|

| By Mark Gough |

Altcoin season just got institutional backing.

Three major altcoin ETFs — tied to Solana (SOL, “B”), Litecoin (LTC, “C+”) and Hedera (HBAR, “B”) — officially began to trade on U.S. exchanges.

This marks the first time these assets can be owned directly through traditional brokerage and retirement accounts.

And here’s the kicker: The launches came despite the ongoing government shutdown.

Issuers used Form 8-A filings to bypass the traditional SEC approval queue.

This move cracked open the door for a massive pipeline of more than 150 pending crypto ETF applications. Bloomberg analysts say we could see over 200 new funds hit the market within the next 12 months.

The Numbers That Matter

The Bitwise Solana Staking ETF (NYSE: BSOL) stole the show with $56 million in first-day trading volume.

That’s not just the best performance out of these three crypto ETFs. It’s the largest debut of any ETF this year!

The fund launched with $220 million in seed capital and generated $10 million in trades within the first half hour.

BSOL’s structure is a breakthrough in itself.

It stakes 100% of fund assets on-chain through Bitwise Onchain Solutions (powered by Helius). This lets it capture Solana’s 7% average staking yield … all while maintaining full SEC compliance.

Even better, the 0.20% management fee is also being waived for the first $1 billion in assets during the first three months.

Meanwhile, Canary’s Hedera ETF (Nasdaq: HBR) and Canary’s Litecoin ETF (Nasdaq: LTCC) rounded out the trio with $8 million and $1 million in first-day volume, respectively. HBAR jumped 17.4% to 21 cents heading into the debut, while Litecoin held steady near $101.

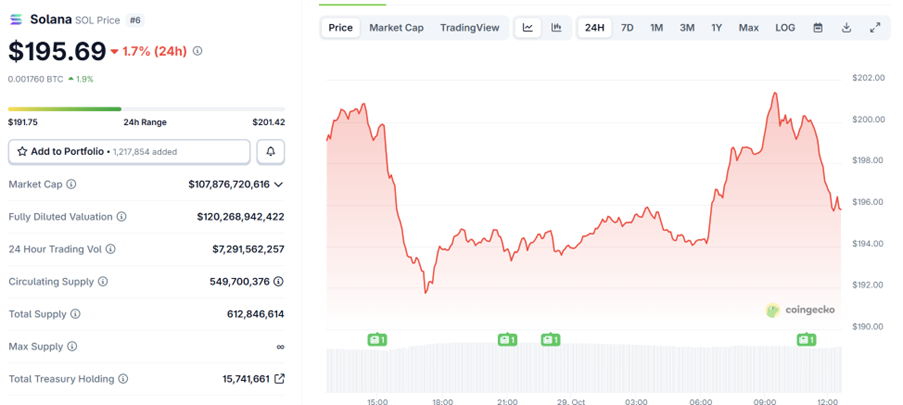

As of this morning, Solana trades at $194, down just 2% from yesterday’s high — a modest pause after an ETF-fueled surge.

What This Means for Your Portfolio

The floodgates are open.

The U.S. now hosts 76 crypto ETFs and ETPs. Collectively, they manage $156 billion in total assets — a record level of institutional exposure.

Bitcoin ETFs alone attracted $29.4 billion in inflows through August, including $1.21 billion in a single day earlier this month.

And this is only the beginning.

Bitwise expects Q4 inflows to smash new records as major wealth managers like Morgan Stanley and Wells Fargo open crypto allocations to thousands of advisors managing trillions in client capital.

If the Solana ETFs follow the same adoption curve as the Bitcoin and Ethereum funds, Bloomberg analysts project up to $3 billion in inflows over the next year.

That could extend Solana’s run as the clear leader among non-BTC, non-ETH assets.

The Pipeline Ahead

Today marks another key milestone: Grayscale’s Solana ETF officially begins trading after converting from its OTC trust.

Grayscale recently enabled staking rewards for GSOL investors. That puts it in direct competition with BSOL’s yield-generating model.

And there’s a lot more coming.

There are now 155 pending ETF applications tracking 35 different crypto assets, from Chainlink (LINK, “B”) to Arbitrum (ARB, “C+”) and Avalanche (AVAX, “B”).

Combine that with the Trump administration’s pro-crypto stance — including the GENIUS Act (stablecoin framework) and CLARITY Act (regulatory oversight) — and it’s clear Washington is shifting toward mainstream institutional adoption.

The Bottom Line

For years, retail investors had the edge.

We could buy altcoins directly while institutions sat on the sidelines.

That dynamic had just flipped.

Solana, Litecoin and Hedera are now available in IRAs and brokerage accounts — with some 401(k) plans beginning to offer access.

No wallets, no private keys, no exchange risk — just ticker symbols.

With more than 200 ETFs likely to follow, the next phase of this market won’t be about whether institutions can buy crypto.

It’ll be about the size of their balance sheets.

Your time to get ahead of them is running out. To learn how my colleague Juan Villaverde plans to stay one step ahead of the TradFi crowd, click here.

Best,

Mark Gough