Beat the Sideways Market with a Stablecoin Strategy

|

| By Bruce Ng |

Bitcoin (BTC, “A”) dumped 10% over the past two weeks, from $72,000 to now $65,000.

Worry not, we are still in a bull market. But remember when I gave you the breakdown for when altcoin season would start?

I said back then that after Bitcoin’s halving, the markets tend to consolidate. This is that consolidation, and history supports that.

My colleague Juan Villaverde broke it down in his Friday issue in more detail. But traditionally, the months between May and September tend to be sluggish for crypto. They either slowly bleed downward or trade sideways.

But I expect to see crypto recover starting around September.

In the meantime, though, there are still ways to work the market. A popular strategy is yield hunting — finding projects where you can provide liquidity in return for a yield.

This way, you can earn rewards on crypto you already own.

Now, you can yield hunt on centralized exchanges, or CEXes. This may be a little easier and more accessible, especially if you already have a CEX account and are familiar with that CEX’s user interface.

But yields on those platforms are usually pretty low. Especially when compared to the yields you can find in the decentralized finance, or DeFi, realm.

Just take a look at Coinbase as an example. You can stake your Ethereum (ETH, “A-”) there for up to 6% APY.

But on Uniswap (UNI, “B”) — the largest decentralized exchange, or DEX, on the Ethereum blockchain — you can add your ETH to a pool for at least 21% APY, at the time of writing.

That’s over 3x higher!

But, as we’re entering a potentially volatile period in the markets, providing liquidity in the form of variable-price assets, like ETH, may expose you to more risk than reward.

If the price of ETH plunges while you have it in a pool, you’ll need your yield to offset any capital gains. And if it doesn’t, you’ll be sitting on a loss.

That means the name of the game is reducing exposure to market volatility and protecting your capital. To that end, you may want to consider stablecoins as a solution. These are digital coins pegged 1-to-1 to the U.S. dollar, meaning the value should always be $1.

So, if you want to target higher yields and are comfortable navigating DeFi with your own self-custody wallet, providing stablecoins as liquidity to DeFi projects may just be a strategy worth considering.

