|

| By Marija Matic |

For centuries, whenever the world felt unstable, people reached for gold.

Wars, currency collapses, political upheaval, it didn’t matter. Gold was the constant through it all.

And it makes sense. Gold is a tangible, scarce resource. And one that existed outside the direct control of any single government.

Entire monetary systems were built around it, and its role as a store of value became deeply embedded in human history.

But history doesn’t stand still. And neither does money.

Unlike in the slower, more physical world of the past, wealth moves at the speed of information. Financial infrastructure is increasingly politicized. And access to assets can matter as much as ownership itself.

Reserves can be frozen, payment systems can be turned into political tools and borders can tighten overnight.

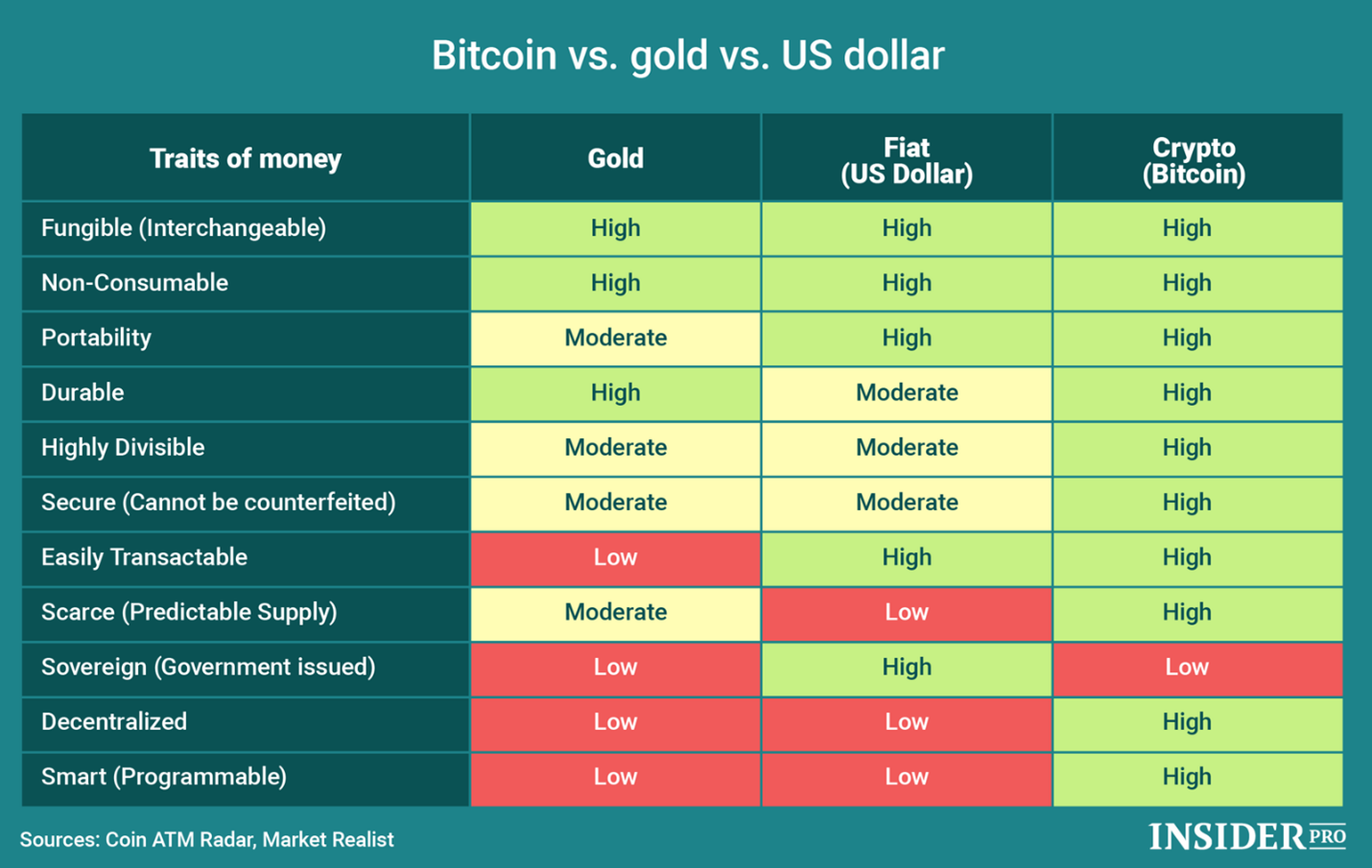

Under these conditions, the qualities that define “hard money” start to change.

Portability, neutrality and resistance to seizure matter more than ever.

When judged by those standards, you can see how gold doesn’t shine as brightly.

Not Your Keys, Not Your … Gold?

Gold’s reputation rests heavily on its non-sovereign nature.

Simply put, no government issues gold, and no central bank can decide to print more of it at will.

This independence has protected wealth for generations.

And yet, most gold today is held through intermediaries: custodians, vault operators, ETFs or banks. These structures introduce layers of jurisdiction and authority that inevitably shape how easily you can access or move your own.

Can gold really be a safe haven if there’s no guarantee you can use or move it without permission?

