|

| By Bob Czeschin |

On the third day of the new year, 150 combat aircraft came screaming out of the winter night, at low, radar-confusing altitudes over Caracas.

They came from the USS Gerald R. Ford carrier battle group and various U.S. airbases …

Helicopter gunships, electronic warfare jets, specialized intelligence and surveillance aircraft and troop carriers.

Delta Force operators hit the ground outside Venezuelan President Nicolas Maduro’s heavily defended compound, around 1 a.m. local time.

Within minutes, they burst inside and seized Nicolas Maduro and his wife Cilia Flores.

By late afternoon, they were both in a New York City jail cell.

They faced arraignment on a laundry list of federal charges that include cocaine trafficking and narco-terrorism.

Whether such an operation is legal under international and U.S. law — or smart or dumb global politics — is already being endlessly debated.

But one thing is already clear.

It’s causing aftershocks in surprising places.

Here are three of them.

1. Iran will likely be the next domino to fall.

On Dec. 28, graphic cell phone videos of massive street demonstrations across 100 cities exploded across social media.

And not for the first time.

Tehran’s ruling mullahs have never been very popular among ordinary people. Mass demonstrations have repeatedly rocked the nation — in 2009, 2017, 2019 and 2022.

But each time, Islamic Revolutionary Guard Corps (IRGC) and Basij stormtroopers brutally suppressed them.

This time, however, is different.

Today’s protestors have three major advantages their predecessors did not.

-

June’s 12-day war with Israel reduced the mullahs’ military muscle to historic lows. Almost overnight, they lost over 30 senior commanders, 50% of their ballistic missiles and 80% of their air defense capability.

Then, Trump’s “Midnight Hammer” air raid destroyed their deep underground nuclear weapons facilities.

-

Unlike prior outbursts of dissent that often centered around Sunnis, Kurds and other minorities, the burning issues infuriating today’s protestors impact nearly everyone.

Food prices are up 72% in a year. The currency, down 60% in 6 months. The bitter irony of a major oil producer forced to ration motor fuel for civilian use. Water bankruptcy, as hydrologists report the collapse of ancient aquifers, making hundreds of square miles — including some cities — virtually uninhabitable.

-

President Trump explicitly threatened to intervene if the mullahs violently crack down on Iranian protestors. And what just happened to Maduro in Venezuela is stark warning he is not all bluster …

Reinforcing this message, the Farsi-language social media account run by the U.S. State Department recently posted a picture of the American President with a caption, saying: "President Trump is a man of action. If you didn't know, now you know."

Fearing what may lie ahead, Ayatolla Ali Khamenei has apparently settled on the same escape plan used by Syrian dictator Bashar al-Assad — who decamped for Russia as his regime collapsed in November 2024.

The 86-year-old cleric reportedly has a private jet standing by to take him and his son to Moscow — with his $95 billion personal fortune largely intact.

2. Despite the biggest live-fire military exercises in decades, Beijing will not invade Taiwan in 2026.

For decades, Beijing and Caracas have had compelling common interests. Venezuela has the world’s largest oil reserves, but international sanctions exclude it from most markets.

China is the world’s largest oil importer — and mostly doesn’t give a hoot about sanctions. So, Beijing routinely purchased up to 95% of all the oil Caracas could produce. At a suitable discount, of course, reflecting China’s status as a monopoly buyer.

In addition, Venezuela’s Orinoco Mining Arc is one of the few places not under Chinese control with sizeable deposits of critical minerals and rare earths the Pentagon considers essential to U.S. national security.

So, Beijing naturally maneuvers to ensure ore from these deposits wind up at Chinese controlled smelters for processing.

In fact, a high-level delegation led by Beijing’s Special Representative for Latin American Affairs held meetings with Maduro in Caracas last weekend.

Petroleum and rare earths were almost certainly near the top of their talking points. As they reportedly inked several hundred cooperation agreements — just hours before U.S. special forces swept in.

