AI Powers a Perfect Storm for Higher Copper Prices

|

| By Bob Czeschin |

Over the past year, we’ve seen epic rallies in gold and silver fill the headlines. But the shine of these precious metals has blinded many to the potential of a different resource.

Copper has relatively unnoticed this year … even as it quietly transformed itself from a mundane base metal to a critical strategic resource.

It’s the center of the $244 billion AI market … and the clash-of-giants competition between the U.S. and China. Both of which are determined to dominate this powerful new technology.

For his Weissgiving gift, Mark Gough told you about a powerful growth pick that’s powering the AI boom.

But that’s just one pick-and-shovel play in this narrative. Copper — the backbone of electronic infrastructure — is another.

Look no further than the massive, windowless mega-buildings that have sprung up around the world to train AI networks for evidence.

These can be 100 times the size of the familiar server farms run by cloud computing companies like Amazon and Google.

And because of higher power density, they require a lot more copper, an essential material in just about anything electrified.

Microsoft's newest AI-optimized facility in Chicago, for example, required 23.5 tons of copper (per megawatt capacity).

That’s nearly 3x as much as its standard cloud data centers built just five years ago!

Of course, AI evangelists and data center entrepreneurs are a notoriously optimistic bunch. So, it is probably wise to take their forecasts for future buildouts with a grain of salt.

So, let’s suppose they actually achieve only 60% of their current projections. This is can easily consume 1 million extra tons of copper year.

That’s about 4% of all the copper all the world’s mines produced last year.

Computer Sheds on Steroids

New AI data centers also have immense, insatiable appetites for electricity. A single installation can consume as much as 750,000 residential homes.

Indeed, if these data centers were a country, by 2035 they would be the world’s fourth-largest electricity consumer — after the U.S., China and India — according to Bloomberg estimates.

That’s power consumption on a scale that inevitably affects the cost and quality of service for other locally connected users.

For example, wholesale electricity prices have gone up as much as 267% in the areas around large data centers over the past five years.

Households can also face degraded power quality. Voltage and frequency distortion can damage appliances and consumer electronics … and stress the local power grid, leading to brownouts and blackouts.

This is where AI morphs into a perfect storm that could shake the foundations of 21st-century urban life.

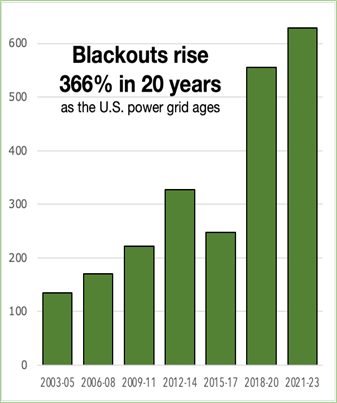

Even before it came on the scene, power outages had been getting worse for decades.

America’s antiquated, decrepit power grid

The U.S. power grid basically consists of:

- 160,000 miles of long-distance, high-voltage transmission lines,

- 15,000 transmission substations,

- 4.8 million miles of low-voltage local power lines, and

- 60,000 distribution substations …

All of which connects more than 7,300 power plants to 3,300 utilities serving hundreds of millions of end users across the continental U.S.

Sadly, however, this one-time marvel of 20th-century engineering has not been properly maintained into the 21st century.

Consultancy Marsh & McLennan estimate 140,000 miles of U.S. transmission lines need to be replaced.

The average substation transformer, with a design life of 25 to 30 years, is now over 40 years old. Tons of now obsolete equipment — from oil-filled breakers to electro-mechanical relays — have not been upgraded or replaced.

On top of that, grid infrastructure designed for lower, more predictable demand now faces frequent overloads. This accelerates equipment aging, increases the risk of catastrophic overheating and compromises system reliability.

No wonder power failures and black-outs black have been rising steeply! The grid is falling to bits.

And now, here comes AI to push it completely over the edge.

Can you imagine how much copper it’s going to take to upgrade or replace nearly 5 million miles of power lines? Or the huge copper coils inside hundreds of thousands of substation transformers?

In short, our crumbling physical infrastructure and new AI demand create …

Copper Prices’ Perfect Storm

The AI revolution plus the imperative to upgrade the grid to keep it going … is going to be a hugely bullish for copper prices.

That’s because they both require massive amounts of copper. And it’s virtually impossible to significantly expand mine production in the next decade or so.

Simply put, new discoveries have been trending down for decades. Of the 239 major copper deposits discovered between 1990 and 2023, only 14 came in the final 10 years.

And now, even when an infrequent new discovery comes along, it takes 12 to15 years to build the infrastructure to bring it into production.

That effectively means any more copper for AI or the grid will have to be bid away from some other big copper consumer. Like electric vehicle (EV) makers — whose cars require 3 to 5 times as much copper to build as conventional gasoline or diesel vehicles.

As this competition for supply heats up, copper prices have nowhere to go but up over the next few years.

Indeed, analysts say copper could hit $25 per pound by 2030. That’s roughly 4.3x present levels.

And we can see this trend is already underway …

Copper Climbs 43% in 2025

Investment Implications

There are many ways to hitch your portfolio to rising copper prices in 2026 and beyond.

Here are two of the most promising:

- An ETF, like the iShares Copper and Metals Mining ETF (ICOP), gives you broad exposure to dozens of top copper miners around the world. With an attractively low expense ratio — just 0.47%.

- If you want to be more targeted in your approach, you could also track the top publicly traded copper producers and trade them on your own. They are …

- BHP (BHP),

- Freeport-McMoRan (FCX),

- GrupoMexico (GMBXF), and

- The soon-to-be merged Anglo American (AAUKF) + Teck Resources (TECK).

If you go this route, you may consider adding Weiss Ratings Plus to your investment toolkit.

This is our ultimate data-driven investment tool.

That’s because it’s the key to unlocking Weiss’ 10+ terabyte financial database — including scanners that can give you a snapshot of specific sectors to identify which are most promising to buy right now … and which to avoid.

Then, pick up a few shares so you can ride two of the hottest trends in investable metals at the same time.

Best,

Bob Czeschin