|

| By Bruce Ng |

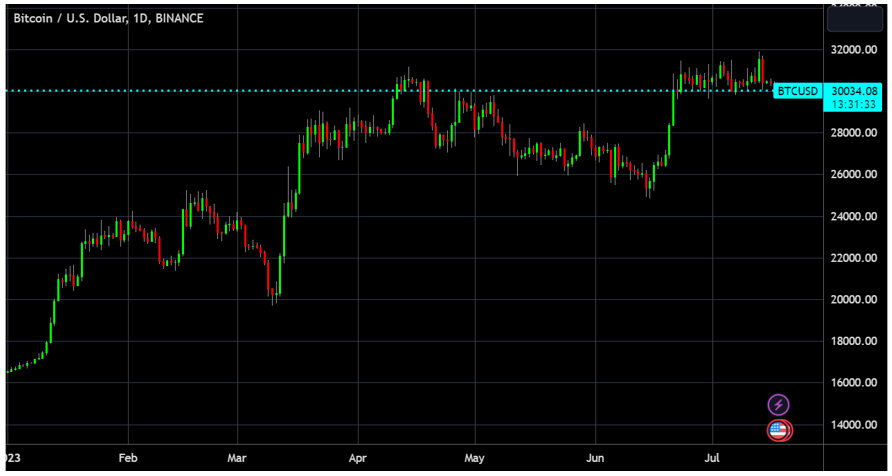

In the past week, Bitcoin (BTC, “A-”) has failed to break above the $31,000 level multiple times.

At the time of writing, it’s on the brink of losing its $30,000 support. If it moves below this level, it will likely head down to $28,000.

On the bright side, if Bitcoin does slip down to $28,000, this could present an advantageous buying opportunity.

Alternatively, if BTC decides to move upward, the next range to look out for is between $32,000 and $32,750.

For now, all we can do is wait and see what the price action has in store for us.

But what’s the outlook for altcoins? Let’s take a glance at BTC dominance to find out:

Usually when BTC drops, it drags the whole market with it. So, what we need for alts to do well is for BTC’s price to hold steady while its dominance drops.

We hit a local high of 52% for BTC.D recently. And for the past few months, 48% was a key resistance level.

Now, for alts to do well, we need BTC.D to go below 48%. Typically, a good rally for alts occurs when BTC.D ranges from 48% to 44%.

All of this is also dependent on BTC staying above its key support level of $30,000.

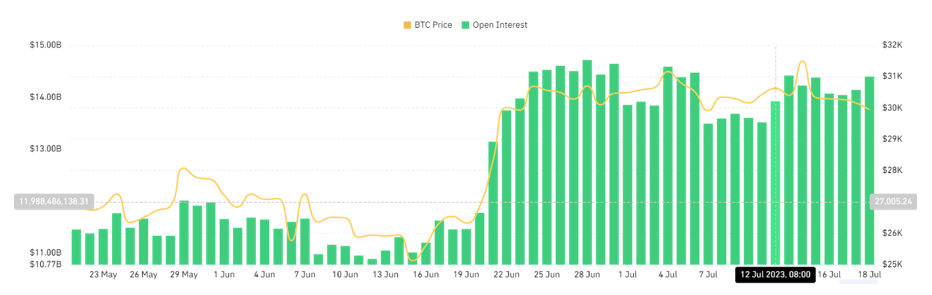

Lastly, let’s consider one more piece of data to get a better picture of where BTC is headed.

In the chart above, the open interest for futures across all centralized exchanges is displayed in green.

Although there was a minor leverage wipeout over the past week, OI has bounced back to $14.4 billion. This is considered one of the highest levels in the past month.

In summary, we have a few bearish indicators going for us here:

- BTC failed to break $31,000 resistance multiple times over the past week.

- BTC has slipped below $30,000 resistance to taste $29,000 levels at least once since the time of writing.

- OI is still relatively high in the local time frame, signifying that there is still too much exuberance in the market.

Going forward, there is a strong possibility that some liquidations could occur … and BTC could head to the $28,000 region soon.

In this case, alts will bleed even more.

As we wait for this price action to play out, stay safe and make sure to check back in with Weiss Crypto Daily for your market updates.

And if you would like a more in-depth analysis of high-quality alts to invest in for the long term — which you can hold through short-term market volatility like what’s happening now — I suggest checking out my colleague Juan Villaverde’s Weiss Crypto Investor.

Best,

Bruce