|

| By Jurica Dujmovic |

As we bid farewell to 2024, it's time for some real talk about the elephant in the crypto room: rug pulls.

You know, those delightful moments when project developers suddenly decide to ghost their investors faster than people clear out of the office on a Friday afternoon.

This year started with a bang, and not the good kind. The first half of 2024 saw a whopping 30% increase in rug pulls compared to 2023, with over 10,000 investors getting that sinking "oh no" feeling by July alone.

But here's where it gets interesting: The total damage from crypto scams actually dropped by 20% in 2024 when compared to 2023's grand theft crypto!

By May 2024, the crypto community had lost "only" $473 million across 108 incidents, down from $595 million in the same period of 2023.

So, in 2024 we faced less overall damage … but more scams.

Why? Well, because the scammers got smarter.

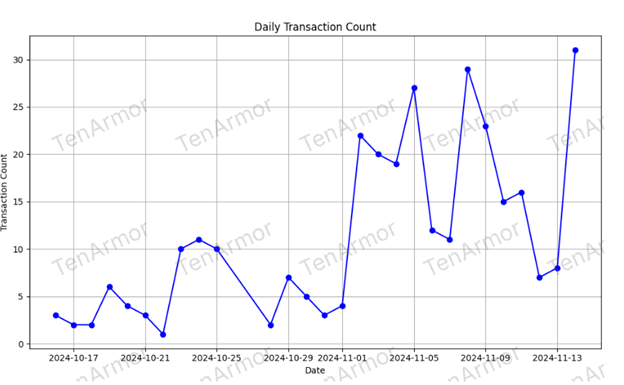

By November of this year, these bad actors were setting new records. In fact, there were 31 rug pulls in a single day in 2024.

According to the Bitcoin mining platform Ecos, 2024's rug pulls came in three distinct varieties, each with its own playbook.

I expect scammers will continue with these methods in 2025. So, let’s break them down so you know what to look for to keep yourself — and your investments — safe.

First up, we have the traditional rug pull, accounting for 45% of cases.

This is where developers simply abandon the project and drain all liquidity.

We saw this happen with GreenTech Token (GTEC, Not Yet Rated), where $15 million vanished overnight.

How can you avoid getting caught in a similar scam yourself? Look for the telltale sign: A seemingly thriving project suddenly goes dark — website down, social media deleted, team unreachable.

It's the crypto equivalent of a midnight move out. But instead of skipping rent, they're skipping away with millions.

Next in line is the liquidity rug pull, making up 35% of cases.

This one is more sophisticated. To pull off a liquidity rug pull, developers create a liquidity pool pairing their token with established cryptocurrency, like Ethereum (ETH, “A-”) or Tether (USDT, stablecoin). Once enough people have bought in, they pull out all the linked crypto, leaving worthless tokens behind.

BioEnergy Coin (BIO, Not Yet Rated) perfected this move in July 2024 with a $30 million heist.

The warning sign of this type of scam is unusually high liquidity early on. Especially if you also see it paired with aggressive marketing campaigns.

Last, but certainly not least, we have the various wash trading schemes, comprising 20% of cases.

This is where developers manipulate token prices through fake orders and artificial trading activity. SmartTrade (TRADE, Not Yet Rated) pulled this off to the tune of $20 million in 2024. Its team created the illusion of active trading and rising prices to lure investors in before dumping their holdings.

To avoid this type of rug pull, watch out for tokens with suspicious trading patterns. Be extra wary of coins that show perfect upward trends with minimal price retracements.

Remember, nothing in crypto — not even the most bullish assets or dearest market darlings — go up in a straight line. If you see a perfect upward trend, chances are it’s a fake.

And there are a few other tips you should take to heart to keep your crypto investment dollars safe in the coming year. Because while we can't stop the scammers from trying, we can definitely make their job a lot harder!

So, here are five tricks you can use to avoid a rug pull.

1. Do Your Own Research

The crypto curious should start with the basics. DYOR isn't just "crypto-bro" speak — though the acronym is definitely within the crypto community’s communication style.

Doing your own research is truly the difference between true investing and fancy gambling with extra steps.

Every project has a history, and in crypto, that history is your best friend. Look beyond the fancy website and Instagram-worthy graphics to find a project’s true utility and purpose.

Blockchain explorers — such as Etherscan for the Ethereum network and Solscan for the Solana (SOL, “B”) network — can show you a token’s wallet concentration.

If you see the top 5-10 wallets holding more than 50% of the total supply, or if a single wallet controls more than 20% of tokens (excluding locked liquidity and burn addresses), you're looking at a suspicious level of centralization. And that is a big red sign to think twice before jumping in.