In addition, China is known to have two satellite ground-control facilities in Venezuela. Which are thought to be gathering potentially very valuable signals intelligence very close to America’s backyard.

But now, with the Maduro regime effectively decapitated, all the foregoing is at great risk of being lost.

Also, China depends on imported oil for roughly 70% of its daily consumption. Venezuela supplies 3% to 4% of its daily consumption. Imported Iranian oil supplies a further 10% to 12%.

So, if Tehran’s ruling mullahs follow Venezuela down the rabbit hole as expected, China could be short 13% to 16% of daily petroleum needs.

That’s quite a substantial sum. More than enough to cause spot fuel shortages and supply interruptions. And make invading Taiwan a logistical nightmare.

Also, the People’s Liberation Army (PLA) hasn’t gone to war since 1979 (a border skirmish with Vietnam). That means China no longer has any soldiers of military age with combat experience.

On top of that, President Xi’s anti-corruption campaign plus infighting among Party factions has caused a perfect storm inside the PLA.

Indeed, more generals were fired or purged in 2025 than any other year in the post-Mao era.

Invading Taiwan would always be a perilous undertaking — even in the best of times.

But in 2026, it would also consist of freshly promoted general officers … commanding troops who’ve never fired a shot in combat … in a war with uncertain fuel supplies.

In other words, a monumental gamble.

With the fate of the Party — and perhaps the nation — hanging in the balance. That’s exactly why it’s very unlikely to occur in 2026.

