Bitcoin Treads Water After Wholesale Inflation Miss

|

| By Sam Blumenfeld |

The November Producer Price Index numbers came in higher than expected with a 0.3% monthly gain.

In response, Bitcoin (BTC, Tech/Adoption Grade “A-”) and other cryptos are trading slightly lower.

Now, the investors are looking forward to the Consumer Price Index data that’ll be released on Dec. 13. This should shed additional light on the Federal Reserve’s progress fighting inflation.

That CPI report will be critical because it comes a day before the Fed’s interest rate policy decision on Dec. 14. The market widely expects central bankers to slow the pace of interest rate hikes to 50 basis points after four consecutive increases of 75 bps.

As for our largest crypto by market cap, Bitcoin is down less than a percentage point today as it hovers slightly above $17,000.

The critical support level to watch is still $15,500, because a drop below it would establish a new bear market low. If Bitcoin can establish $15,500 as the bear market floor, it would likely follow up with a period of extended sideways trading.

Bitcoin currently sits above its 21-day moving average of $16,700, but its price action isn’t notable unless it either drops below $15,500 or jumps past $19,500.

Here’s Bitcoin’s price in U.S. dollars via Coinbase (COIN):

Click here to view full-sized image.

Meanwhile, Ethereum (ETH, Tech/Adoption Grade “B”) has shown considerable strength despite market turmoil caused by the FTX collapse and resulting calls for regulations.

Like Bitcoin, Ethereum is also down less than a percentage point today, and it’s sitting at $1,275.

ETH’s chart looks stronger than BTC’s, as it currently trades right where it did in the middle of October. Ethereum is not in any immediate danger of retesting its bear market low of $880 without a significant sell-off.

ETH is trading above its 21-day moving average of $1,220, and it quickly bounced off that level when tested on Wednesday.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Click here to view full-sized image.

Looking forward, ETH is lined up to have an exciting 2023.

Ethereum developers released a promising update earlier this week by predicting a tentative March 2023 Shanghai hard fork date, which will allow staked ETH withdrawals.

The network will also implement another scaling solution later in the year with “sharding,” which will segment the network into “shards” to raise its capacity and reduce fees.

Index Roundup

The crypto market lost minor ground this week, and the damage was minimal for the most established cryptos. The market continues swaying back and forth as investors digest macroeconomic data and how it impacts future interest rate policy.

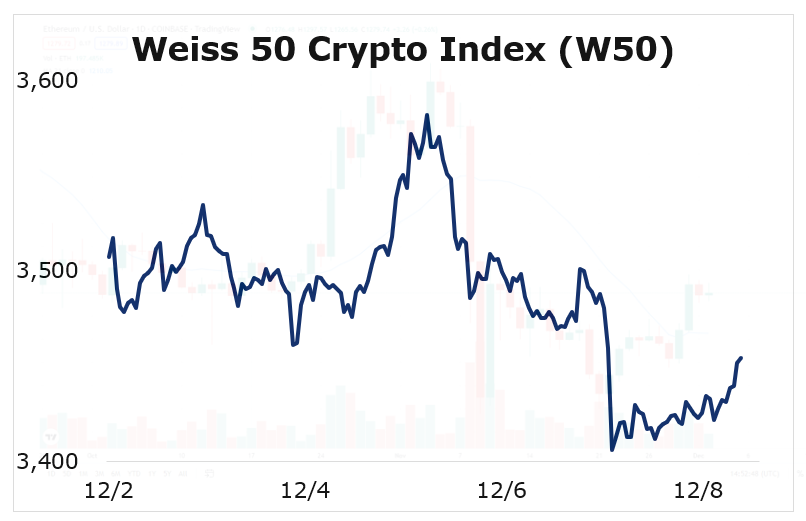

The Weiss 50 Crypto Index (W50) dipped 1.51%, as most cryptos finished the week slightly below where they started.

Click here to view full-sized image.

The Weiss 50 Crypto Ex-BTC Index (W50X) lost 2.33%, showing Bitcoin slightly outperformed the broader market.

Click here to view full-sized image.

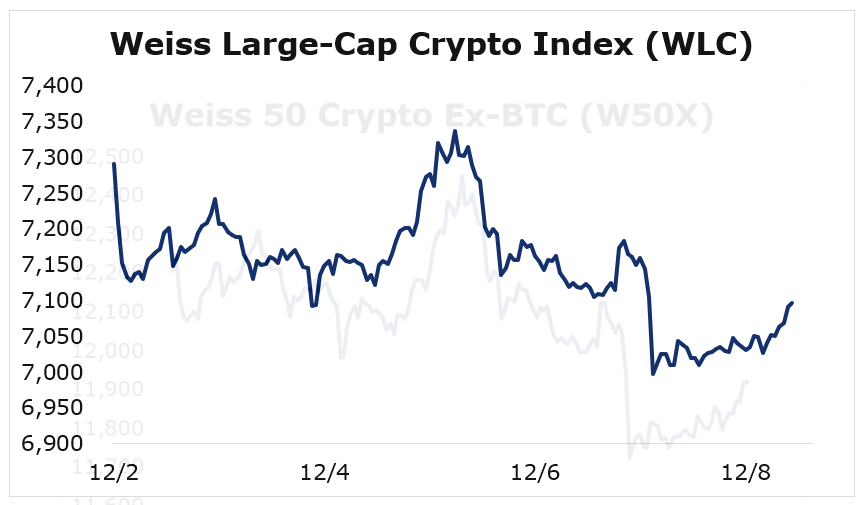

Breaking down this week’s performance by market cap, the largest and mid-sized cryptos outperformed their smaller counterparts.

