The Fed’s 2024 Sleight of Hand Will Send Bitcoin Soaring

|

| By Juan Villaverde |

Three major events will come into play this year that individually have the potential to send crypto into the stratosphere.

Together? They create a perfect storm for a massive rally.

One of those events is the official pivot in Federal Reserve policy to restart the money printers.

But it’s not as big an adjustment as you might think. That’s because the Fed never really stopped spewing liquidity into the market.

Just think back to last year, a time when gold and crypto assets thrived. That suggests a world awash in liquidity … despite the words of Fed Chair Jerome Powell.

Sure, if you listened to his press conferences and interviews, you’d have thought 2023 was a year of monetary drought. He claimed the Fed was fighting inflation with high rates and a tight liquidity grip.

The reality, however, was that every move Powell claimed would remove liquidity from the system was a magician's sleight of hand.

For every dollar he took out, two would be injected back in.

You don’t have to take my word for it, either. It’s not an interpretation but an objective fact.

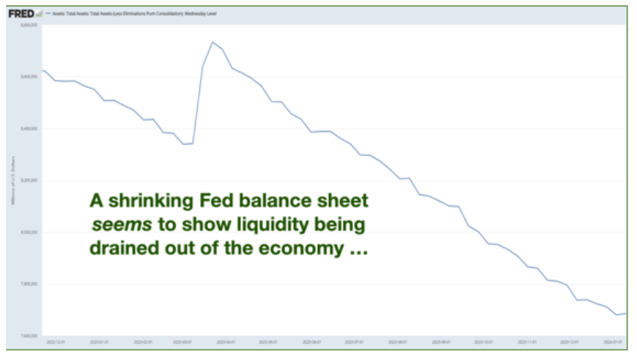

Just look at the chart below. It shows the Fed's balance sheet in 2023, and you can see a downward trend. Well, save for that cheeky spike around March, but more on that in a second.

Federal Reserve Balance Sheet 2023

This drop, nearly $1 trillion worth, supposedly shows the Fed playing the tough guy, taking liquidity out of the system.

But don’t be fooled, that's just half the act.

See, there’s a pesky thing called the Reverse Repo Facility. Basically, it acts as the Fed’s piggy bank, a place where financial institutions stash their cash. The Fed can dip into this when it needs to for additional liquidity without printing.

And you can see below that the Reverse Repo Facility balance decreased in 2023:

Reverse Repo Facility Balance 2023

But unlike the Fed balance sheet, when this line goes down, it's not a diet.

The Reverse Repo Facility balance decreasing means the Fed is taking money from there and feeding it back into the economy.

In 2023, this little piggy bank shrank by about $2 trillion, translating to a generous dose of liquidity.

And remember that March spike in the Fed’s balance sheet? That was courtesy of the Fed's Bank Term Funding Program — the Fed's version of a payday loan shop, but for banks and government bonds.

Well, it “loaned” about $90 billion to avoid a banking hiccup back in March 2023. More recently, the Fed added another $70 billion in “loans” to banks.

Add it all up, and you see the magic trick: Powell’s Fed may have cut $1 trillion from its balance sheet with one hand, but with the other, it secretly slipped over $2 trillion back into the market.

Voilà, the grand illusion of tight liquidity!

That’s why stocks, crypto and gold had a party in 2023. The Fed's money printers were working overtime, even if they didn't want you to hear the machines whirring.

If you didn’t catch this ride in 2023, that’s OK. Because it’s set to continue in 2024. And the Fed will craft more new tricks to keep the liquidity flowing.

Additional liquidity in the markets means investors have more room to gobble up assets.

And we’ll be seeing a wave of hungry new investors now able to hold Bitcoin (BTC, “A-”) thanks to the brand-new spot ETFs.

Pair that demand with an already limited supply that’s only getting smaller after Bitcoin’s halving, and the stage is well and truly set for Bitcoin to skyrocket this year … and take the broad market with it.

Best,

Juan Villaverde