|

| By Bob Czeschin |

Disillusioned investors have recently taken to social media to decry the changing character and culture of crypto.

Long gone, they say, are the days of visionary, change-the-world enthusiasm and community-driven innovation. When average people with no special connections — or trust fund — could make life-changing profits.

By contrast, these investors believe today’s crypto landscape has been corrupted by memecoins and big money interests that exploit average crypto users.

Related story: Bitcoin’s Revolution Takes a Twist

A recent thread on Reddit famously went viral. It crystalizes the frustration many have with today’s crypto climate …

“Crypto topped in 2021. Though not often admitted, everyone I know peaked their (crypto) net worth then. And it’s all downhill since.

“Crypto is like Japanese stocks in 1990. (Over the next 20 years, the Nikkei went [from] 40,000 to 10,000 — even as yen in circulation rose a hefty 60%.)”

The post ends with a warning: “If you’re trying to make money … extract whatever you can and get out.”

I can understand this frustration. Even as Bitcoin (BTC, “A-”) soars to new highs above $120,000, things are different now than in cycles past.

Just a few years ago, a Bitcoin rally like the one we’ve seen over the past week would have lifted the broad market with it. Everything would have rallied in its wake.

Now, we are happy to see segmented rallies in various corners of crypto.

And gone are the days of low correlation to the TradFi market.

But just because things have changed, doesn’t mean it’s for the worse.

In fact, I see …

3 Key Reasons Crypto’s Best Days Are Still Ahead

Reason 1: On-chain innovation is alive and well.

Memecoins are merely a passing fad. One that we’ll likely see return in moments of extreme bullishness.

But they are not designed to last.

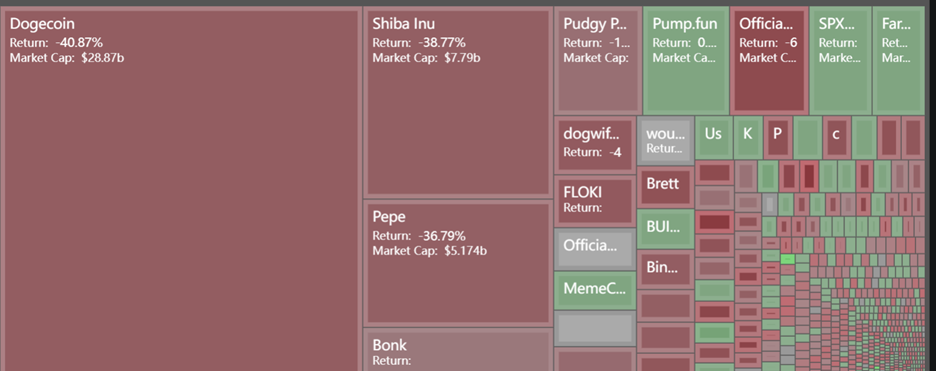

In the first quarter of 2025 alone, their average daily transactions plunged 87%, from 71,000 to 9,000.

Meanwhile, the market cap of the biggest memecoins on the Solana (SOL, “B”) network crashed by 85%.

It was only recently, with renewed market momentum, that they have begun to pick up speed again.

But blockchain technology has continued to evolve at a rapid pace all the while.

High speed, low-cost transactions have opened up a new frontier of potential applications — from DeFi to gaming to real-world asset (RWA) tokenization.

Related story: Unlock Trillions with Real-World Assets

And that’s just the start. The advent and integration of AI and AI agents promise enhanced smart-contract utility.

Not to mention powerful new analytics to forecast market trends.

In other words, the restlessly innovative, world-shaking character of the crypto revolution remains intact.

And it may even be intensifying.

Reason 2: Complaints about crypto’s changing character are mostly nostalgia for the wild, early days of the blockchain revolution.

From the birth of Bitcoin until the early 2020s, crypto was a sprawling Wild West. Untamed idealism and a “sky’s-the-limit” opportunities ran amok.

This is when Bitcoin famously went from valued at pennies to thousands of dollars. And legions of ordinary investors reaped thousand-percent returns.

Then, altcoins like Ethereum (ETH, “A-”) proved crypto wasn’t just a one-trick pony. ETH soared from 43 cents at launch in 2015 to its peak of $4,500 in 2021.

Which, I believe, is at the crux of this issue.

ETH hasn’t seen highs like that since last cycle. Which is why you have so many folks pining for “the good ol’ days.”

If their net worth peaked in 2021 — like the anonymous Reddit blogger — chances are their portfolio is mostly in altcoins.

Which made sense at the time. Back then, we saw a healthy, robust altcoin season. While Bitcoin moved ahead at a steady pace, strong altcoin projects soared past.

And the absence of altcoin season is one of the biggest changes in the crypto climate this cycle.

Where leading alts outperformed in the past, investors would be 56% richer today compared to 2021 if they held mostly Bitcoin.

That’s a big divergence from the standard a few years ago. And it’s likely the collateral effect of growing institutional adoption.

ETFs and big-foot corporate crypto buyers bring deep pockets and sophisticated risk management to the market.

Which, along with growing liquidity, naturally dampens the wild price swings that defined crypto’s early years.

Today, Bitcoin’s market cap tops $2.1 trillion. Total market cap is about $3.4 trillion.

With such scale, the scope for exponential increase must shrink.

For Bitcoin’s token price to pump to $1 million (about a 9x increase), its market cap would have to balloon to roughly $19 trillion.

That would rival the GDP of major global economies!

Such an increase is improbable without unprecedented global adoption. Which, in time, can and likely will occur.

After all, Bitcoin is still the best performing financial asset in the history of money. And likely to remain so.

But it can’t happen in the compressed time frames that prevailed in crypto’s early days.

In other words, the low-hanging fruit — where a $100 investment could turn into a fortune in a matter of months — has largely been picked.

But that hardly means big profits are a thing of the past.

They’re just going to take more effort to find and need more time than they used to.

Reason 3: Bitcoin versus the Japanese stock market is a false comparison.

Comparing the two may be rhetorically provocative. But it’s also logically flawed for one key reason …

Bitcoin has a hard cap on the total amount of coins that can be created.

That’s what makes it a digital safe haven that can compete with gold. That’s why Bitcoin can offer protection against runaway inflation and fiat currency debasement.

By contrast, there is no fixed ceiling on how many shares of stock a corporation can issue.

Generally speaking, companies are more than happy to create new supply whenever a bull market appears.

Because of this, stock prices are far less sensitive to changes in liquidity, the money supply or how much confidence average investors have.

One Bonus Reason to Be Bullish

As monetary historian Franz Pick observed, “All fiat currencies go to zero. Some just take longer than others to get there.”

At the end of the day, this is the ultimate bull-market case for Bitcoin … and select altcoins as well.

When the U.S. dollar nears the end of its lifecycle, you’ll see Bitcoin change hands at prices you couldn’t believe today.

Best,

Bob Czeschin

P.S. If you’re still looking for the excitement of early-day crypto opportunities, then there’s one more place you should look.

And that’s in TradFi companies … that aren’t yet public.

My colleague Chris Graebe is a startup investing specialist. And he’s hosting a special. Private Investment Summit on Tuesday, July 22

That’s where he’ll break down how pre-IPO opportunities work. And where he plans to tell you more about a little-known company that’s set to disrupt one of the most lucrative industries on earth.

Successful deals in this sector offered returns as high as 900% ... 19,942% … 53,423% and more.

Now those are returns that can rival what early crypto investors saw!

This event is for regular people who want to get into private, pre-IPO companies. All you need to do is save your seat here.

Then, join him on Tuesday, July 22 at 2 p.m. Eastern.