|

| By Juan Villaverde |

After flirting with the stratosphere at a near $74,000 high, Bitcoin (BTC, “A-”) decided it needed a breather, or perhaps just wanted to see what $60,000 felt like again, plummeting about 20% faster than you can say “correction.”

Ethereum (ETH, “B+”), not wanting to feel left out, took its own leap from over $4,000 to just about $3,000, shedding a cozy 25% of its value as if it was last season’s fashion.

Yet, despite this tempest in a teacup, this is merely a pit stop on the express train to higher highs. That’s because …

Global liquidity remains absurdly generous.

The sheer volume of euros, yen, pounds and dollars sloshing around inside the financial system remains generously abundant.

Central banks and finance ministers around the world are diligently pumping in cash to shield their sovereign bond markets from potential collapse.

As they have been doing since the U.K. gilt crisis of approximately October 2022.

Remember last year’s banking crisis, when Silicon Valley Bank (among others) succumbed to the pressures of an illiquid U.S. Treasury market?

The Federal Reserve created the Bank Term Funding Program (BTFP) as a lifeline — allowing banks to offload bonds at face value, thus avoiding market-to-market losses.

Even though the BTFP expired last week, it's way too early to declare a liquidity crunch.

The banking crisis was a crucial wake-up call. And the surge in liquidity it has ushered in propelling asset prices continues.

As I’ve pointed out before, the Fed may appear to be tightening the financial screws, but reality is far more nuanced.

Yes, the Fed has been offloading bonds, amounting to about $1 trillion over the past year. But the U.S. Treasury extracted twice that amount through the Reverse Repo Facility. That adds up to a net liquidity boost of about $1 trillion since the Silicon Valley Bank debacle.

Now, as the reverse repo facility dwindles to its last $500 billion, the approaching U.S. tax season is expected to supplement this stimulus for a bit longer.

With the stock market at all-time highs, this year’s harvest will be plentiful.

Adding to this, Fed Chair Jerome Powell hinted at a potential cessation of Quantitative Tightening this week, which signals an end to the Fed's bond sell-off.

This announcement aligns perfectly with the depleting reverse repo reserves, indicating a strategic withdrawal from bond sales.

All this maneuvering by the Fed and Treasury is no coincidence. It's an orchestrated effort to flood U.S. and global markets with cash.

Market reactions reflect this understanding. This is a key reason gold prices hit new highs, despite outflows from the SPDR Gold Shares (GLD) ETF.

This could be a hint a lot of gold buyers don’t trust gold held in the form of a U.S. security that could be seized or frozen on a whim by the government. Or it could just be lack of confidence in holding U.S. bonds amidst rampant money printing.

Bitcoin’s recent ascent to all-time highs, followed by a minor correction, echoes the latter sentiment.

The deluge of liquidity from indebted developed economies shows no signs of abating. And that compels central banks to fend off widespread defaults via the only tool in their arsenal: the printing press.

As long as this trend persists, with no foreseeable reversal, assets like crypto and gold, seen as monetary hedges, will only climb higher.

Further supporting my argument is the fact that the broad market sell-off stopped as soon as the Fed’s Federal Open Market Committee announced after its meeting this week that interest rates would likely fall soon, and that quantitative tightening is soon to stop.

This served as a reminder that liquidity is so loose nowadays that monetary assets like Bitcoin are bound to continue marching higher.

What, then, was behind the sell-off?

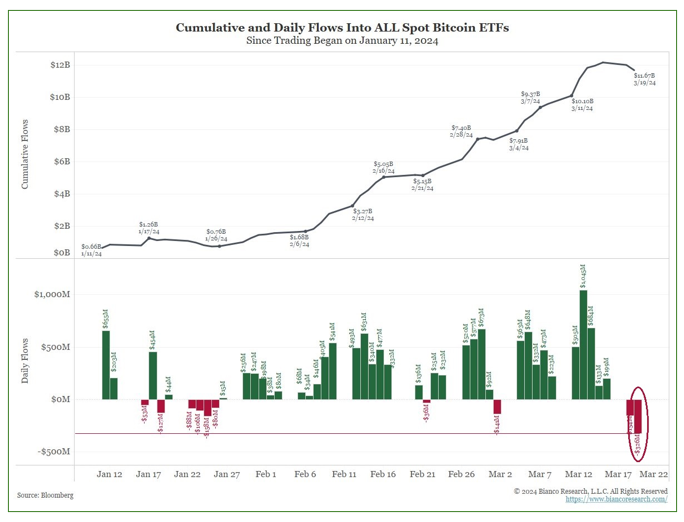

Record Amounts of Money Exiting the Bitcoin ETFs

This outflow of money caused a wave of liquidations across crypto derivative exchanges.

I am now pleased to report that a lot of leverage has come out of the market, as U.S. dollar borrowing and funding rates have cooled from their overheated levels.

Why pleased?

Because this was our last chance for markets to cool off. Otherwise, we’d have hitched a ride on a runaway train to the upside that would have crashed come Bitcoin’s usually bullish halving next month.

Fortunately, BTC pumped the brakes before things got out of hand … a move I welcome.

If Bitcoin and other assets can remain below their March 12 highs for another 10 days or so, this will be a sign of a healthy market taking a pause on the way to much higher highs.

Best,

Juan Villaverde