3 Possible Scenarios for Bitcoin’s Short-Term Price Action

|

| By Bruce Ng |

Last week, Bitcoin (BTC, “A-”) easily blasted through $30,000 due to its recent rally. However, as my colleague Marija Matić pointed out yesterday, it closed the week slightly below its resistance level of $30,500.

This key level is demonstrated by the yellow arrow in the chart below:

So, where do we think Bitcoin and altcoins will go from here?

The key is in BTC’s price action. At this point, its price should dictate the short-term direction of the market.

The short story is that if Bitcoin can flip this $30,000 level from resistance to support, it can continue its upward trajectory.

For this to happen, it will need a weekly retest of the $30,000 level. In other words, it needs to hit $30,000 or below and then bounce back up on the weekly.

Of course, there’s always a flip side to this:

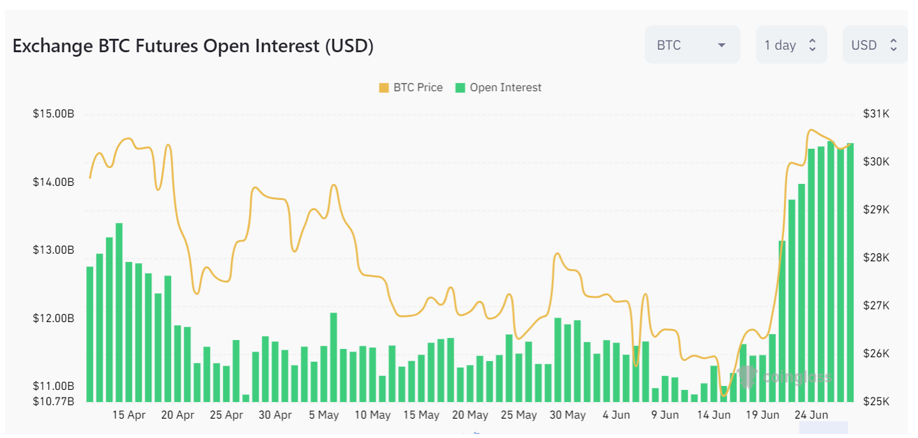

As Bitcoin’s price rallied up on June 14 from $25,000, open interest on futures increased in tandem.

You see, OI is a measure of the still-open volume of leveraged positions. And every time there’s a price rise, it’s no surprise that OI increases as investors become more bullish.

Now, the danger here is that any sort of quick dip on spot markets will cause those leveraged positions to be liquidated.

From here, I can foresee three possible scenarios:

- BTC does not experience any major liquidations, so its price can continue to climb upward after the weekly retest of $30,000. In this case, $35,000 is most likely the next stop.

- There is a major flush out of leveraged positions as BTC dips slightly. This would wash out many of the leveraged positions, but BTC would continue its upward trajectory. Additionally, this leverage washout would make any following price increase by BTC healthier so to speak.

- BTC falters and triggers major liquidations. If this happens, there would be insufficient future volume as well as a lack of interest to provide a spot-driven rally. So, BTC would hover around the $28,000 to $30,000 level.

Only time will tell which situation will play out from here.

However, centralized exchanges know the liquidation levels for all trades on their platforms. With this knowledge, they are financially incentivized to liquidate traders.

In other words, irrespective of whether BTC goes up or down, there is a high chance of a major liquidation event soon. This may be a good opportunity to add to your positions if you are bullish, so keep an eye out.

As for bull markets, they are typically characterized by three consecutive green monthly candles and higher highs and higher lows on the weekly candles. So, it’s still too early to say if we are in a bull market or a bull trap.

On the bright side, alts have performed superbly since BTC’s rally from $25,000. In fact, there are some which even made 40% gains since this recent rally.

If you would like more in-depth analysis about which altcoins to buy — and when — I suggest checking out Juan Villaverde’s Weiss Crypto Portfolio.

And as always, make sure to check back in here at Weiss Crypto Daily for key market updates.

Best,

Bruce