Exchange-traded funds (ETFs) are increasingly popular among investors seeking digital asset exposure within traditional financial markets.

Makes sense. ETFs are traded through the TradFi markets, making them much more accessible to a wider audience … including institutions and their big investment dollars.

And last week, I broke down how adding staking to the Ethereum (ETH, “B+”) ETFs could give them the boost they need to finally compete with the Bitcoin (BTC, “A”) ETF inflows.

But while the Bitcoin and Ethereum ETFs have dominated headlines, attention has begun to turn to other potential crypto ETFs.

I believe one crypto that could cut ahead to receive its approval first. And it’s not one you may expect …

Litecoin: The Silver to Bitcoin’s Gold

Often described as the “silver to Bitcoin’s gold,” Litecoin (LTC, “B-”) boasts solid fundamentals and an extensive track record.

Launched in 2011 by former Google engineer Charlie Lee, Litecoin is one of the oldest cryptocurrencies on the market. It has over a decade of uninterrupted operation to underscore its resilience and reliability.

In fact, it was that track record that CEO of Canary Capital Steven McClurg underscored in the S-1 filing he submitted for the first Litecoin ETF.

That’s because it makes Litecoin particularly enticing for institutional portfolios. And ETFs are, after all, an easy way for institutional investors to gain direct exposure to Litecoin.

And crypto analysts see things similarly. They have raised their predictions regarding the approval chance of a spot Litecoin ETF.

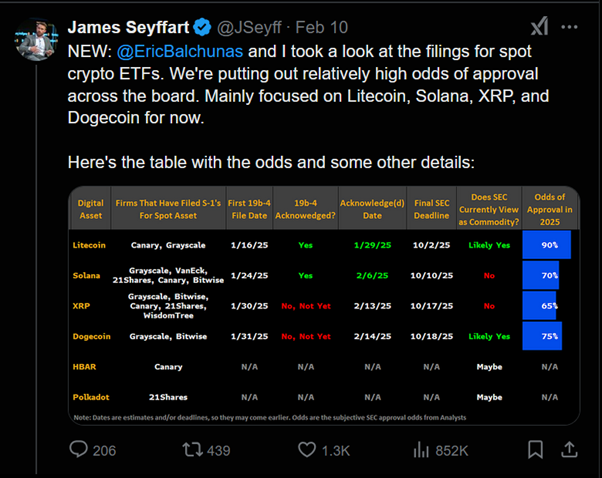

Notably, Bloomberg ETF analysts James Seyffart and Eric Balchunas assigned a 90% probability that the SEC will greenlight a spot Litecoin ETF within the year.

By comparison, other popular altcoins such as Dogecoin (DOGE, “C+”), Solana (SOL, “B”) and XRP (XRP, “B-”) are considered less likely to secure ETF approval soon with respective odds of 75%, 70% and 65%.

But beyond its history and track record, there are four main advantages that give Litecoin a leg up in the ETF race.

Advantage 1: High Liquidity

Liquidity is fundamental to ETF viability. And Litecoin regularly ranks among the top digital assets in daily trading volume, often exceeding $500 million.

Additionally, LTC is widely available on major exchanges such as Binance, Coinbase, Kraken and Bitstamp.

Advantage 2: Widespread Adoption

Litecoin’s mainstream integration has also grown.

PayPal (PYPL), for instance, supports buying, selling and holding Litecoin. And broad adoption supports the case for an ETF by bolstering LTC’s market visibility and usability.

Advantage 3: Faster and More Cost-Effective Transactions

A key advantage of Litecoin is its faster block generation time — just 2.5 minutes compared to Bitcoin’s 10. As a result, transactions become quicker and fees remain low, making Litecoin especially attractive for everyday use and cross-border payments.

Growth has been steady, with 2024 recording over 92 million transactions — a 38.55% spike from the prior year — at an average transaction fee below $0.01.

By early 2025, Litecoin had processed its 300 millionth transaction, cementing its reputation as an efficient and widely utilized digital currency.

Advantage 4: Regulatory Clarity and Commodity Classification

Regulatory approval remains pivotal for any ETF’s success, Litecoin included. And this is where Litecoin really stands out from the crowd: The U.S. Commodity Futures Trading Commission (CFTC) has classified Litecoin as a commodity, placing it on regulatory ground like Bitcoin.

That means it has one less battle when it comes to securing an ETF approval.

Now, this doesn’t guarantee a green light, but it certainly can help streamline the process.

Additionally, shifts in political leadership continue to give confidence an approval may be on the horizon across the board.

President Donald Trump has openly championed pro-crypto policies to boost innovation and investment and supports a more rapid path to ETF authorizations.

Carrying out this new approach are SEC Chair Mark Uyeda and David Sacks, designated as the Trump administration’s “crypto czar.”

These leadership changes at the SEC heighten the likelihood that a Litecoin ETF could clear regulatory hurdles more swiftly than in previous administrations.

Challenges on the Horizon

Despite its merits, Litecoin does face a few notable challenges on its road to securing an ETF.

For example, its current lack of institutional demand.

While Litecoin is fast, liquid and secure enough to handle institutional transactions, it has flown under the radar for many hedge funds and large-scale investors. Especially as Bitcoin and Ethereum have drawn the lion’s share of institutional interest.

Heightened demand from these groups is essential for an ETF’s success.

Its increasing competition from other cryptos is also a potential headwind.

We have an increasingly crowded market. Many blockchain projects offer smart contracts, decentralized applications and other advanced functionalities that sometimes overshadow Litecoin’s narrower focus on payments.

And while those additional functionalities are not currently supported in ETFs — as I covered last week — it may only be a matter of time until they are incorporated.

At which point, it may be tough for a simple medium of exchange to compete against multi-use platforms like Ethereum or Solana.

The Road Ahead

With its robust security model, high liquidity and regulatory clarity as a commodity, Litecoin is a strong candidate for an ETF.

Ultimately, however, final approval will hinge on consistent institutional backing, favorable regulatory conditions and the coin’s ability to stand out in a dynamic cryptocurrency landscape.

Should the SEC grant the green light, a Litecoin ETF would mark a major milestone for the coin’s acceptance in mainstream finance. And it could potentially pave the way for broader adoption and spur further innovation across the industry.

The SEC’s final decision on a Litecoin ETF is scheduled for October 2025.

Savvy investors should keep an eye on the process in the meantime.

If you are long-term bullish on a Litecoin ETF, you could buy the token ahead of that approval and ride the hype higher if it gets announced.

Best,

Mark Gough