Bitcoin Insight from a Gold Mining Entrepreneur

|

| By Beth Canova |

Gold has been tearing higher in 2025.

Just yesterday, it made a new high near $3,833.

And there’s been a lot of noise from the peanut gallery as the yellow metal continues to climb.

That’s where Sean Brodrick comes in.

In his three decades as an investment analyst, Sean has become famous for his “boots-on-the-ground” approach.

He rarely misses a chance to go deep into a gold or silver mine, test out products on factory floors and meet executives in their natural habitats.

And he uses that expertise to help Resource Trader Members ignore the noise to target impressive returns on precious metals, including gold.

In fact, Sean recently sat down with Rob McEwen. This is a guy who took a gold company from a market cap of just $50 million to over $8 BILLION!

You can get his insight in this exclusive interview right here.

But the spark notes of it all is that Mr. McEwen and Sean both believe gold’s rally has a long way to go.

Mainly due to three more major forces.

Force No. 1: The Fed

Earlier this month, the Federal Reserve issued a quarter-point rate cut.

And, though Fed Chair Jerome Powell was careful to avoid promises, there could be more to come.

Rate cuts tend to drag on the U.S. dollar.

Since gold is priced in dollars, this tends to push gold higher.

Why is the Fed cutting rates?

The U.S. labor market has shown clear signs of weakness.

Initial jobless claims surged to 263,000 in early September (the highest since October 2021), August payroll growth fell to just 22,000 and revised data show 911,000 fewer jobs were created in the past year than previously reported.

Bottom line: The current monetary environment is highly supportive for gold.

Force No. 2: Geopolitical and Economic Uncertainty

A climate of economic anxiety persists due to ongoing global trade tensions, notably the U.S.-China tariff disputes, which have disrupted supply chains and promoted economic nationalism.

Investors are flocking to gold as a safe haven amid unstable equity markets, renewed Middle East and Ukraine conflict risks and persistent global inflation.

You think prices at the grocery store are going up? It’s worse in many other countries.

Political instability means investors hedge risk, and one way they do that is to buy gold.

And the primary reason why gold is going higher is …

Force No. 3: Central Bank and Institutional Buying

Central banks are buying gold hand over fist, on pace to scoop up 1,000 metric tonnes of gold in 2025.

This makes four years in a row of large-scale buying as they diversify away from the U.S. dollar and U.S. Treasurys.

This isn’t short term. A whopping 71% to 76% of reserve managers surveyed expect to increase gold holdings in the next 12 to 24 months.

That shows this is a sustained structural trend.

Tariffs, U.S budget shenanigans and the way Uncle Sam uses King Dollar as a cudgel all make gold very attractive to central bankers.

This is the trend that underlies gold’s big move so far — a move that should send gold first to $4,100 an ounce, then to $6,900 and perhaps beyond.

So, maybe listen to Mr. McEwen and do the smart thing: Buy gold juniors.

The easiest way to do that according to Sean? Use the VanEck Junior Gold Miners ETF (GDXJ), a basket of the best junior miners.

It’s surged a staggering 112.8% year to date!

Or you can go for digital gold … before its next rally hits.

Gold: Bitcoin’s Six-Month Oracle

If you think gold’s tailwinds look familiar, they should.

That’s because they are the very same forces Juan Villaverde says are building bullish momentum under Bitcoin (BTC, “A-”).

Makes sense, right?

After all, both are considered store-of-value assets. Gold and BTC are where smart capital seek and find refuge.

But there’s more to this story.

According to Juan, gold isn’t just treated similarly to Bitcoin in the present.

It leads the OG crypto by roughly six months.

Which means, it can act as a crystal ball, hinting at what we can expect for BTC over the medium term.

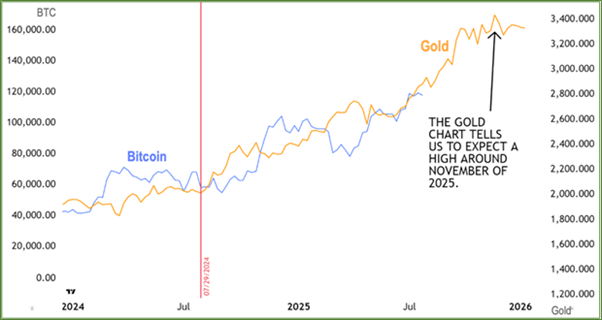

Just look at this chart, which shows gold’s price action projected forward by 24 weeks, or roughly six months:

Bitcoin may show more volatility in its price action. But trend-wise, you can see it moves in step with gold.

And with a wave of new highs, gold suggests Bitcoin’s current correction is a buying opportunity savvy investors shouldn’t pass up.

But gold is only one indicator Juan uses to get ahead of the market.

To keep up with crypto’s changing landscape, Juan has gone back to the drawing board. With the help of AI, he’s given his Crypto Timing Model a serious upgrade.

He calls it Version 2.0. and testing shows it has the power to generate AVERAGE gains of 6,630% for each crypto asset.

It’s an innovation too good to keep locked away.

Which is why Juan has decided to go live on Tuesday, Oct. 7 at 2 p.m. to break down what’s changed …

What his model sees on the horizon …

And which cryptos he believes could even outperform Bitcoin when its rally comes.

This briefing is free to attend. Just click here to save your seat.

Best,

Beth