|

| By Chris Coney |

Last week, we struck crypto gold by staking stablecoin against PAX Gold (PAXG, Unrated) — a crypto asset backed by vaulted gold held in trust.

However, the decentralized nature of crypto poses a problem for our gold-backed coin issuer, Paxos. Because crypto assets are bearer assets, the owner must sign a transaction to move their funds … otherwise, they won't budge.

There's no way to arbitrarily pull money out of a crypto wallet like you can with a credit card or bank account.

This means Paxos is unable to pass on the cost of physical vault storage to us.

Why does that matter to you as the investor?

Because it's crucial to consider the revenue model of any crypto asset to ensure that the ecosystem is sustainable … and that you're not exposed to any unnecessary risks.

So, how on Earth does Paxos make a profitable business out of this?

Well, to start, it has two streams of revenue:

- Minting and burning fees

- Transaction fees

Minting and burning fees are only applied when investors buy PAXG directly from Paxos.

How does that process work?

First, you would transfer U.S. dollars to Paxos. In return, it would allocate you the relevant amount of gold at the current market price. Then, it mints the appropriate amount of PAXG inside your account.

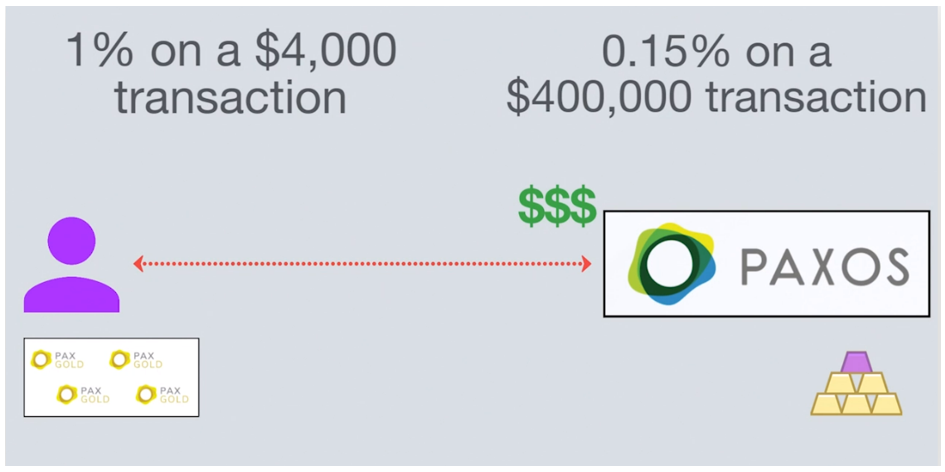

This process can incur fees that can range anywhere from 1% on a $4,000 transaction to 0.15% on a $400,000 transaction.

However, the transaction fee is charged both ways — minting and burning.

In other words, you can basically reverse the transaction.

If you have an amount of PAXG that you bought on a decentralized exchange, you can set up a PAXG account and send them back to Paxos, effectively burning your tokens. Then, you'll receive the value in U.S. dollars.

This method doesn't give Paxos the ongoing revenue to cover the cost of gold storage.

As unlikely as this is, what if there's a period where there's no minting or burning taking place? They would have no revenue.

That's where Paxos' second revenue stream — transaction fees — comes in.

