2 New Hot Features to Expect in Shanghai Upgrade

|

| By Beth Canova |

Since the Merge, Ethereum (ETH, Tech/Adoption Grade "B+") has been inflating its coin supply 12 times slower than Bitcoin (BTC, Tech/Adoption Grade "A-").

Don't get me wrong, I like Bitcoin — which remains the world's No. 1 crypto, and bluest of all crypto blue chips.

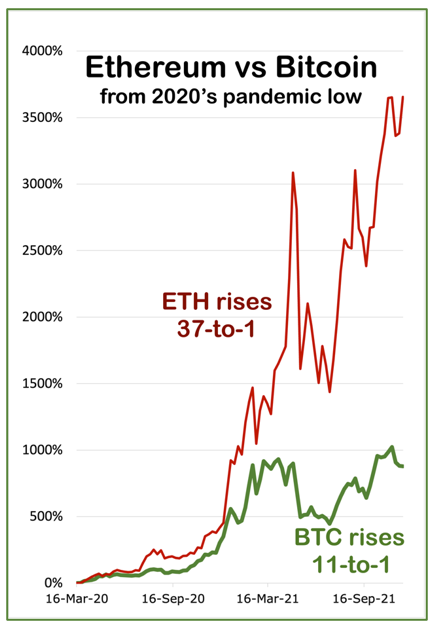

But Ethereum is the world's biggest, most adopted smart-contract blockchain. And unlike Bitcoin, it now offers investors yield. On top of that, it outperformed Bitcoin more than 3.5-to-1 in the previous bull market.

Click here to view full-sized image.

I think we'll see Ethereum outperform Bitcoin again in the next bull market as it strives for constant improvements.

And the next round of improvements is expected to come in the Shanghai upgrade, expected sometime next year. And amazingly, even after that, Ethereum will be only 55% complete, according to founder Vitalik Buterin.

Here are two of the most important features of the Shanghai network upgrade.

1. Allow stakers to withdraw their stake.

Staking in the new proof-of-stake Ethereum began on an unfinished chain two years before the Merge. And it was subject to strict and rather onerous conditions.

For one thing, the minimum amount you could stake was a hefty 32 ETH, or roughly $42,244 at current prices. Second, nobody could say for sure when you could get your money out again!

That's right, stakers were told their money would be locked up at least until some months after the Merge. And keep in mind that back then, even the date of Merge itself was a big question mark.

Nonetheless, staking was a massive success. A robust 12.4% of total coin supply is locked up on the blockchain and, therefore, unavailable to buy or sell. And now that the Merge is out of the way, the Shanghai upgrade will finally enable stakers to withdraw their ETH in early 2023.

But how will opening these floodgates impact prices?

Answer: I think any kind of selling frenzy is very unlikely indeed. Five reasons why:

1. The floodgates won't open all at once. Only accumulated staking rewards can be withdrawn straightaway. Withdrawals of principal will go into a queue to be released over time in a manner designed to minimize impact on market prices.

2. ETH stakers are true believers. Otherwise, they wouldn't have locked up their money under terms that scared off most ordinary folks. That makes them quintessential long-term investors unlikely to bail out at the first opportunity.

3. When Shanghai opens the door to flexible staking, a whole new crop of investors will likely want in, once they know they can get out anytime while staking in a non-custodial manner.

4. Ethereum was trading at substantially higher prices when most pre-Merge stakers came onboard. As a result, over 70% of them would be in the red if they sold now. Absent some financial emergency, I think very few stakers would choose to lock in a loss rather than hold for higher prices.

5. "Liquid stakers" who staked their ETH via a third party, such as Coinbase or Lido, are not subject to Shanghai rules, but to the rules (if any) of the third-party provider. And because of this, most of them can already exit any time they want.

2. Slash gas charges.

Enabling withdrawals isn't the only upgrade Shanghai will bring. Most notably, there is a proposed EIP-4488 with the aim to promote usage of Ethereum's rollups, Layer-2 scalable networks that make transactions vastly cheaper.

Indeed, fees are expected to be 1% or even less than corresponding transactions on Ethereum's base layer. This is important because there are classes of use cases, decentralized applications and games that require near-zero gas charges to be viable.

In addition, various other proposals are also currently under consideration. In fact, there were so many proposals coming in that earlier this year, core developers declared a pause until the Merge had passed.

Now, the time has come for them to get back into focus. It is precisely this kind of intense, ongoing development that makes us long-term bullish on Ethereum, despite the market-wide, near-term volatility sparked by the FTX debacle this week.

That's why it's always important to keep an eye on your long-term goals even as you navigate short-term market storms.

Best,

Beth