3 Risks of Memecoin Trading and How to Mitigate Them

|

| By Bruce Ng |

Liquidity is starting to trickle down, and smaller projects are gobbling it up.

But something about its path this time is different. See, usually, liquidity flows in the same direction when it enters the crypto market. First stop, Bitcoin (BTC, “A-”). Then comes Ethereum (ETH, “B”) and other big-cap altcoins. Then the medium- to small-cap projects. The final stop in this trickle-down liquidity waterfall is memecoins.

This time, this order was upended. Sure, some larger alts are moving in sync with Bitcoin, as my colleague Marija Matić pointed out yesterday.

But more notable is the fact that, all the memecoins on our watch list pumped at the same time BTC exploded upward. In other words, we did not need to wait for money to slowly trickle down from Bitcoin in the order mentioned above.

I wrote about memecoins the last time the sector saw a surge in May. But as a reminder, these are joke coins created without any fundamental value.

Typically, a cryptocurrency’s value is based off metrics like revenue, profit and usage, which analysts use to determine how much a project is currently worth and how much growth potential it has.

Instead, memecoins rely on the popularity of the meme they’re based on and their ability to catch attention on social media to entice new investors.

So, they go up because people buy them. They go down because people sell them. And people continue to buy them in hopes that it will continue to go up.

Memecoins are great for three main reasons.

First, you can make big gains. Just look at Pepe (PEPE, Not Yet Rated). It hit its all-time high in May of this year. That all-time high represents a 100x rise from its ICO.

And that isn’t unusual for popular memecoins. Just think back to how Dogecoin (DOGE, “C”) and Shiba Inu (SHIB, Not Yet Rated) were some of the best performing coins in previous cycles.

Second, they have no VCs or early investors with special privileges.For most DeFi coins, VCs are offered special discounts, typically 10x to 100x lesser than initial market price. And they can dump their huge supply on retail investors once public trading goes live for a particular coin.

With memecoins, distributions can be fairer as token holders and token sizes can be inspected publicly.

Third, there is no upside limit.Because they have no fundamental value, their prices are not anchored to some arbitrary multiple of revenue to market cap — e.g., PE ratios. In other words, there theoretically is no limit to how high they can go.

But they can also go to zero. Hence, it is best to carefully quantify the upside (potentially 10x) versus downside (goes to 0) before buying a memecoin.

And this last point has some additional merit behind it.

Indeed, while representing incredible profit opportunities, especially in a bull market like the one we’re approaching, memecoins can also be incredibly risky investments. Investors considering memecoin trading should be aware of the significant downsides to this strategy as well.

Here are the three biggest risks when dealing with memecoins, and ways you can mitigate them:

1. Some of them could be outright scams.

Anybody can just launch a token on Uniswap, so there’s no guarantee that the team behind a new memecoin will act responsibly.

This risk can be managed by checking memecoins against security audit sites. To aid in your research, I’ve gathered the following tools:

BubbleMaps: To check who owns which coins and how much each holder owns.

TokenSniffer: To see if the smart contract that launched the coin is safe or not. There is a safety score outputted after you input the contract address for the coin.

NerdBot: You can check inflows/outflows of smart money, new wallets, coin age and various other important metrics.

You can search any coin by its contact address — which you can find on Dextools, the leading DeFi portfolio and cryptocurrency price tracking app.

2. They have incredibly low liquidity.

This makes them susceptible to volatility that could make the broad crypto market dizzy.

Mitigate this by sizing your bets accordingly. For example, in a $10 million market cap coin with $1 million in liquidity, obviously enter with $1,000 instead of $10,000 all at once. Also, you can ladder out your sells.

Just like dollar-cost averaging is a strategy that has you continuously buy an asset to even out your entrance price, laddering out your sales means selling smaller amounts at set exit prices. This means giving up some potential profits in order to lock in smaller gains when you get them.

3. They have no fundamental value.

They truly don’t. Price goes up due to speculators buying high and selling higher. They depend critically on the strength of their community and the memes pervading said community.

There isn’t so much a way to mitigate this. But staying on top of current events and internet culture is crucial in knowing which meme is on the rise … and which is fading away. Indeed, one significant downside is that memecoin dilution is a big problem now. Too many memecoins are being launched … and they leech off liquidity from each other.

What is needed is a PEPE-type scenario, like what happened in May 2023, where one coin outperforms all the others and rockets up to $100 million gaining hype and attention and vacuuming in liquidity from the other memecoins.

One investment thesis I have is: Price action begets attention. And attention begets liquidity.

After all, memecoin trading is a world where the majority of memecoin buyers are mainly zoomers (Generation Z) getting investment advice from TikTok influencers. This particular demographic typically buys crypto in hopes of landing a lottery ticket to retirement.

Being able to identify which coin will be on the lips of all the influencers is vital.

Memecoins on the Market Today

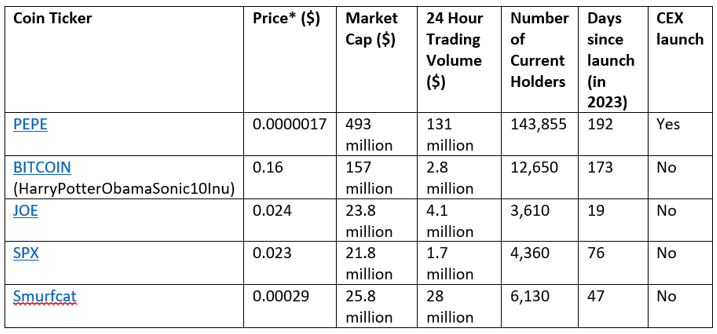

This is a list of memecoins that have caught our attention, along with their respective financial metrics:

Of these, I think the most likely candidate to pull the next PEPE is Joe (JOE, Not Yet Rated).

It has a better risk/reward ratio based on its market cap as it has more room to grow than say PEPE, for example. It’s currently struggling to break $25 million in market cap — a popular resistance level for memecoins. If it, or any of the other two that are currently below that threshold, can break past it, there is a high chance it could grow to a $50 million market cap.

But of course, this is not a recommendation to buy. You still must do your own research — first to see if the volatile and risky world of memecoin investing is right for you and then which memecoins to target.

If you do your research and still decide to give memecoin trading a try, I urge you to utilize the strategies and tools I mentioned above and only invest money that you can afford to lose.

Of course, memecoin trading really only kicks up if Bitcoin holds strong. If BTC nukes down to $32,000 for example, memecoins are likely to see huge drawdowns due to their low liquidity. So keep that in mind as you explore the more volatile corners of the crypto market.

Best,

Bruce