Editor’s Note: Decentralized AI is revolutionizing both blockchain and AI technology.

But there’s another AI opportunity that could revolutionize your trading strategy: Weiss Rating’s AI-powered stock system.

Unlike human traders, it doesn’t get swayed by emotions or rattled by rumors. Instead, it relies purely on objective, unbiased data.

It also works better than any other stock tool we’ve developed before, beating the stock market by 94-to-1.

And this coming Tuesday, Aug 12, our founder, Dr. Martin Weiss, will host a history-making demonstration to show you how it can work for you.

All you need to do is RSVP now to secure your seat.

And in the meantime, I hope you check out these other AI opportunities …

|

| By Beth Canova |

AI is now transforming tech, human resources and all kinds of other sectors.

In this way, it’s influencing our society in profound ways.

It has paved the way for advancements in healthcare, finance, transportation and beyond. AI

Naturally, it has also found its way to the blockchain. This convergence of technologies has created a unique new branch of AI: decentralized AI.

Combining the automation of AI and the trustlessness and transparency of blockchain technology, decentralized AI democratizes what is otherwise a guarded and highly centralized opportunity.

Which is why today, I want to dive into three crypto AI plays you may want to put on your radar.

RENDER: Where Decentralized AI Thrives

Video rendering is probably the hottest narrative most people have never heard of.

That’s because it’s full of projects that operate behind the scenes. But it empowers media that is much flashier than the process itself.

Think of it this way: A standard HD video frame contains 2 million pixels — each involving up to 10 separate calculations (for position, color, saturation, etc.).

So, at 24 frames a second, a mere two hours of screen time requires a whopping 3.4 trillion calculations!

Now, think about your favorite animated movie, video game or metaverse. Can you imagine the number of calculations they needed?

Video rendering is one of the most computer-intensive tasks on the planet.

And before Render Network (RENDER, “B-”), rendering services were limited to large companies with enough computer firepower for this kind of work.

Because of this, the likes of Amazon Web Services, Microsoft Azure and Google Cloud, were able to charge an arm and a leg for it.

Render’s genius was to cleverly exploit the fact that the vast majority of computers are used only a few hours a day. Its app allows you to rent out unused idle time on your machine in exchange for RENDER tokens.

Render aggregates these resources, from tens of thousands of computers around the world, for video rendering.

Which it can do faster and cheaper than the cloud computing giants.

That’s thanks to Render’s decentralized nature.

Unlike those big cloud computing services, Render has no hardware that needs to be stored in a physical building and serviced by expert technicians.

Those costs can add up quickly. Without them, Render can afford to charge less for its services.

And now, it turns out this same technology can also be used to train the neural nets at the heart of ChatGPT and other AI platforms. Which is another massive computer-intensive task.

This puts RENDER in a very exciting position where two of the hottest narratives in crypto — decentralized rendering and AI — converge.

First launched in 2020 for just 6 cents, RENDER now trades just over $3.90 — far from its previous all-time high of $13.

Even if RENDER doesn’t hit a new all-time high this cycle, with such an advantageous position, usage, adoption and token prices could keep going up … for a very long time.

PROMPT: Bring Average Users to the DeFi AI Revolution

Launched on April 11, 2025, Wayfinder (PROMPT, Not Yet Rated) is still mostly unknown among crypto investors.

But I don’t think that’ll be the case for long.

Wayfinder has the potential to open up an even bigger market. One that virtually anyone with a cellphone and an internet connection can access.

And they can do it by simply talking to the blockchain.

It’s no secret that AI has been a hot narrative in crypto. Heck, it’s dominated headlines across markets in the past year.

But Wayfinder is not your typical AI-driven platform.

Sure, it is designed to enhance interactions between artificial intelligence and blockchain environments. But what really sets it apart is how it uses natural language to create autonomous AI agents called “Shells.”

Shells are crypto bots with individual personalities. They can learn, influence and accumulate on-chain resources,

That means Wayfinder users do not need to understand how to code the complex algorithms AI agents run on. Instead, average folks like you or I can speak plainly to create an AI that does exactly what we want it to.

For example, Shells can execute …

- token swaps,

- smart contracts,

- DeFi strategies and …

- bridging assets across chains.

