Bitcoin (BTC, “A-”) has always fascinated me.

I remember closely following the Cypriot banking crisis in 2012. Back then, people were desperately searching for ways to protect their savings from a collapsing financial system and internal capital controls.

In that moment, Bitcoin emerged. Not just as a novel technology, but as a lifeline, a digital escape hatch from the vulnerabilities of traditional banking.

Fast forward to today and Bitcoin has moved beyond just a store of value or speculative asset. Now, it’s starting to revolutionize traditional financial products.

And there’s one company that is pioneering a way to merge Bitcoin’s potential with a rather unexpected industry: insurance.

Meanwhile: The Life Insurance Paid in BTC

Meanwhile is a Bitcoin-based life insurance company. Founded in 2022, its founders, Zac Townsend and Max Gasner, had a clear vision: to leverage Bitcoin’s unique properties to transform the life insurance industry.

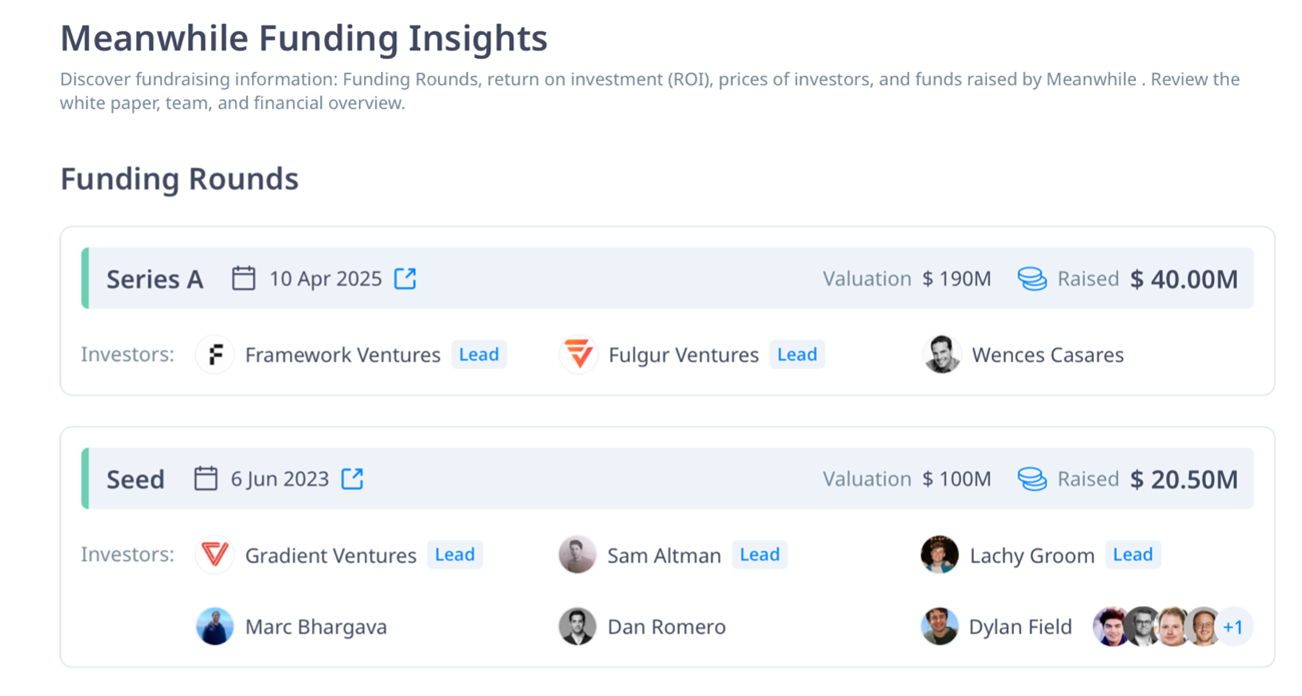

Licensed and regulated by the Bermuda Monetary Authority, Meanwhile has quickly made headlines … and attracted over $20 million in seed investment from big names like Sam Altman and Google’s Gradient Ventures.

Building on the first investment they recently completed a $40 million Series A round led by Fulgar Ventures and Framework.

But why is Meanwhile capturing so much attention?

Simply put, because it offers something we’ve never seen before — a life insurance policy denominated entirely in Bitcoin.

How Bitcoin Whole Life Insurance Works

Meanwhile’s Bitcoin Whole Life Insurance is at the same time comfortingly familiar and refreshingly different from traditional life insurance.

