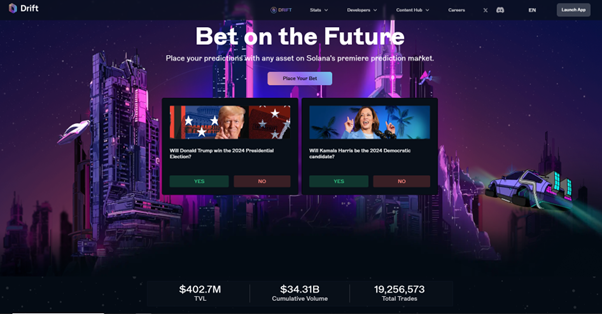

If you are interested in decentralized finance, you’ll want to get to know Drift (DRIFT, Not Yet Rated).

Drift is built on the fast and scalable Solana blockchain.

And it’s quickly making a name for itself as one of the most innovative Decentralized Derivatives Exchanges (DEXes).

News broke today that Multicoin Capital took a substantial stake in Drift.

With a crypto venture capital firm behind it plus a rapidly growing ecosystem, Drift is poised to become a major player in the crypto world.

So now, let’s look at why Drift is becoming a big deal and what the future holds for this exciting platform.

What Makes Drift Stand Out

Drift isn’t your run-of-the-mill crypto exchange.

It’s a decentralized exchange (DEX) focusing on derivatives. This allows traders to speculate on assets with leverage without needing to trust a central authority.

Unlike centralized exchanges like Binance or FTX, Drift is completely permissionless.

Meaning, you always have full control over your funds.

There are no middlemen or third-party risks — just you, your trades and the blockchain.

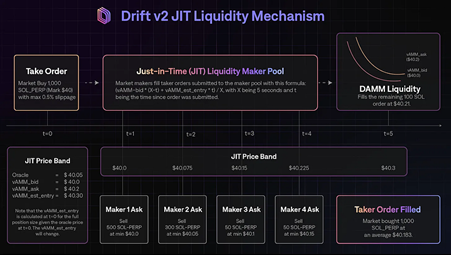

But what really sets Drift apart is its unique liquidity model.

Drift offers three types of liquidity provisioning:

- Dynamic AMM (DAMM) for automated market-making,

- Decentralized Central Limit Order Book (DLOB), and

- Just-in-Time (JIT) auctions for real-time liquidity.

This hybrid model means better liquidity, tighter spreads and faster user trade execution.

And it’s working — Drift’s trading volume has increased 67x over the past year.

Yes, you read that right — 67x!

Drift has been able to scale quickly because it’s built on one of the world's fastest and most scalable blockchains.

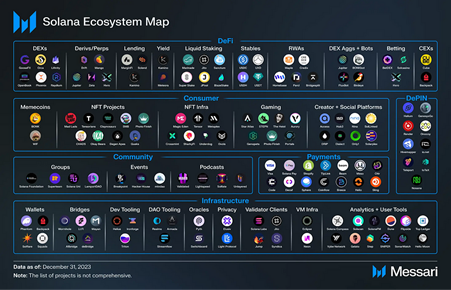

Solana: The Wind Beneath Drift’s Wings

With low fees, high speeds and ever-improving infrastructure, Solana has become the go-to platform for DeFi projects like Drift.

The adoption of Solana isn’t just happening in the DeFi world — major players like Visa and PayPal are also leveraging its technology for faster, cheaper transactions.

As Solana’s ecosystem grows, so does Drift’s potential.

So, how fast is Drift growing?

Drift’s Growth: From Underdog to Contender

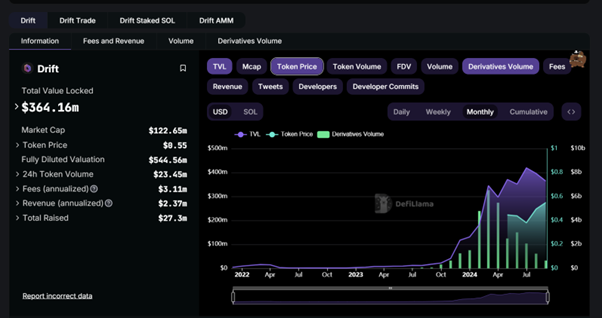

In April 2024, Drift recorded an eye-popping $6.5 billion in trading volume, compared to just $97 million the year before.

As I mentioned, that’s a 67x increase in just 12 months.

But despite this massive growth, Drift’s share of the DeFi derivatives market is still relatively small at 2.2%.

That means there’s a lot of room for Drift to capture more of the market as more users and liquidity pour in.

Today, Drift is trading at 52 cents, with a 24-hour trading volume of over $25.7 million.

The price has seen about a 13% increase in the past 24 hours, reflecting growing interest in the token.

Currently ranked at No. 285 on Coinmarketcap, Drift holds a market cap of $117.6 million (in U.S. dollars).

There are some 225.2 million DRIFT tokens already in circulation.

Why Are People Flocking to Drift?

It’s all about capital efficiency.

Drift allows traders to use a single margin account to trade multiple types of assets (crypto, prediction markets and more).

This kind of flexibility isn’t something you find on most platforms.

And this is drawing more sophisticated traders into the fold.

What’s DRIFT Worth?

The Valuation Breakdown

In a recent report, Multicoin Capital crunched the numbers and wrote that Drift is sharply undervalued at its current price.

The DRIFT token is priced around $0.46, but Multicoin’s base case valuation puts it at $3.58 by 2027.

That’s more than a 7x increase in the next three years!

How did its analyst arrive at this figure? A few key assumptions drive their model:

- The overall crypto derivatives market will double by 2027.

- DeFi derivatives will capture 10% of that market, up from the current 4.9%.

- Drift will grow its market share to 10% of the DeFi derivatives market (currently 2.2%).

The numbers are conservative, especially considering Drift has grown its market share by 10x in the past year.

If you’re looking for a project with real upside, Drift could be a solid bet.

The Future of DeFi Derivatives:

Why Drift Could Be the Next Binance

Remember when Binance first entered the centralized exchange market?

It wasn’t long before it dominated, thanks to its fast execution, strong liquidity and low fees.

Many are now calling Drift the “Binance moment” for decentralized derivatives.

With Solana’s growth as a backdrop and Drift’s intelligent design choices, this project could quickly eat into the market share of other decentralized platforms — and possibly even some centralized ones.

The Drift team isn’t just stopping at derivatives trading.

It’s “drifting” into borrow/lend markets, prediction markets and synthetic assets.

The goal?

To become a DeFi super app, offering a one-stop shop for all decentralized financial services.

Why Drift Is One to Watch

Drift is not just another DEX. It’s a platform that aims to redefine what decentralized derivatives trading can be …

One with a future-proof design, strong backing from Multicoin Capital and the full support of the fast-growing Solana ecosystem.

The growth potential is massive, and the numbers speak for themselves.

Some $6.5 billion traded in a month … 50x growth year over year … and a market just waiting to be tapped.

With a valuation that could easily grow 7x by 2027, Drift offers one of the most compelling opportunities in the DeFi space today.

For traders, investors and anyone interested in the future of decentralized finance, Drift is a project to watch closely.

Best,

Mark Gough