3. China’s stealth purchases will lift gold to a new string of all-time highs in 2026.

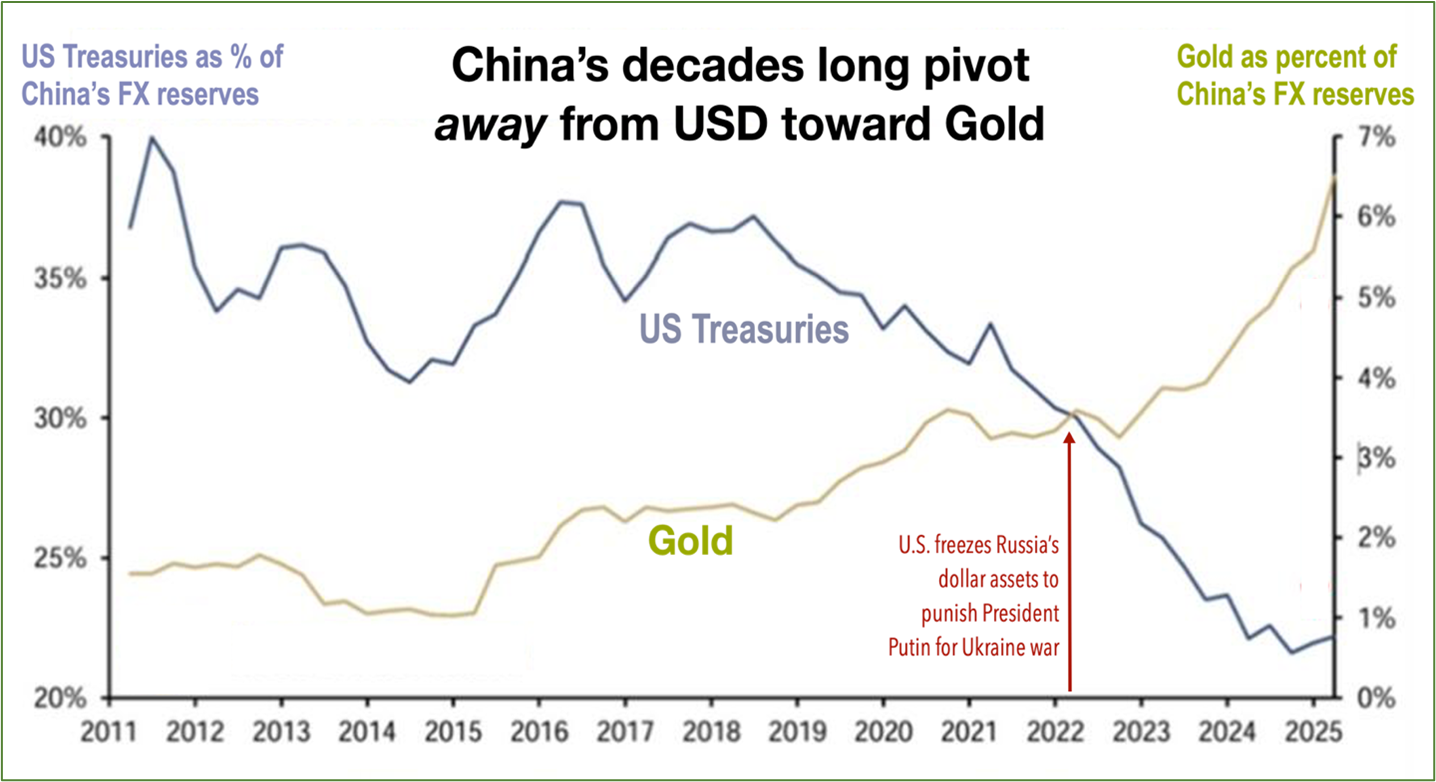

One of the most under-appreciated bullish influences on gold prices is China’s decades-long stealth-buying program.

And that’s largely because the stealth is far from obvious.

The World Gold Council, ranks official gold reserves of 100 countries. China weighs in at a respectable, if unremarkable, No. 7 on this list — with 2,305 metric tons.

But in China’s case, this number conceals far more than it sheds light on. The true extent of China’s gold hoard is one of Beijing’s most closely guarded state secrets.

What we actually know for sure … is this:

- China is the world’s largest gold producer, and half its mines are directly owned by the state.

- Since 2000, Chinese mines have produced 6,800 tons of gold.

- China is also the world’s largest gold importer. And 7,000 tons of gold have come in through Hong Kong since 2000.

- More than 22,000 tons of gold have been withdrawn (since 2008) from deliveries made on expiring futures contracts on the Shanghai Gold Exchange.

- On top of that, the World Gold Council estimates some 2,500 tons have likely accumulated in private hands since Beijing legalized private ownership of gold in 2002.

Add up all these numbers, and China vaults to No. 1 in world gold reserve rankings. With roughly 4x as much gold as its nearest rival, the U.S.

In other words, China has been quietly scooping up gold far faster and in greater quantities than most investors are aware.

And since the Ukraine war, the scooping has been on steroids.

When President Biden froze Russia’s dollar assets, it sent shockwaves through just about every paneled central bank boardroom worldwide.

Why? Because nearly all of them also hold dollar assets as reserves to back the local currencies they issue.

So naturally, they worry what could happen if Uncle Sam one day became annoyed at them.

But they’re not standing around, waiting to find out. Virtually all of them have been swapping dollar for gold as fast as they can (without roiling the markets).

2025 was gold’s best year since 1979. 2026 is set to be even better. Expect a long string of new all-time highs.

Investment Implications

If you don’t already have some gold in your portfolio, it’s time to add some forthwith.

One of the easiest ways to do that is with ETFs like iShares Gold Trust (IAU).

If you want your gold on the blockchain, then the PAX Gold (PAXG, Stablecoin) coin can track the price of the yellow metal from the safety of your crypto wallet.

Or, if you’re looking for even greater gains, you may want to skip gold and target another resource altogether.

That’s because, according to my colleague Sean Brodrick, this market is about to shift into a new phase.

Sean is a resource expert who prefers boots-on-the-ground experience over researching from a distance. He accurately called gold’s rise to $3,200 when most said it was the stuff of fantasy.

And now, he’s revealing a hidden paradox in gold’s bull market. It’s a discovery that could help investors notch impressive gains without buying gold … and stay one step ahead of the crowd.

To learn more about it — and which asset is poised to grab even greater gains soon — click here.

Best,

Bob Czeschin