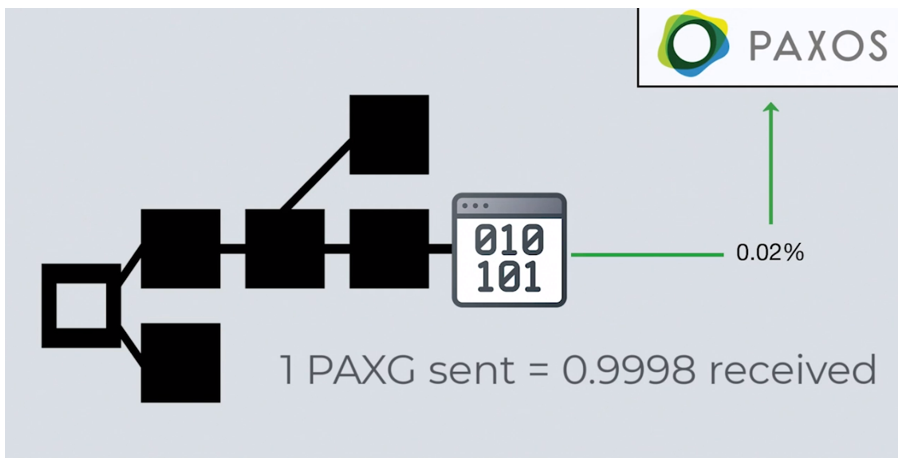

The smart-contract code that manages PAXG is programmed to send 0.02% of the transacted amount back to Paxos as a fee.

For example, if I sent you 1 PAXG token, you would receive 0.9998 tokens, and Paxos would pocket 0.0002 tokens in their corporate wallet.

This is important to know when sending PAXG to another person, because you need to make sure to send an amount that includes the transaction fee. Otherwise, the recipient won't receive the amount they expect.

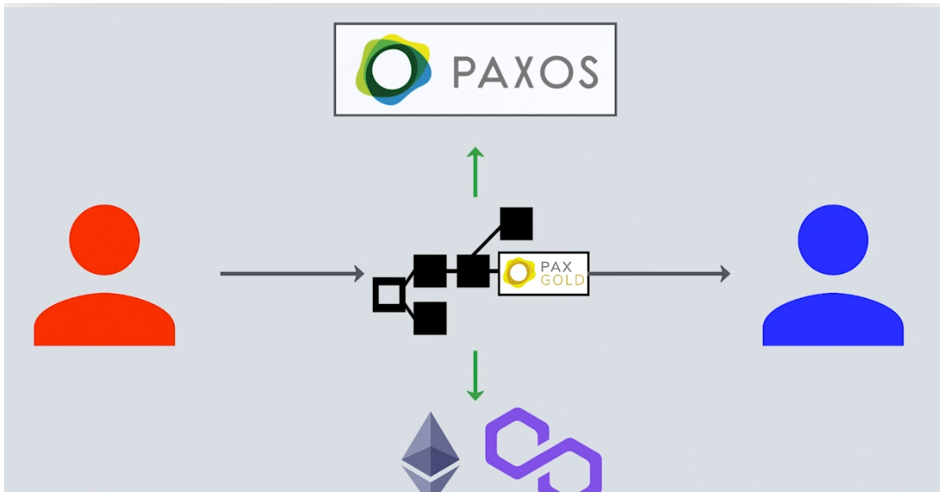

This is a bit of an unusual setup, because when sending PAXG, users incur two transaction fees simultaneously.

They pay the 0.02% Paxos fee — which is charged in PAXG — along with a normal network transaction fee for performing a token transfer.

For instance, if you transferred tokens on the Polygon (MATIC, Tech/Adoption Grade "B+") network, you would pay that fee in MATIC tokens, whereas if you did the transfer on the Ethereum (ETH, Tech/Adoption Grade "A") network, that fee would be in ETH.

Essentially, the Paxos fee is pretty much a small tax on transactions involving their token, which I personally kind of like.

If more tokens operated on this model, then perhaps they wouldn't have to rely so heavily on big initial token sales.

Instead, they could focus on building features that incentivize usage — broadening its adoption on major apps, building partnerships with platforms and getting it listed on major exchanges — instead of being primarily focused on pumping up token prices.

Fortunately, because PAXG's value is bound to the price of gold, concern about token price just isn't there, and Paxos can focus on building up use cases.

After all, the more places investors can use PAXG, the more likely users will be drawn to it. And with more users and transactions, it could generate even more fee revenue.

In some ways, I personally think this is a more honest model because it's more symbiotic with the user.

You could even say it's as good as gold.

So, that's how Paxos makes money on PAXG, how they cover their vaulting fees and how this is sustainable long term.

Let me know your thoughts on Paxos' revenue model by tweeting @WeissCrypto.

That's all I've got for you today, but tune in next week for my next crypto update.

Until then,

Chris Coney