2 Things Crypto Projects Need to Make Major Money

|

| By Chris Coney |

A few months ago, I was watching a livestream on Twitch and typed a comment in the chat.

My username on Twitch has the word “crypto” in it, and after reading my comment the streamer said “You’re into crypto? You owe me $20,000.”

Turns out this streamer had invested $20,000 of his savings in VeChain back in 2017 during that major crypto bull run and lost it all.

He said he couldn’t understand why that happened because the use case for VeChain (supply chain management) was an amazing idea and a good application for blockchain technology.

This is a rookie mistake and a very easy one to make.

Fundamentals

The fundamental value of an investment is derived from what the thing you are investing in does.

The fundamental value of Nike (NKE) stock is that it sells running shoes — a product that avoids the customer getting blisters as they engage in their fitness routine.

So, the fundamentals of a company are metrics like revenue, profit, dividend per share and so on.

Hard, measurable, practical stuff.

Now, you would think that all the value of something would be derived from that, but that’s just not how economics works.

And that is principally because the economy is all actions taken by human beings, and human beings are emotionally driven.

Pumpamentals

A “pump” in markets just means the price went up.

Pumpamentals are features of an investment that cause the price to increase separate to the fundamentals.

This typically happens when there is some strong affinity or emotional connection to the investment.

Tesla (TSLA) stock was like this for a long time.

On paper, its fundamentals were pretty poor. But the business inspired people so much that they bought the stock, pushing it to levels it would never have reached based purely on fundamentals.

For example, even today, the price-to-earnings ratio of Tesla stock is 70.

To put that into perspective, I would typically deem anything over 30 to be overvalued.

That extra 40 that Tesla enjoys I put down to its great pumpamentals.

It is how investors “feel”’ about it.

You Need Both

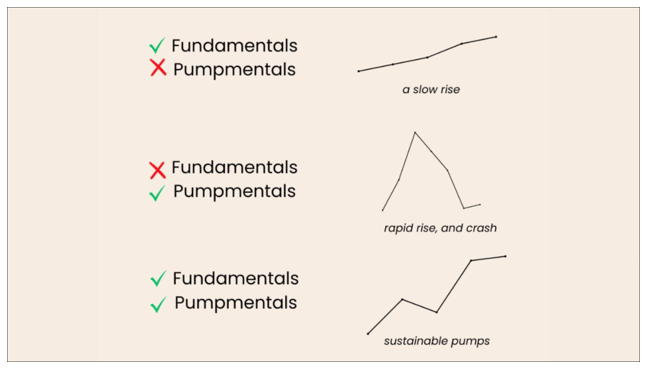

Let’s bring this together in a diagram I found on Twitter recently:

I find this such an elegant way of demonstrating the point.

Most good crypto assets have fundamentals.

They are good businesses, but they are “boring,” and thus their value rises over time as they grow their user base.

Pumpamentals don’t rely on a project having any fundamentals and can often be based purely on affinity, like the wide range of meme coins that have quickly come and gone.

That is the whole point.

If a project has no fundamentals to back it up, it may get a big rise based on an emotional frenzy, but emotional states don’t last forever.

So, if there is no sustainable fuel beyond the initial excitement, you get a rise and a crash like you see in the above diagram.

Right now, we’re entering the early stages of a bull market. At its peak, it’ll create so much hype, most crypto projects will benefit.

That’s a market-wide pumpamental.

Insist on Both

Unless you want to spend all day every day keeping up with every crypto project, you are better off investing only in assets that have both strong fundamentals and strong pumpamentals.

Even in a bull market.

That’s because the rise and crash of assets that only have pumpamentals can come so fast that unless you are really on it, your money can be gone before you even realize it.

But an investment that has both creates a “rising floor” effect: each time the price pulls back, it only gives back part of the price pump before pumping again.

Bitcoin (BTC, “A-”) is the clearest example of this.

The two-year span of 2016 and 2017 saw Bitcoin go up from $420 to just under $20,000.

In the crypto bear market of 2023, the furthest Bitcoin pulled back was to $15,500, thus demonstrating what I described above as a rising floor.

The Tag Team Effect

Pumpamentals are typically some kind of inspiring story or narrative that triggers a set of emotions that get people to take action.

That is what creates the price pumps.

Then, the fundamentals determine how much of that money sticks around.

If a price pump is based purely on emotion, it’ll fall right back down once that hype wears off.

Using Bitcoin again as an example, people tend to get into it for the pumpamentals and stay for the fundamentals.

While Bitcoin is the easiest example, this same framework applies to every crypto asset on the market today.

So don’t rush into any investment.

Make sure you have a clear understanding of the fundamentals — i.e., why people are going to use this product long term — and the pumpamentals — i.e., what is particularly inspiring about this project that is going to get people's attention.

If you make sure every crypto investment you make has both, you’ll be in great shape.

But that’s all I’ve got for you today. Let me know what you think about this topic by tweeting at me.

I’ll catch you here next week with another update.

But until then, it’s me, Chris Coney, saying bye for now.