Here’s how it works …

-

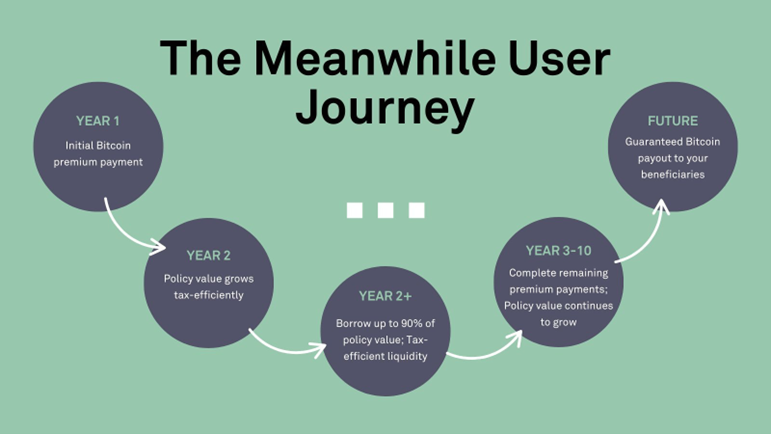

Premiums in BTC: Policyholders commit to paying their insurance premiums in Bitcoin over a fixed period, typically ten years.

This means you’re investing your Bitcoin into a policy designed to grow over time.

-

Bitcoin Death Benefits: When the insured passes away, the beneficiaries receive the death benefit in Bitcoin, not in fiat currency like traditional policies.

This could offer substantial value appreciation if Bitcoin continues to grow in price. Especially when compared to traditional fiat-based insurance policies, whose value often erodes due to inflation.

-

Unlock Your BTC in Between: After just two years of premium payments in BTC, Meanwhile allows policyholders to borrow up to 90% of the policy’s value. This is a huge benefit, especially if you’re hesitant to sell your Bitcoin holdings due to tax consequences or because you believe Bitcoin’s price will continue rising.

This flexibility makes it a powerful tool for those looking to maintain liquidity without prematurely exiting their Bitcoin positions.

But that’s not all. Meanwhile’s Bitcoin life insurance offers impressive tax advantages.

Namely, borrowing against your Bitcoin policy doesn’t trigger capital gains tax. This is particularly advantageous for long-term Bitcoin holders who’ve accumulated significant appreciation and wish to access funds without hefty tax bills.

But borrowing against your policy does reset your cost basis. That is, when you borrow Bitcoin against your policy, the loaned Bitcoin receives a new cost basis.

This potentially transformative aspect significantly reduces your future capital gains tax liabilities if you later sell the Bitcoin after repaying your loan.

Additional Meanwhile Services

While BTC-fueled life insurance is Meanwhile’s bread and butter, it also offers estate planning, which has traditionally been challenging when it comes to BTC.

After all, securely storing Bitcoin, managing private keys and ensuring beneficiaries understand how to access funds after your passing can be daunting.

Meanwhile addresses these concerns by directly managing your BTC. This removes the complexities and risks associated with private key management. Beneficiaries thus enjoy a seamless and straightforward inheritance process.

However, it does mean you forgo a core ideology of crypto: trustlessness.

You’ll have to put a lot of trust in Meanwhile to handle what happens to your Bitcoin when you’re gone.

As such, Bitcoin life insurance isn’t necessarily for everyone. But it can be especially appealing if …

- You’re bullish on Bitcoin’s long-term prospects as a store of value.

- You want to integrate Bitcoin into your broader financial strategy without selling or incurring immediate tax liabilities.

- You seek innovative estate planning solutions that safely incorporate cryptocurrency holdings.

The Road Ahead: Opportunities and Considerations

Meanwhile is currently available to U.S. residents. And it holds significant potential for global expansion as Bitcoin adoption rises.

Yet, two main concerns remain that prospective users should be aware of:

Bitcoin’s volatility: Bitcoin’s price is notoriously volatile. While potentially highly rewarding, this also entails substantial risk. Potential policyholders should be comfortable with these fluctuations.

Regulatory landscape: Cryptocurrencies operate within an evolving regulatory framework. While Bermuda currently offers stability, international regulatory changes could influence the product's attractiveness or accessibility.

Final Thoughts

Having analyzed and traded Bitcoin for over a decade, I view Meanwhile’s innovation as a significant step toward integrating cryptocurrency into traditional finance.

The strategic benefits around liquidity, tax planning and inheritance are particularly compelling.

And it shows Bitcoin’s strong potential to reshape global financial systems.

Whether you pursue this opportunity or not, Meanwhile’s approach undeniably signals a significant advancement.

As always, you’ll need to do your own research and consult with professionals to see if Meanwhile’s services have a place in your financial planning.

But even if you decide Meanwhile’s policies aren’t for you, there’s no denying the exciting reality it represents: As Bitcoin continues to evolve, its horizons and influence will continue to expand.

And with it will come even greater crypto adoption and acceptance.

Welcome to the future of finance.

Best,

Mark Gough