|

| By Beth Canova |

There are many ways you can make the crypto market work for you.

The key to knowing which one will suit your needs the best is to know which type of crypto investor you are.

Short-term investors are the profit-seekers.

These are traders who want to grab quick gains from the fast-paced crypto market.

Long-term investors take a different approach. This group relies on solid fundamentals and no small amount of patience to realize substantial returns.

By comparing and contrasting the mindsets and goals of these two types of crypto investors, you can better align your own strategy and goals.

So let’s go through both approaches to see which one best suits you.

Short-Term Gains: The Art of Degen Trading

Degens — shortened from “degenerates” — are crypto traders known for their risk tolerance and highly speculative trades.

Their trades are typically based on patterns or momentum, rather than fundamentals. And they require a level of technical expertise and a strong stomach for risk.

Now, you don’t need to be a degen to be a short-term investor.

But they do set the bar for how profitable a short-term strategy can be. Especially in the crypto market.

Take memecoins, for example.

This is a popular sector for degens to trade. That’s thanks to their extreme volatility, low market caps and potential for massive short-term gains.

New memecoin projects can launch for just a fraction of a single cent. And the most successful ones can grow to trade for several dollars.

For example, the viral Solana (SOL, “B”)-based memecoin, Bonk (BONK, “C+”), launched at $0.00000008614 back in late 2022.

At the time of writing, BONK trades near $0.00002081.

All those zeroes may make it hard to see, but that’s a 22,939.7%% increase!

Memecoin volatility has meant that there have been plenty of opportunities for traders top hop in, grab gains and hop out along the way.

Now, let me be clear: This is an extreme example.

The likelihood that the coin will blow up like this is slim. In fact, launches tend to be followed by a lot of volatility.

Memecoins in particular are incredibly volatile, and many never recover after falling from their highs.

That’s why, if you’re interested in degen-like trading, there are two key steps you’ll likely want to consider:

-

Cast a wide net. One of the best strategies for maximizing return probability with volatile coins like these is to put a little capital in a lot of projects.

All you need is to hit the mark once with a project like this to see insane profits. The hope is that, should one investment do well, it’ll offset any loss you experience from the ones that went belly up.

- Be ready to act quickly. Serious degen traders are like TradFi’s day traders. Due to the small size of the projects they invest in, they have to be ready to trade at a moment’s notice as tiny — and large — changes in the market send prices swinging.

Long-Term Vision: True-Blue Blockchain Believers

Because crypto has the most exciting and profitable speculative market in the world today, big overnight wins can often overshadow the slow and steady returns of true blockchain believers.

Having “diamond hands” isn’t just a meme; it’s an actual strategy.

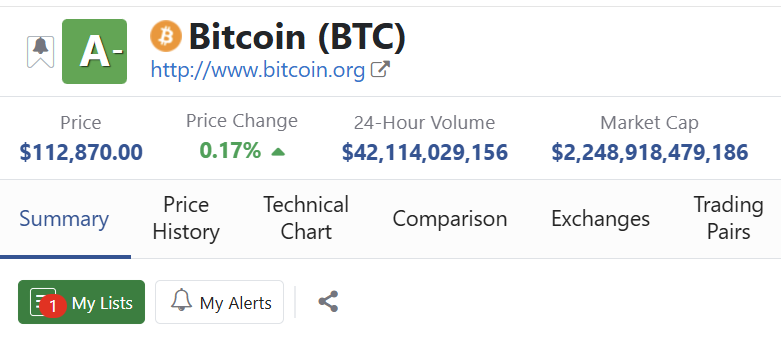

Imagine you had a conversation with a friend who got you interested in Bitcoin (BTC, “A-”) only five years ago. You went home, read a few articles and decided to invest back then.

Because you stuck to a single crypto investment, you went big and bought an entire BTC in January 2020.

That would have cost you a whopping $7,410.45.

But you didn’t sell when, just a few months later, BTC blasted to $20,000 … despite the impressive 169% gain.

That’s because you weren't looking for a quick buck. You really believed in the future of blockchain technology and Bitcoin's role in it.

So even as several juicy opportunities to sell arose, you stayed the course. When the price dipped, you didn't panic.

Now here we are: Five years later, and your one BTC token is worth $112,881 — a 1,423.27% increase.

Long-term investors were able to target those gains without fretting over near-term market volatility.

That’s the power of HODLing — that is, “holding on for dear life” in cryptospeak.

Crypto is still an emerging technology. Despite the volatility, the trends of Bitcoin and other major altcoins have been rising for years.

Buying and holding was a good idea five years ago. And it’s still a solid strategy today.

But that doesn’t mean it’s easy. If it were, everyone would be Bitcoin-rich.

Not only do you need the knowledge and insight to analyze whether a project has long-term potential. You also need the discipline to avoid market panic that could convince you to sell way too soon.

Finally, you have to be comfortable with a time horizon, which means you may not see a return for years.

Find the Right Opportunities for Your Strategy

Now that you know how you want to work the crypto market, you need to find the right assets for your portfolio.

Which means you’ll need data.

To narrow your focus, you can first look for the narratives that have the most momentum in the market.

DeFi Llama’s Narrative Tracker is a free tool that can get you started.

And since sentiment is critical when it comes to crypto performance, don’t be afraid to use social media to your benefit.

A lot of the crypto community congregates online. And it’s in these spaces where you mine for market sentiment.

In short, you can get insight into various projects from multiple investment perspectives.

If you know how to refine your search, that is.

Don’t worry, our team has you covered.

Tech expert Jurica Dujmovic broke down an unexpected way to monitor market sentiment in a previous Weiss Crypto Daily.

Finally, be sure to check out our Weiss crypto ratings. These help you see at a glance what we think of these crypto projects. You can read how our ratings work here.

You can even use our website to set up ratings and price change alerts for projects you are interested in.

Just click on a crypto to go to its data page. That’s where you’ll find the My Lists and My Alert buttons at the top, right under the rating and real-time price.

Lists help you keep all the projects you’re interested in, which we rate in one place.

Alerts let you know the moment we’ve updated our rating or the price has crossed a level you want to target.

And if you’re interested in taking Weiss Ratings’ data to the next level with customized reports, you may want to check out Weiss Ratings Plus.

I hope you take the time to play around with these tools.

Because at the end of the day, your own research is what will make you confident and comfortable in your crypto journey.

No matter how you invest.

Best,

Beth Canova