3 Lessons on Crypto Investing … from Ancient Rome?

|

Editor’s Note: My colleague over on the TradFi side, Sean Brodrick — a cycles expert with over three decades of experience as an investment analyst — recently returned from an exciting vacation to Italy. While exploring the remains of ancient Rome’s famed cities, he learned three investing lessons there that not only transcend time but even technology to benefit the crypto investors of today. As volatility resurfaces in the crypto market, I thought now was the perfect time to share Sean’s wisdom. I’ll let him take it from here. To your wealth, Beth Canova |

|

| By Sean Brodrick |

I recently took my family on a dream vacation to Italy. We got to visit ancient historical sites like the Colosseum and Palatine Hill in Rome, along with two former enclaves of Rome’s idle rich.

You’ve probably heard of Pompeii, which vanished in a volcanic eruption in 79 AD. Herculaneum was its lesser-known neighbor. But its ruins hold a treasure trove of lessons for even the most modern-day investors.

While Pompeii was wiped out in a pyroclastic flow of superheated volcanic ash, the wind was blowing away from Herculaneum when that happened.

The people in Herculaneum thought they were safe …

That is, until the wee hours of the next morning.

Suddenly, a 65-foot wall of boiling, 1,000-degree mud buried the town. The mud then turned to stone, and the secrets of Herculaneum were sealed.

Once modern archaeology got going, digging began at Herculaneum. Few bodies were discovered, so scientists assumed that, unlike the people of Pompeii, most of the inhabitants succeeded in escaping toward nearby Naples.

In the 1980s, however, excavations at Herculaneum’s ancient shoreline uncovered a chilling sight …

More than 120 human skeletons, huddled in the stone doorways that opened to the beach.

Scientists also found one boat and its crew on the ancient beach. They’d pulled in to rescue people just as the mud roared over the town and buried them, permanently moving the coast 300 yards away.

This was that boat.

I can’t stop thinking of that poor crew. They were Roman sailors doing the right thing. But then disaster hit so fast, they were dead before they knew it.

The ship’s wood survived —in fact, it’s remarkably preserved — because the super-heated mud smothered it so fast that the wood didn’t have time to burn.

The sailors, unfortunately, had no warning.

However, the people of Pompeii and Herculaneum had plenty …

A terrible earthquake in 62 AD toppled buildings in both towns. The Romans rebuilt quickly, using whatever materials they had at hand. That’s why walls in these towns are a patchwork of materials, as our guide Ionica shows here …

That wasn’t the only warning. There were previous eruptions.

Heck, an eruption of Mt. Vesuvius had wiped out a Bronze-Age civilization and periodically would wreak havoc on the countryside.

While eruptions were not clockwork, they did happen from time to time.

So, why did people stay?

The volcanic soil was incredibly fertile, and farmers did brilliantly there.

This area was a massive exporter of olives, olive oil, figs, wheat, sheep, you name it. If it could be grown, it grew there … and FAST.

Pompeii was a prosperous town. And Herculaneum was fabulously wealthy. The Palm Beach of its day. Those rich folks could have lived anywhere. Why there?

I think for the same reasons why people buy beachfront real estate despite weather-related threats to Florida’s coastline.

They couldn’t conceive of disaster affecting THEM.

And these towns were so pleasant. They boasted beautiful hot-water baths — the height of luxury in the day — and stadiums where actors performed plays and brave gladiators battled …

And that luxury made the Romans who ran Pompeii and Herculaneum short-sighted.

They could not imagine such a catastrophe overtaking them. Bad luck was for other people.

So, when ash clouds started spewing from Mt. Vesuvius, many in both towns fled to Naples … but many others stayed.

The buildup to the final eruption took days. There was plenty of warning.

And even after Pompeii was buried and burned alive, the folks remaining in Herculaneum thought the Fates had spared them.

That is, until more rumblings and ash flows sent them to the navy to beg for an evacuation in the middle of the night.

Too late!

So, what did I learn in Herculaneum? Three things:

- Live every day as if it’s your last. Because one day, your busy life will be gone in a puff of smoke. For investors, I’d say that also means enjoying some of those returns you worked so hard to earn.

- Have an exit plan. Whether it’s neighborhood strife, an apocalypse or the markets, be ready to get out fast if necessary.

- Heed warnings. There were plenty of rumblings that Vesuvius was up to no good. I’m sure if you look around, you will find warning signs in our market, too.

I mean heck, I’m about as bullish a guy as you can find on America’s economy and market, but I can see signs of stress rearing up.

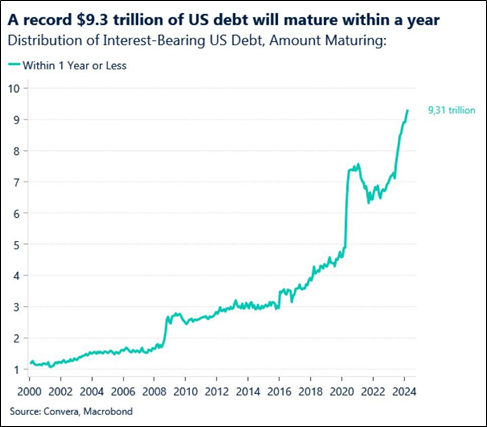

This chart of interest-bearing debt that is close to maturity, for example …

As you can see, $9.3 trillion of U.S. debt will mature in a year. That was probably financed at very low interest rates and will have to be refinanced at higher rates.

You don’t have to be an oracle to see the trouble brewing here.

I don’t have a crystal ball, but when that debt bubble finally bursts, I can guarantee that some people will tell you it’s a great time to buy.

Sure, buddy, sure. You go ahead and hop right on that last boat into Herculaneum. I’m sure it will be fine.

As for me, I’m optimistic with a healthy dose of caution. I’m watching for warning signs that disaster could be imminent.

I’ll tell my subscribers to act when the rumblings start, not when it’s too late.

I hope you do the same.

All the best,

Sean

P.S. While the U.S. is likely going to be forced into paying higher interest rates, it is still possible for you to lock in higher income rates, too.

In fact, my colleague and DeFi expert Marija Matić explained how DeFi helps her do just that in her “Superyield Conference” with Dr. Martin Weiss.