5 Key Turning Points Suggest Sentiment Shift as Volatility and Innovation Collide

|

| By Mark Gough |

This week, the crypto markets took a hit as macro jitters weighed on top assets.

But that’s why price action doesn’t paint the full picture.

Because under the blockchain’s surface, regulatory breakthroughs and ecosystem developments are reshaping the crypto investment landscape.

Market leaders like Bitcoin (BTC, “A-”) and Ethereum (ETH, “A-”) may have pulled back in the short term. But the sector continues to evolve.

And the highlights we’ve seen this week suggest the next wave of crypto leadership is beginning to emerge.

At least, that’s what these five key developments all suggest …

Development 1: Crypto ETF’s Rotating Liquidity Act

AsBTC dropped 6.5% last week to test $112,000, global spot Bitcoin ETFs saw net outflows hit $643 million.

This marked one of the heaviest weekly redemptions since U.S. ETFs launched, reflecting bearish macro sentiment and risk-off flows amid inflation concerns.

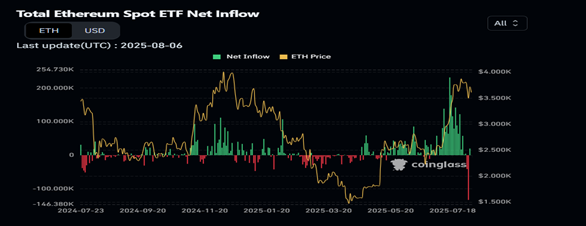

But that wasn’t the experience over with the ETH ETFs …

While ETH dropped 14% to test the $3,300 level, it bounced back stronger as institutional flows held firm.

ETH ETFs recorded $154.3 million in net inflows globally, signaling a growing tilt toward Ethereum’s platform potential over its role as a “digital gold” proxy.

My takeaway? The ETH/BTC ratio is now under the microscope.

Ethereum’s favorable ETF flows — despite its price softness — point to institutional interest in ETH’s broader utility across staking, DeFi and infrastructure.

Meanwhile, heavy BTC ETF selling confirms that macro anxiety is impacting perceived “store of value” assets more directly.

Development 2: SEC Clears the Air on Liquid Staking

This past week saw a major update when it comes to U.S. regulation: The SEC clarified that liquid staking tokens are not securities.

This announcement removes a significant worry that’s weighed on projects like Lido (LDO, “C-”) and Rocket Pool (RPL, “D+”).

The SEC didn’t stop there. It also hosted its first digital asset policy forum, signaling a more consultative approach moving forward.

This is arguably the most favorable U.S. regulatory week for DeFi in over a year.

Staking plays just got de-risked, and large holders may now revisit allocations to the segment.

Development 3: Altcoins See Quiet Rotation into Real Tech

While memecoins dominated much of the early stages of this bull market, times have indeed changed.

Just look at the altcoin ecosystems that have gained traction over the past week, even amid broader drawdowns:

- Solana’s (SOL, “B”) NFT and throughput gains continue. Kamino and Drift are seeing upticks in usage. And developers remain active post-Firedancer testnet.

- Avalanche (AVAX, “B”): VanEck’s ETF filing hints at growing institutional interest.

- Chainlink (LINK, “C+”) has seen advances in cross-chain interoperability protocol and new integrations across Layer-2s and RWAs that reinforce its oracle moat.

- Toncoin (TON, “C+”) & Polkadot (DOT, “C”) have benefited from organic developer interest and Asian ecosystem growth.

And this interest is coming from builders and investors alike.

These aren’t speculative pops. They’re signs of capital and engineering talent rotating into chains with real throughput and DeFi/NFT traction.

Of these, SOL and AVAX are particularly well-positioned for narrative leadership if macro tailwinds return.

And this development isn’t limited to established projects. Even new tokens are feeling the shift as utility trumps hype.

Take Hexydog (HEXY, Not Yet Rated), for example. It has surged over 90% during its presale!

This tells me that across crypto, retail and early-stage investors are moving past memes to target credible, well-structured token models.

I expect more high-quality presales will follow as teams adjust to the new standard.

Development 4: $3 Million Phishing Attack Highlights Ongoing Risks

While crypto’s wild ways are slowly fading away, investors wading into the blockchain still need to keep their wits about them.

Because bad actors exist everywhere, on-chain and off.

The latest attack? A single phishing exploit that drained $3 million last week, adding to the year’s tally of retail-targeted scams.

The attackers leveraged bots, deepfakes and social engineering — the unholy trinity of scammers everywhere — to outpace many users’ defenses.

Broadly, I expect this latest hack to bring security to the forefront for both wallets and consumer-facing DeFi platforms.

But on an individual level, it’s also a good reminder for the rest of us to stay vigilant.

Keep up with your crypto education and monitor your wallet security frequently. Disconnect from dApps when you’re not using them. And do your due diligence when it comes to any communication about your crypto.

Remember to verify, rather than trust.

Development 5: Ripple Expands Stablecoin Utility in Cross-Border Payments

Ripple— the company behind XRP (XRP, “B”) — gained traction in Asia and Latin America this week with its new dollar-backed stablecoin on the XRP Ledger.

This stablecoin launch aims to accelerate enterprise adoption across remittances, payroll and business-to-business commerce.

This tells me that Ripple is evolving beyond its traditional remittance focus.

If this stablecoin achieves meaningful adoption, XRP Ledger could carve out a stronger role as a global payments infrastructure layer.

Final Takeaway

The crypto market may feel choppy. And sure, it can still stir the stomach of many investors.

But under the surface, key developments are taking shape from regulatory breakthroughs to altcoin ecosystem growth.

The most important shifts this week weren’t just about price. They were about maturing infrastructure and investor psychology.

That’s why I hope you continue to stay in the know with our Weiss Crypto Daily updates. Because between the price moves, real informative data waits right there in plain sight.

And it could be the difference between you chasing the market … and staying a step ahead of the next curve.

Stay patient. Stay sharp. The next wave of leadership is already building.

Best,

Mark Gough