|

| By Jurica Dujmovic |

We're in the midst of what Bloomberg's Eric Balchunas has dubbed "Altcoin ETF Summer."

And no wonder!

We’re in the midst of a regulatory approval frenzy. One that has asset managers filing applications faster than a DeFi protocol can mint new tokens.

The crazy — and bullish — part? More than you may think could actually get approval.

For years, the SEC kept the crypto-ETF roster limited to Bitcoin (BTC, “A”), repeatedly pushing every altcoin ETF application to the back of the queue.

Then, something shifted.

The same regulatory body that once treated altcoins like financial contraband is now actively engaging with ETF applications for Solana (SOL, “B”), XRP (XRP, “B-”), Litecoin (LTC, “C+”) and, yes, even Dogecoin (DOGE, “C+”).

Today, I want to dive into what changed … and what it means for the crypto market.

The Regulatory Renaissance

In short, regulators are “under new management.”

The current SEC chair, Paul Atkins, was sworn in on April 21, 2025. And since then, we've seen a dramatic shift from the Gensler era's crypto skepticism to something approaching genuine engagement.

The agency is now working with applicants on technical details — like custody arrangements and staking mechanisms — rather than dismissing applications out of hand.

It's the difference between “we don't do that here” and “how can we make this work within our framework.”

Take the Solana ETF applications, for example.

There are at least six major ETF applications from heavyweights like Grayscale, VanEck, 21Shares and Bitwise.

And just this week, the SEC reached out to all of them, asking to include staking provisions and in-kind redemption mechanisms in their filings.

Translation: Regulators want these funds to earn yield, not just hold tokens.

This is a huge departure from the precedent set by the Ethereum (ETH, “B+”) ETF approvals. Back then, staking was expressly prohibited.

Now, it's like regulators have discovered DeFi … and decided it's actually pretty neat!

Bloomberg's 90% approval odds for Solana feel conservative when you consider the ecosystem's growth, institutional adoption and the fact that CME launched SOL futures back in March.

And with the regulatory pieces seemingly falling into place, I’ll be watching closely for developments.

Especially if they’re approved with staking. That could do a lot of heavy lifting to bring DeFi capabilities to TradFi investors.

The final 240-day deadlines are in October. But approvals are possible as early as July.

As for the other applications, it’s too early to say with confidence which will be approved.

But one to look at is …

The Early Winner Already Swimming in ETF Waters

In a plot twist that would make Hollywood writers jealous, XRP — the token that spent years mired in SEC litigation — became one of the first altcoins to break through the ETF barrier.

It hasn’t had success with a spot fund just yet. That’s the application still with the SEC.

But it did get approval for two futures-based products.

Volatility Shares’ plain-vanilla XRPI began trading on May 22 with only a couple million dollars in seed capital.

It then cleared $3 million in net assets within 48 hours and swelled to roughly $13 million after its first three weeks.

Now, its average daily volume sits around 70-100 thousand shares (about $1 million — 1.5 million notional).

Now that’s solid liquidity for a brand-new crypto ETF.

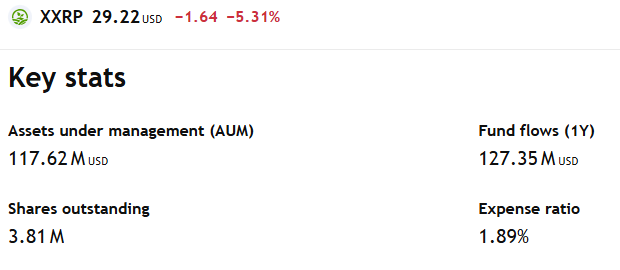

Teucrium’s XXRP, a 2× leveraged version, launched earlier in April. It sprinted to about $35 million in AUM by late April/early May and ballooned to about $118 million as of June.

Clearly, there is pent-up demand for regulated XRP exposure!

Why This Actually Matters Beyond the Hype

Altcoin ETFs solve what I call the "MetaMask problem."

That is, institutional investors want crypto exposure. But they don’t want to deal with self-custody, private keys or explaining to compliance why they're using DeFi protocols.

ETFs provide the familiar wrapper that makes crypto palatable to pension funds and wealth managers.

And they allow institutions to access the broader crypto market. As of right now, they’re limited to just Bitcoin and Ethereum when it comes to spot exposure.

In short, altcoin ETFs are a bridge between DeFi and institutional capital.

Bitcoin ETFs demonstrated the pent-up institutional demand for crypto access. If altcoin ETFs follow a similar trajectory, we could see billions flowing into crypto.

The impact on liquidity and price stability could be transformative.

And for retail investors, these altcoin ETFs offer a shortcut to diversification.

Instead of picking individual tokens, you can simply buy basket ETFs to cover the top crypto assets or targeted single-asset funds for specific thesis plays.

The Investment Reality Check

That said, there are a few pitfalls in the ETF push.

First, not every altcoin will benefit equally from ETF availability.

Regulatory favor seems concentrated on established projects with commodity-like characteristics.

Second, ETF success doesn't guarantee underlying asset performance. It’s expected, sure, but look no further than the launch of the Ethereum ETFs last year. Prices bounced, but failed to rally the way Bitcoin did when its ETFs launched.

Finally, the fee structures for these products will likely be higher than traditional ETFs due to custody complexity and active management requirements.

That expense ratio math matters for long-term returns.

What to Watch This Summer

Altcoin ETF Summer represents crypto's graduation from fringe speculation to institutional asset class.

Not every application will be approved. And not every approved ETF will succeed.

Still, the trend trajectory is unmistakable.

Whether you're a crypto veteran who remembers when ETH was under $100 or a traditional investor just discovering digital assets, this summer is shaping up to be the season that bridges two worlds.

I know I’ll be watching the SEC’s moves closely over the summer and into fall.

I suggest you do the same.

Just remember: Regulatory approval doesn't eliminate volatility.

Fundamental analysis still matters, and past performance definitely doesn't guarantee future results.

Even for assets that come with official SEC stamps.

And for more direct strategies to ride the coming crypto rally, you’ll want to watch the Crypto All-Access Summit.

It’s going offline tonight, so this is your last chance.

Best,

Jurica Dujmovic