All in ways that optimize speed and cost. All initiated and directed by natural language commands.

Look, merely being able to talk to crypto (in plain English) to get stuff done … is an immense breakthrough all by itself.

By democratizing AI blockchain access in this way, Wayfinder could potentially open up, introduce and connect virtually the entire sentient world to crypto.

Talk about mass adoption! It simply doesn’t get more massive than this.

Investors with long time-horizons and robust risk tolerance quite naturally see potential to change the world on such a grand scale … as a seedbed for vast future fortunes.

That said, unlike RENDER, it doesn’t have a complete cycle under its belt. That means we don’t have a precedent for how PROMPT will react in a more risk-off environment.

Still, if things work out as expected, Wayfinder could be an opportunity much like the very early days of crypto … when you could still buy Bitcoin for under a dollar.

Bittensor: Breaking Barriers to AI Innovation

Bittensor (TAO, “E-”) is a pioneering decentralized network that offers a collaborative platform for sharing and enhancing AI models.

This approach aims to break down the barriers to AI innovation, which have previously been confined to entities with significant computational resources.

How? Through a peer-to-peer marketplace.

By allowing participants from all over the world to contribute to and benefit from collective intelligence, Bittensor democratizes AI development.

It does so through a unique technological framework known as the Decentralized Mixture of Experts (MoE).

This setup allows multiple specialized AI models, called subnets. These subnets then collaborate to address complex problems more effectively than any single model could.

All while they compete for TAO tokens, a process that incentivizes continuous subnet improvements to keep up.

This approach not only enhances prediction accuracy. It also allows the system to handle larger data volumes more efficiently.

In short, Bittensor addresses key AI challenges such as the high cost of development and the centralization of computational resources.

Which makes Bittensor’s platform a sustainable and evolving AI development environment that promotes a wide array of AI applications.

The TAO token represents a potential growth opportunity, especially as the network expands and its technologies are adopted across various industries.

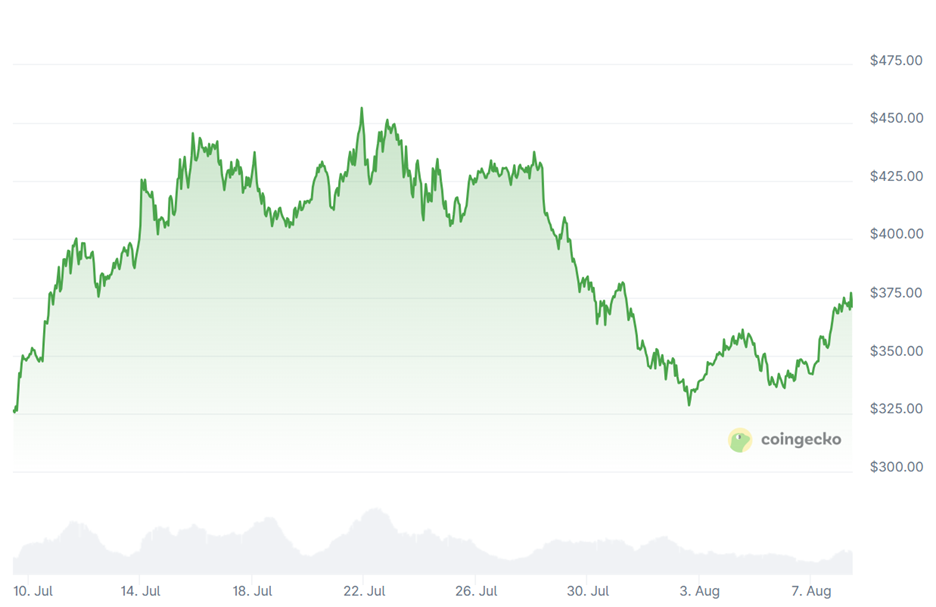

Despite the late-July correction, TAO ended the month on a high note, rising roughly 13% in the past 30 days.

As crypto AI grows, Bittensor is set to continue its role as a sector leader.

Of course, only you can decide which cryptos are right for your portfolio.

If you want to keep an eye on their performance, I suggest you add them to your watchlist right here on the Weiss Ratings website.

Best,

Beth Canova

Crypto Managing Editor