Modern financial history has made one lesson clear: Access can disappear faster than ownership.

Assets held inside institutions can be frozen, restricted or delayed. This applies to bank deposits, securities and, in many cases, vaulted commodities.

And of course, these roadblocks can rise at the worst of times.

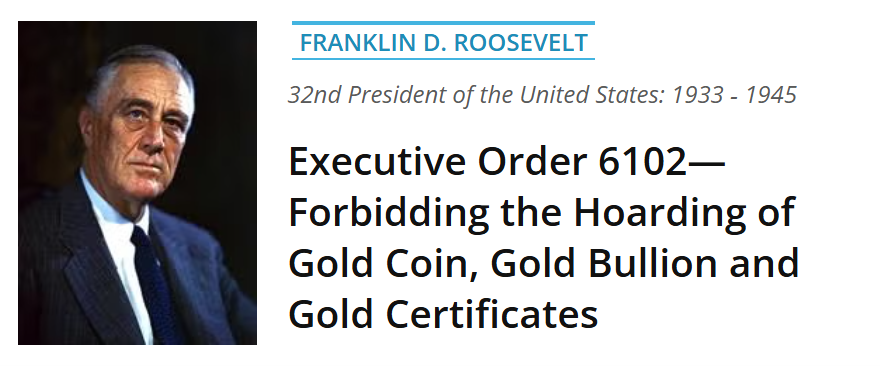

Executive Order 6102 — signed by then-President Franklin D. Roosevelt — was supposedly written to prevent gold hoarding during the Great Depression.

But in practicality, it saw people forced to turn over their gold for less than its market value. All so that the U.S. could get around the constraint on the Federal Reserve that stopped it from increasing the money supply during the depression.

Even sovereign reserves have been immobilized in recent years, demonstrating how powerful these mechanisms can be.

Gold held personally avoids some of these risks. But large-scale storage and transport remain difficult, which pushes most holders toward custodial solutions.

Portability: Moving Wealth in a Fractured World

Gold held personally helps avoid some of the above risks.

But its physical nature is both a strength and a weakness.

Its tangibility inspires confidence. B its weight and bulk make large transfers slow, expensive and visible.

This means moving meaningful quantities of gold across borders requires logistics, security and time.

In extreme scenarios, movement can become impractical altogether.

Where Bitcoin Outshines the Gilded Standard

While its existence as a digital asset has given the establishment pause, Bitcoin (BTC, “A-”) is designed to compensate for gold’s shortcomings.

And to continue to fulfill the role of a safe haven into the future.

Starting with ownership and access.

Unlike gold, anyone can hold their own Bitcoin — no intermediaries or custodians needed. Control resides with whoever holds the private keys.

In practical terms, this creates a stronger form of non-sovereignty than we see with gold. One that applies not only to the asset itself, but to the ability to access and use it at any time.

And it means there is no account to suspend and no intermediary able to block a transaction.

Control is direct and automatic, enforced by cryptography that is verifiable on-chain rather than granted by permission.

This benefit carries unusual weight in periods of geopolitical stress, when financial systems become extensions of political strategy.

And it filters into portability, as well.

Unlike with gold, BTC can be stored on a small hardware device. Keys to a digital wallet can be written on paper or even memorized as a password.

In short, large amounts of wealth can cross borders with the same ease as information.

Imagine fleeing a country at war — pockets empty, valuables left behind, gold confiscated, cash gone.

History is full of moments like this. And the survivors are all acutely aware of how portable wealth can change your outlook. In an era where unforeseen circumstances can appear overnight, portability becomes more than convenience.

It becomes necessary.

Bitcoin’s Potential Pitfalls Aren’t Deep

Some critics worry Bitcoin could vanish during a blackout.But even global outages aren’t fatal.

Satellites beam the blockchain from space, offline nodes store it locally and wallets can sync through nearby connections.

Access returns as soon as the network is reachable, wherever you are.

Which makes Bitcoin resilient in ways gold never is.

Futurists go even further.

They warn that a fully digital, ID-linked financial system could let governments, banks or payment networks effectively exclude individuals from money itself. That could be through programmable rules, compliance checks or even social-credit—style scoring.

These restrictions could — in theory — cut someone off from loans, transactions or everyday payments and leave them financially stranded.

But I’m not too concerned about this possibility. Because crypto operates in a parallel system to TradFi, allowing deplatformed individuals to maintain control of their financial autonomy.

Even in a hyper-digitalized world.

Bottom Line

Does this mean you should dump your gold today and load up on nothing but BTC.

Not at all.

As my colleague Bob Czeschin noted yesterday, failing to diversify your portfolio is one way investors can get themselves in trouble.

What I am saying is that your safe-haven strategy can’t be complete without at least some Bitcoin in your wallet.

At this point, even TradFi titans like JP Morgan have come to recognize this truth.

When it comes to how to add BTC — and even some digital gold — to your portfolio, I suggest you check out Juan Villaverde’s Weiss Crypto Investor strategy.

That’s where uses his Crypto Timing Model to zero in on the best times for long-term investors to buy and sell crypto’s blue-chip assets.

Best,

Marija Matić