|

| By Bruce Ng |

In the recent market dump, crypto took quite a hit.

It was first triggered by the Securities and Exchange Commission’s witch hunt of centralized exchanges Binance and Coinbase (COIN). Then, this was followed by multiple asset delistings by large exchanges like Robinhood.

To determine whether we go up or down from here, let’s take a trip down memory lane and visit Bitcoin’s (BTC, “A-”) price history. We can learn an important lesson here.

You see, Bitcoin has been following a pattern that has repeated itself multiple times. Every four years, BTC undergoes what is known as a halving. In each halving, the quantity of BTC produced every 10 minutes is reduced by half.

Now, the amount of BTC produced every 10 minutes is 6.25 BTC. After the next halving — which will occur in April 2024 — the block reward will be halved to 3.125 BTC.

To track the halving date precisely, you can use this countdown timer.

Bitcoin halvings are important because they mark a huge reduction in supply emission. For an asset like Bitcoin, supply is known many years in advance. So, demand is the only thing that drives prices.

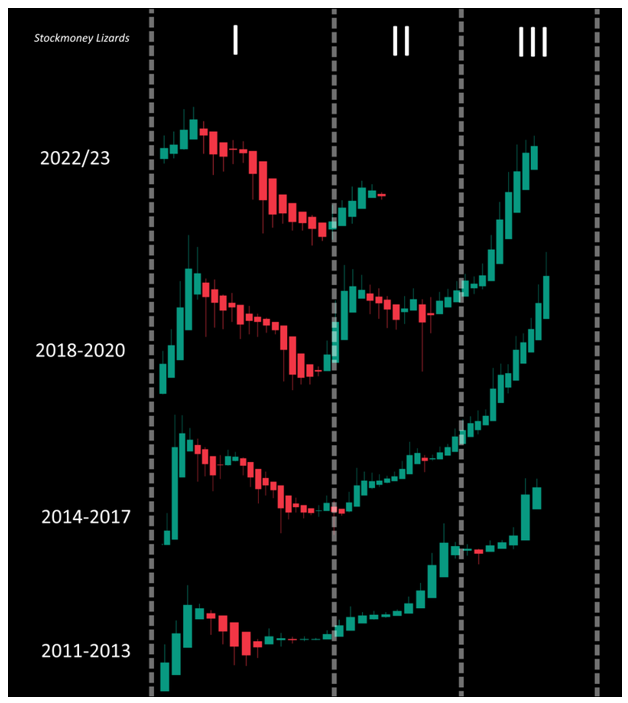

In fact, before every halving, we typically see the same price pattern play out as shown below:

In the image above, it is quite uncanny that all three previous price patterns leading up to halvings play out the same way.

They also undergo the same phases, namely:

- Bear market

- Consolidation and upward

- Bull market

Where we are at now in 2023 is most similar to 2019. To illustrate what I mean, let’s compare the price action between 2019 and 2023 below:

In 2019, BTC had a breakout in April. This was followed by a 147-day rally and then further downside.

Now, in 2023, BTC also had a breakout. And 147 days after, BTC is retracing. If BTC repeats history, we have further downside ahead of us in the coming months.

Looking ahead, if we dip further, the levels of $23,000 and $20,000 should act as strong support.

But fret not, this further downside should be followed by upside at the end of the year.

Then, this should continue into a full-blown bull market in 2024. Of course, all this is assuming BTC repeats its price action from history.

Indeed, there is little reason to doubt that history won’t repeat itself. Halvings have always been bullish leading into and out of them.

But one important factor to consider is that each time BTC halves, profits diminish. We are in the era of diminishing returns for BTC.

However, large gains can still be made with altcoins. And to learn how to pick the most profitable alts, I suggest you check out my colleague Juan Villaverde’s Weiss Crypto Portfolio.

Best,

Bruce