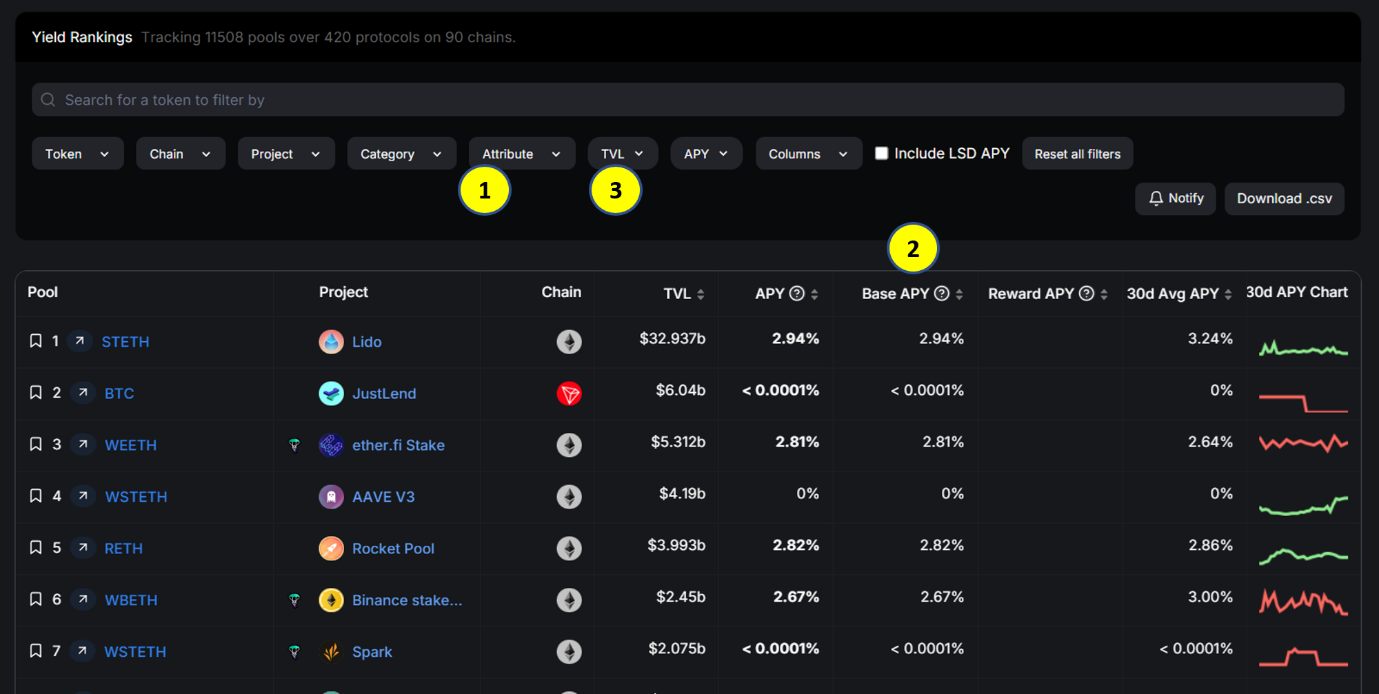

To that end, I recommend DeFiLlama’s Yields page as your one-stop shop for all DeFi related metrics.

This lists all the DeFi pools available to provide liquidity, the platform or project those pools exist on and their metrics.

Naturally, you’ll need to narrow things down in order to find what you’re looking for: stablecoin yields.

- Click on Attribute marked by the yellow oneand tick Stablecoins in the drop-down menu.

- Then click Base APY marked by the yellow 2 to sort the APY offerings from highest to lowest.

Now we need to restrict ourselves to the least risky opportunities. For that, we’ll look at the total value locked, or TVL, of each platform.

This is not a guarantee of safety. Rather TVL measures amount of liquidity locked onto a platform. A higher TVL means more people are actively using the platform and that the platform has sufficient liquidity. And more liquidity on a project means less risk exposure for you.

For my example here, I’ll restrict myself to protocols that have TVL more than $100 million.

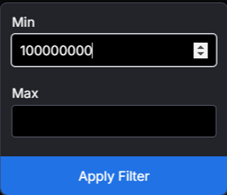

- Click on TVL, marked by the yellow 3and you will see this:

- Type in 100,000,000 and hit Apply Filter.

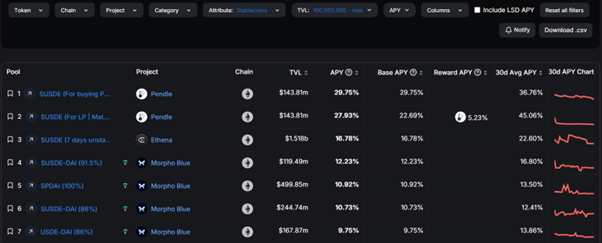

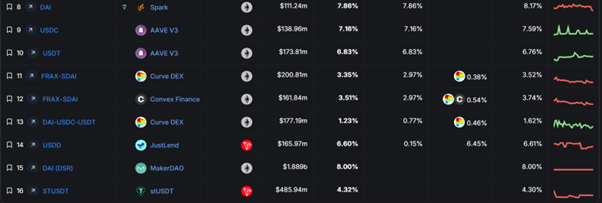

After doing all the above, your screen should display …

- Stablecoins only.

- APY sorted from highest to lowest.

- Only protocols with more than $100 million TVL.

Now scan the list of projects above.

Certain DeFi projects — like Pendle (PENDLE, “B+”) and Ethena (ENA, Not Yet Rated) — have liquidity providing restricted in the U.S. If that is the case for you, head lower down the list and look for other opportunities on projects like Spark (SPARK, Not Yet Rated), Aave (AAVE, “B-”) or Curve (CRV, “C+”).

Then, you can select a DeFi platform that you desire and look into providing liquidity there.

Simple, right? Well, in theory.

There are other concerns I have yet to mention, like:

- How much risk exposure does this project have?

- What blockchain network is this project operating on?

- How much trading activity have both the project and network seen lately? (And, if you’re providing a variable-price coin, how much trading activity has it seen?)

- Is this project or network likely to get hacked?

- What wallet do I need to access this DeFi project?

And more. The higher yields you try to target, the more important questions like these become as you exposure yourself to more risk.

Fortunately, my colleague and DeFi expert Marija Matić recently walked Weiss Ratings founder Dr. Martin Weiss through a yield hunting crash course.

And you can watch the full recording here.

In it, she explains how she targets high-performing DeFi yield opportunities while accounting for the questions above to manage risk. And she shows how you can target opportunities up to 17% APY on stablecoins and up to 169% APY on variable-price coins.

Plus, she reveals her own strategy that can supercharge those yields.

With the summer doldrums already taking shape, I suggest you check out Marija and Martin’s urgent briefing so you can make the most of the coming months.

And I suggest you do it sooner rather than later. We’ll be taking that video offline this week.

Best,

Dr. Bruce Ng