|

| By Chris Coney |

Decentralized finance is in its hyper innovation phase.

That means hundreds of experiments are going on in real time, including many different approaches to the same thing.

Nowadays, there are dozens of networks out there, each one with its own unique method of implementing blockchain technology.

In fact, there are so many that we're now able to organize them into subgroups.

Of these subgroups, the most widely adopted group contains networks based on the Ethereum (ETH, Tech/Adoption Grade "B") technology.

This is not to be mistaken with the Ethereum network.

Remember that Ethereum is three things:

- The name of the major Ethereum smart contract blockchain

- The name of the software that runs the network

- The name of the primary asset on the network (ETH)

Our focus for today is item No. 2, which can also be called the Ethereum virtual machine. It's a type of blockchain operating system that's used to run many of the major DeFi networks you might already know about.

These networks include:

- Polygon (MATIC, Tech/Adoption Grade "B+")

- Binance Chain

- Arbitrum

- Optimism (OP, Unrated)

- Avalanche (AVAX, Unrated)

- Harmony (ONE, Unrated)

- And many more.

The benefit of such a setup is compatibility. Apps built to be Ethereum compatible can run on any of these EVM networks with little to no modifications.

That's great from an app developer's perspective … but from an investor's perspective, it leaves us with an asset management nightmare.

Keeping Track of Your Assets

In my Crypto Yield Hunter service, I often run into a situation where the model portfolio has a bunch of USD Coin (USDC) in an Ethereum wallet, but the high yield opportunity being featured is on a different network.

This doesn't cause too much trouble, though, because I can simply use a bridge to move some assets from one network to another.

The problem comes later when you start to lose track of exactly where all your assets currently are.

After completing several bridging transactions to and from multiple networks — or even across several different wallet addresses — you might want an easy way to make an inventory of your assets across all networks.

A few third-party tools have sprung up trying to accomplish this … but now this much-needed tool has been integrated as a core feature of the MetaMask wallet!

Introducing MetaMask Portfolio

Recently, MetaMask added their portfolio site feature to the wallet.

This pivotal feature conducts an automatic scan across all the DeFi networks you select to create a clear inventory of all the assets you own.

An extra bonus is that compatibility-wise, MetaMask allows us to connect to many of the major networks that are based on the Ethereum technology, such as Polygon.

Now, let's walk through how to utilize this incredibly useful new tool and how to get the most out of it.

1. In your MetaMask wallet, a "Portfolio site" link should be nestled just below the "Assets" and "Activity" tabs.

2. Clicking on this link will direct your web browser to a web app that your MetaMask wallet can connect to and perform a special function.

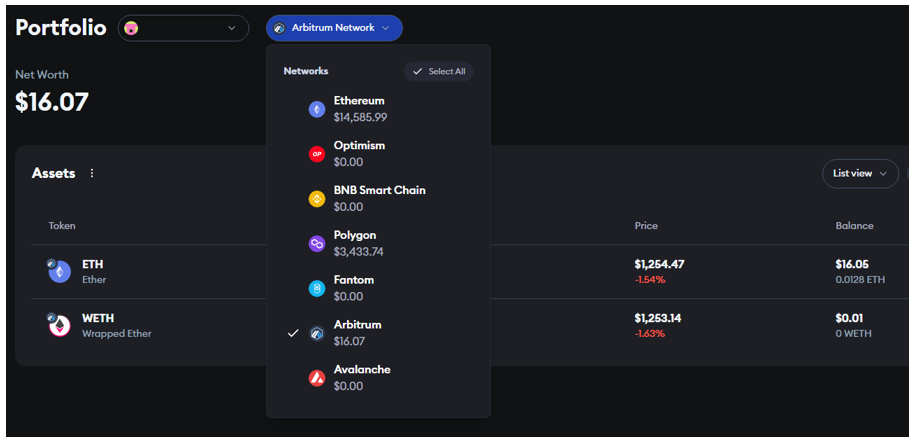

3. Once there, select the list of networks you have been using from the dropdown:

You can also use the other dropdown menu to select multiple wallet addresses if you have been using them.

Also, note in this screenshot it shows the total value of assets held on each network.

4. The app will then scan all your selected wallet addresses across all your selected DeFi networks and present the results in a table:

See how the top row is USDC held on the Ethereum mainnet and the second row shows USDC held on the Polygon network. This difference is depicted by the small circular icon overlapping the bigger icon.

Additionally, each of these rows can be clicked to display the data in greater detail.

For example, the screenshot above shows a USDC balance on Ethereum of $14,521. Clicking on this row would show how those assets were distributed across the wallet addresses selected, if any.

However, if you only use one wallet address, then you may not need the additional details page at all.

Changing Perspectives

Sometimes apps like these can just look like a wall of data that's hard to make sense of when displayed all at once.

Fortunately, the developers of this tool have taken this into consideration and have implemented features that allow you to show and hide different elements.

So, the tool will only display the data you want to see.

For example, if I just wanted to know what assets I currently have on the Arbitrum network, I could untick everything but Arbitrum on the dropdown menu of networks:

While the dropdown menu tells me I have $16.07 worth of assets on Arbitrum, the main table in the background of this screenshot shows me which assets this is comprised of and how much I have of each.

You can also apply this method to answer other questions such as:

- How much USDC do I have in total across all wallet addresses?

- In which wallet addresses do I have a balance of Ethereum?

- Which of my wallets are empty?

The possibilities are endless.

Suffice to say this feature is a great way to stay organized by providing a single place to get a complete overview of all the assets in your personal DeFi wallets.

As I mentioned at the outset, this is possible because all the networks featured are Ethereum-compatible blockchains.

Limitations of This Feature

While this feature is incredibly useful and welcomed, it does have some limitations.

At the time of writing, it's limited to recognizing standard crypto assets and displaying their values.

It's currently incapable of accounting for funds you have deposited in various DeFi smart contract platforms.

In an earlier screenshot, the portfolio tool quoted the total net worth of the Crypto Yield Hunter wallet to be just over $18,000 when it should read closer to $25,000. This is because the other $7,000 is invested in various yield-bearing opportunities.

This could be due to a limitation in the way those opportunities report data to the outside world, or it could simply be due to the MetaMask portfolio tool being in its early stages of development.

In any case, given time to evolve, I'm confident that this limitation can be overcome in the near future.

So, give the MetaMask portfolio tool a try and feel free to share your thoughts about this new feature by tweeting @WeissCrypto.

That's all I've got for you today.

I'll catch you here next week with another update.

Until then,

Chris Coney