Large-cap cryptocurrencies managed to log the best week by a small margin, as the Weiss Large-Cap Crypto Index (WLC) slipped 2.67%.

Click here to view full-sized image.

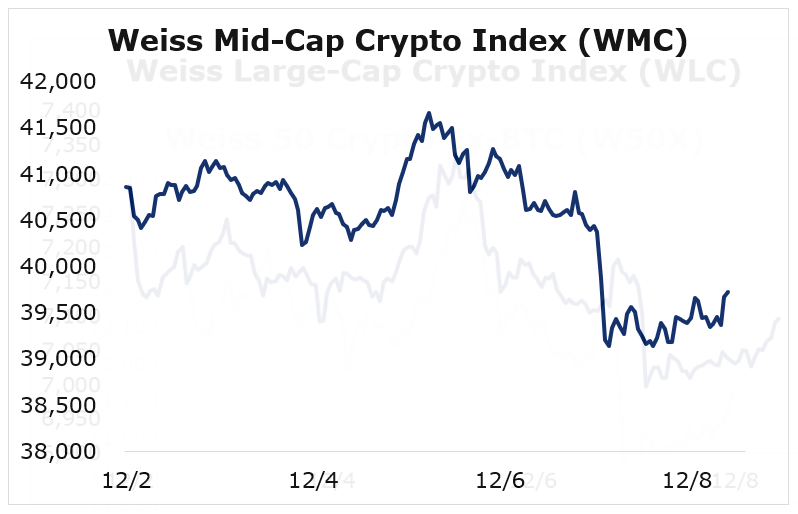

The mid-caps finished just behind the large-caps, as the Weiss Mid-Cap Crypto Index (WMC) decreased 2.77%.

Click here to view full-sized image.

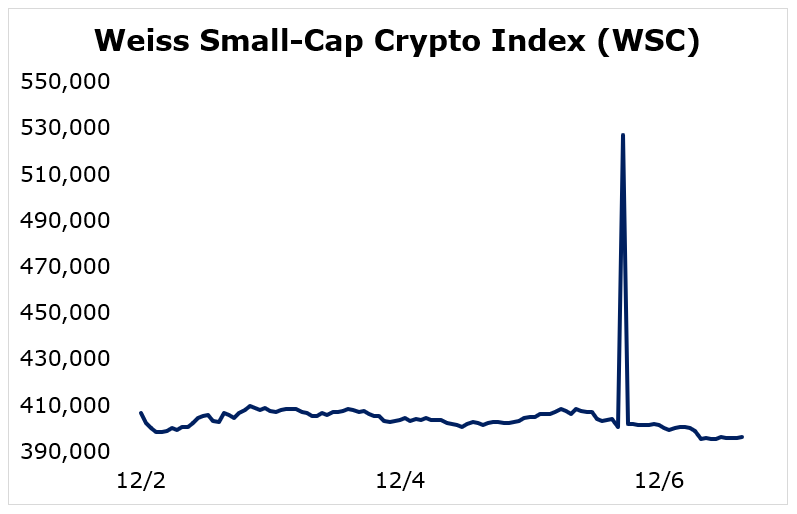

Small-cap cryptos underperformed this week and experienced the most volatility. The Weiss Small-Cap Crypto Index (WSC) declined 7.21%.

Click here to view full-sized image.

The crypto market is still trying to stabilize after Bitcoin set a new bear market low on Nov. 9. But as long as the market leader doesn’t set lower lows, sentiment should remain neutral.

On the bright side, it’s a positive sign for altcoins that Ethereum continues showing strength.

Notable News, Notes and Tweets

- The Securities and Exchange Commission will require publicly traded companies to report their exposure to bankruptcies and other risks after the fallout from FTX’s collapse rippled throughout the industry.

- Despite the negative crypto price action during the bear market, institutional and government adoption continue progressing.

- U.S. legislators proposed a bill looking to assess the environmental impacts of crypto mining.

What’s Next

All things considered, it’s promising that the crypto market is holding up right now. But it isn’t out of the woods yet, as the FTX situation is still playing out.

Macro conditions could continue acting as a headwind for crypto prices while investors weigh inflation and recessionary risks, so a lot will depend on the upcoming CPI data and the Fed’s interest rate decision.

Regardless, the crypto market’s outlook seems extremely bright as institutional and government adoption ramps up.

This week, Porsche announced it would enter the web3 space with non-fungible tokens, while Brazil and the U.K. move forward with integrating crypto into their financial systems.

As the market moves closer toward the end of crypto winter, adoption should play a critical role in the next bull run.

Best,

Sam