I also suggest reading a project’s whitepaper. Even if you’re not a crypto expert, this could give away a scam if there is one. If trying get through it feels like decoding ancient hieroglyphs filled with vague promises about "revolutionary blockchain solutions," your Spidey sense should be tingling.

If it’s a decentralized finance project, you may want to consider giving its smart contract audits a glance. Reading those may be about as exciting as watching paint dry, but it’s more fun than losing your investment to a rug pull.

And no, "audited by my cousin who once took a JavaScript course" doesn't count. You’ll want to see reputable audit firms’ stamp of approval. And even then, you’ll likely want to read those reports for yourself.

2. If It Sounds Too Good to Be True, It Likely Is

Watch out for buzzwords and hype. Remember that nothing in any market, let alone the highly volatile crypto market, is ever guaranteed.

Any project with a claim that it will soar with certainty … likely has the same probability as winning the lottery while being struck by lightning. Twice.

A crypto project worth its salt will offer more realistic outlooks.

In the same vein, beware of fake partnerships — another favorite smoke screen of rug pull artists in 2024.

Partnership announcements became the crypto equivalent of name-dropping at a party. Sure, your project might claim they're "in talks" with Google, but so is my spam folder. Real partnerships leave trails — joint press releases, verifiable integrations and actual collaborative work.

If the only evidence of a partnership is a social media or blog post with more emojis than substance, you may want to keep your powder dry for now.

3. Check In with the Community

Community support is key in any crypto project’s long-term survival. And taking the temperature within that community can tell you a lot about a project.

When it comes to spotting scams, you’ll want to get a sense of the community vibes. Watch out for Telegram groups or Reddit threads where every message is just rocket emojis and reminders to “buy the dip.”

You should be seeing robust conversations about tokenomics and real-time market reactions from other investors. If these types of comments are absent or banned, run.

4. Set Up Security Alerts

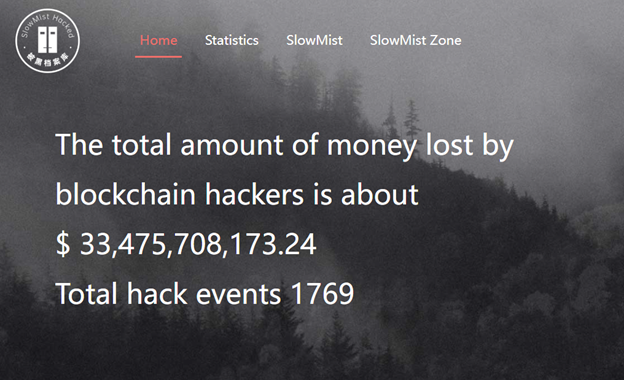

Keep your ear to the ground with alerts and announcements from sites like CertiK, SlowMist or Hacken.

This requires a little more proactivity on your part. But trust me, the effort is worth it. A simple alert could save your entire portfolio, so there's no excuse for skipping this step.

So, set up notifications and follow the right news sources to significantly increase your chances of making it through 2025 with your wallet intact.

5. Use the Free Tools at Your Disposal

Don’t forget that there are plenty of useful tools you can access for free!

You can check out CoinGecko and CoinMarketCap for metrics and price trends. If a token's trading volume shows classic red flags like …

- Perfectly timed spikes that look like a heartbeat monitor,

- Sudden 500% jumps with no news,

- Consistent round-number trades happening at exact intervals.

You're probably looking at wash trading or manipulation.

If you’re looking into a new decentralized finance platform, I suggest taking a look on DeFiLlama for its total value locked — a measure of locked liquidity and a good sense of active usership. You’ll want to monitor those liquidity pools: sudden changes could mean it's time to say, "thank you, next."

And of course, our Weiss Crypto ratings break down a project’s overall outlook by analyzing its adoption rate, price momentum, utility and the technology behind it.

Not only that, but our crypto team is constantly on alert for larger scams. And we let you know right away.

Like late last year, when we alerted you to a massive hack that compromised your wallet once connected to certain decentralized applications. And we showed you how to keep your wallet and investments safe in the meantime.

That’s why it’s so important to keep up to date with our latest updates.

So, while rug pulls will likely continue to pop up as the crypto market evolves, you’ve got plenty of ways to keep yourself and your money safe.

To be aware is to be prepared. The crypto space isn't getting any less wild, but you can get better at navigating it.

Stay safe out there, fellow crypto explorers.

And as we head into 2025, remember: the best gains aren't just measured in profit alone. They’re also measured in the capital you protected along the way.

Best,

Jurica Dujmovic

P.S. Right now, you have the chance to gain access to ALL the premium crypto research our team publishes. Not only will you have the tools needed to better dodge rug pulls, you’ll also have the chance to target the opportunities our team believes have the best potential based on several investment strategies.

To learn more about this limited opportunity, watch our Crypto All-Access Summit now.