|

| By Marija Matic |

In a market driven by noise, it's easy to get lost.

But while most are distracted by the casino of memecoins and wild price swings, a different kind of opportunity is quietly growing in the background.

One that isn't about gambling, but about finding a structural, stable edge.

It starts in a place most people only see as a casino. But a closer look reveals a hidden "back office" where you can simply collect the profits.

The Decoy: A Trader's Playground

It starts with a platform called gTrade.

On the surface, this is a simple decentralized derivatives exchange. Think of it like a rogue cousin of Binance or Coinbase where traders can use high leverage.

The increased risk can offer increased rewards if the trade plays out in their favor.

And it's impressive.

The platform boasts steady trading volumes and a design that's reportedly up to 100x more capital-efficient than its competitors.

For traders, this means lower slippage and more trading options.

And that’s where most people stop looking. They see a trading platform use it. Or they invest in its native token if they want to bet on it.

But there’s a smarter play on this platform. One that cuts out the gambling.

See, gTrade isn't built on traditional order books. It uses a synthetic engine where traders essentially bet against a central vault of liquidity.

And in the high-leverage world of perpetuals, most traders … lose.

But when they lose, the vault wins.

Those wins are added to the steady stream of fees the vault also collects from all the trading activity — win or lose — on gTrade.

The house, as they say, always has an edge.

The Real Opportunity: The gUSDC Vaults

This is where the real, quiet opportunity lies: the gUSDC vaults on gTrade.

They’re offered on a few blockchains, with each one offering a different yield. You can toggle between them by clicking the icon in the top right corner of gTrade’s Vaults page.

Instead of trading, you can simply provide the liquidity to these vaults. The house then uses that liquidity to facilitate the leveraged trades others are making. And in return, you earn a piece of the rewards.

It works like this:

- You deposit stablecoins — in this case, USD Coin (USDC) — into the vault.

- In return, you receive a "receipt" token called gUSDC.

Here’s the magic: Your gUSDC receipt token grows in value. It’s programmed to absorb the profits the vault makes from trading fees and traders' losses.

This is the key: With this strategy, your only exposure is in stablecoins.

That means your principal isn't exposed to the volatility of assets like Bitcoin (BTC, “A-”) or Ethereum (ETH, “A-”).

Instead, you have a delta-neutral position. So, you profit from the platform's activity, not from the market's direction.

When these vaults first launched, $1 USDC got you $1 of gUSDC.

As of writing, that original $1 gUSDC in the Arbitrum vault is now worth $1.24, for example. And the gUSDC from the (younger) Base vault is already at $1.15.

That means, when you deposit, your principal isn't just sitting there. It's actively appreciating.

Your "share" of the house's winnings gets bigger every single day, all while you hold a token that is backed by stablecoins.

And the returns? They're not hypothetical.

They’re not wild, temporary "degen" yields.

In fact, they've been remarkably consistent.

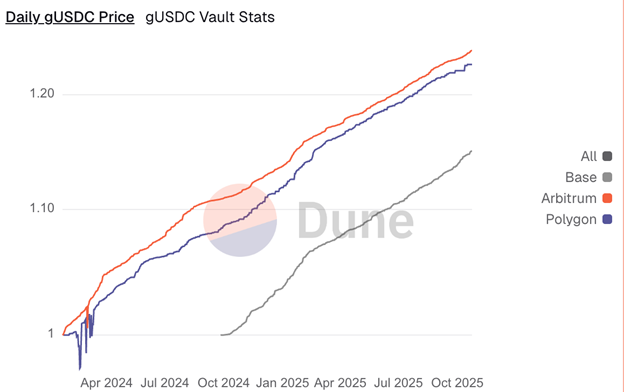

Just look at the track record from Dune Analytics:

The chart above shows the steady, relentless climb of gUSDC's value (its "index price").

The gray line represents the Base vault. It launched just a year ago, and its steep rise from $1 shows just how profitable being the house has been.

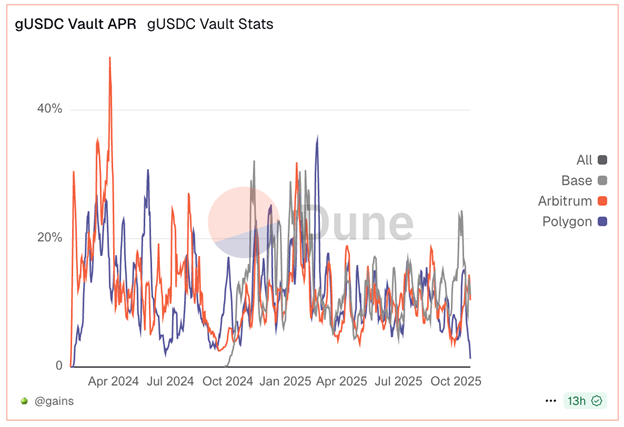

Now, look at the chart below. This one shows the history of the APRs.

You'll see they stay consistently high (with the exception of Polygon, as that network’s use has faded).

Notice how the Base vault (gray line) even jumped above 20% in October?

Those periods of high, volatile trading are good for the vault. They feed it profits and pull the average yield even higher:

Our Proof: This is a Battle-Proven Position

I’m not just telling you about this as a hypothetical; My Crypto Yield Hunter members are already using it.

This has been a core, battle-proven, low-risk position in that strategy for three years. We know it inside and out.

Our previous run in one of these pools — from late 2023 to August 2024 — was incredible. It delivered an average APY of 15.39% over 266 days.

This is what a large part of our DeFi yield hunting strategy is all about: simple, low risk and proven yield on a blue-chip stablecoin.

It's the perfect way to diversify your portfolio, de-risk from market volatility and earn a consistent return while everyone else is just riding the rollercoaster.

So, forget the noise. Focus on being in the house.

Best,

Marija Matić

P.S. Liquidity providing via stablecoins is one way to reduce your risk exposure while targeting high-yield income opportunities.

But my colleague Nilus Mattive has another. One that allows you to earn on gold — the original safe haven asset.

In fact, just this year, he has shown his readers how to collect payments of $828, $973, $884 and $1,040 from gold and silver.

Like my Crypto Yield Hunter approach, this is a strategy that can generate consistent payouts in any market condition — up, down or sideways.

But without navigating the DeFi market.