|

| By Jurica Dujmovic |

April brought us one important lesson about crypto: Nothing — not even tariff tantrums — can keep this market down for long.

What began with a $160 billion market-cap wipeout …

Ended with champagne corks popping thanks to several notable developments, and the historical strength of this month in the crypto cycles.

It’s hard to remember now, but the month began with crypto markets caught in the crossfire of geopolitical brinkmanship.

When President Trump announced new tariffs on China on April 3, Beijing's swift retaliation sent tremors through global markets, with crypto suffering collateral damage. As $160 billion in market cap evaporated, the doomsayers emerged from hibernation to declare the bull market officially dead.

But history has vindicated the optimists.

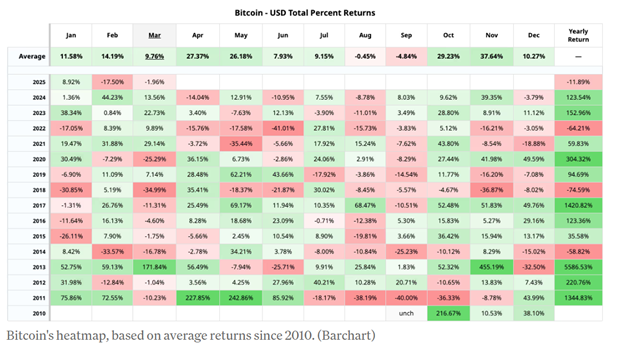

April has historically been a rebound month for Bitcoin, averaging gains of 27% since 2010, making it one of Bitcoin's best months of the year.

True to form, as the month progressed, the market shrugged off geopolitical anxieties and reclaimed its upward trajectory.

Bitcoin (BTC, “A-”) has flirted with the $95,000 mark since April 25. That marks an impressive 11% increase on the week and on track for its strongest weekly gain since late 2024.

And earlier today, it surpassed that level to trade at the time of writing above $97,000.

The rally was fueled by institutional money pouring in at unprecedented rates. U.S.-listed spot Bitcoin ETFs recorded $2.68 billion in net inflows for the week.

That’s the largest weekly influx since December 2024!

By the month’s end, Bitcoin had gained approximately 15%, making April the strongest month since November.

This performance reinforces the post-halving narrative that has propelled previous Bitcoin bull markets.

With some analysts now predicting $130,000 Bitcoin by late 2025 — and our own Juan Villaverde reconfirming that $150,000 is still possible — FOMO is becoming a palpable force even among traditionally conservative investors.

But, as I said, there were several other key developments in April that helped maintain this renewed optimism and momentum.

Hong Kong Steals the ETF Spotlight

While American regulators were busy playing their usual game of regulatory chess, Hong Kong executed a swift sequence that positioned it as crypto's new institutional darling. On April 7, the Securities and Futures Commission (SFC) issued guidance permitting licensed crypto exchanges to offer staking services.

This complete reversal of previous policy was followed by an even more impressive move just three days later: approving Asia's first Ethereum (ETH, “B”) spot ETF with staking features under its new rule.

It’s one of only a handful worldwide, and it will let investors earn native staking rewards inside a regulated spot-ETH ETF. Any yields — which for ETH average roughly ~2% annually at the time of writing — will be reinvested to boost investor returns.

XRP Holders Receive Long-Awaited Relief

For XRP (XRP, “B-”) holders, April 28 will forever be marked as the day their patience was rewarded.

After enduring crypto's longest-running regulatory soap opera, Ripple supporters witnessed an extraordinary moment: The SEC gave tacit approval for ProShares to list three futures-based XRP ETFs.

The approval of Ultra XRP (2× long), Short XRP (-1× inverse) and Ultra Short XRP (-2× leveraged short) funds — all futures-linked products rather than spot ETFs — represents more than just new investment vehicles. It was the regulatory equivalent of raising a white flag in the SEC's war against Ripple.

For a token that the regulatory body had long insisted was an unregistered security, even approving futures-based ETFs amounts to a remarkable about-face.

Memecoin Madness, Round 2

Because no month in crypto would be complete without some absurdity, April delivered its quota of meme-coin madness.

The Trump-themed memecoin, Official Trump (TRUMP, Not Yet Rated) — which is not officially affiliated with the President — created waves on Crypto Twitter with a massive token unlock scheduled for April 18.

Approximately 40 million TRUMP tokens, worth over $320 million and roughly 20% of the token's total supply, were set to be released to the project's team and investors. This triggered widespread speculation about an impending dump and led to a steep price collapse.

The token is now down 83% since its January launch.

Not to be outdone, Solana's ecosystem produced its own viral sensation in Housecoin (HOUSE, Not Yet Rated). HOUSE had rocketed over 900% in just a few weeks, and briefly broke the $100 million market cap after a 60% single-day jump on April 30.

The token's premise — that holding HOUSE is somehow equivalent to owning real estate, despite having no actual asset backing — would be laughable … if it weren't making some traders obscenely wealthy.

Final Thoughts

April 2025 will likely be remembered as a month when crypto demonstrated its resilience in the face of macro headwinds while continuing its march forward.

From record ETF inflows to groundbreaking regulatory approvals, the evidence suggests crypto is maturing as an asset class even as its wilder elements continue to thrive in the ecosystem's fringes.

For investors who weathered the early-month volatility, the rewards were substantial.

Those who panicked at the first sign of tariff troubles missed yet another lesson in crypto's most reliable pattern: short-term pain often precedes long-term gain.

As we head into May, momentum appears firmly on the bulls' side.

With Bitcoin holding strong near all-time highs, XRP enjoying its regulatory redemption arc and even memecoins on the move again, the crypto market seems determined to make 2025 a year for the record books.

I hope you plan to stick around to see it.

Best,

Jurica Dujmovic