform an industry Americans spend $500 BILLION per year on.

And there’s a way you could get in before the angels and other “big guys” out there. Click here, and you’ll see what I mean.

Until next time, my friend!

Happy hunting,

Chris Graebe