|

| By Chris Coney |

If you ask any investor about their biggest gripe with cryptocurrencies, you’ll probably get this response: transaction fees.

Most transactions in the crypto world have fees attached to them — an unfortunate consequence necessary to sustain the networks and blockchains that make up the ecosystem.

Thankfully, by carefully planning a route for your money before you move it, you can minimize fees.

In the past, I’ve shared a trick to efficiently route your money around decentralized finance; you can find the video here and the full transcript here.

Usually, most of my content is born out of discoveries I make in my own personal investing endeavors. What I’m about to share with you is no exception.

The other day, I had to revisit the concept of transaction fees while helping a friend. She had £25,000 (nearly $30K) in savings that she wanted to move over to the Polygon (MATIC, Tech/Adoption Grade “B+”) network to deploy some capital into a liquidity pool.

As luck would have it, Coinbase (COIN) just recently announced that they had integrated deposits and withdrawals to the Polygon network for three different assets: Ethereum (ETH, Tech/Adoption Grade “A”), MATIC and USD Coin (USDC).

That worked out great because USDC was the asset we wanted to move the capital into and then withdraw to the Polygon network.

At first, this looked like it was going to be easy.

The first obstacle, however, came when we realized that Coinbase Pro no longer offers the opportunity to convert British pounds into USDC.

So, for our second attempt, we used the regular Coinbase website.

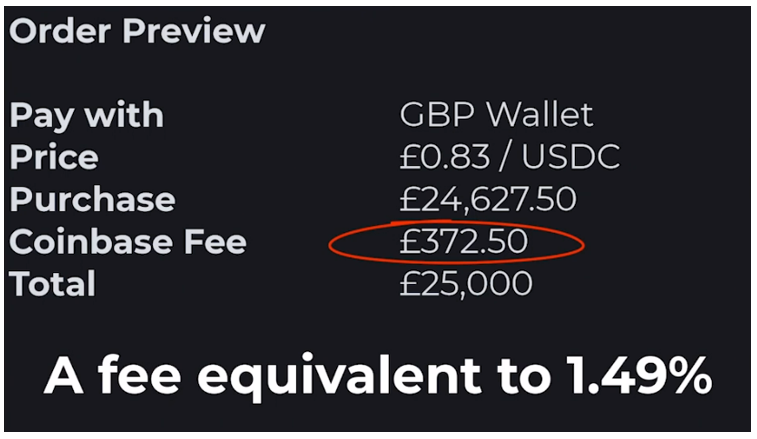

This platform did give us the option to buy USDC using GBP, but quoted us a fee of £372.50, or 1.49%.

To that I said, “No bloody way.” That’s an immediate 1.49% wiped off our return on investment.

In fact, it’s even worse because we would have less capital to deploy from the start.

Fortunately, most exchanges give you a final order summary — including fees — before you press the “Buy” button. In this case, we clicked the “Back” button.

With a little brainstorming, I considered what other exchange allows USDC to be withdrawn to the Polygon network.

The answer was Binance.

Note: Binance isn’t available to those who live in the U.S. If you live in the U.S., you may need to do your own research to find the cheapest route.

But how did we get the capital over there in the lowest cost way?

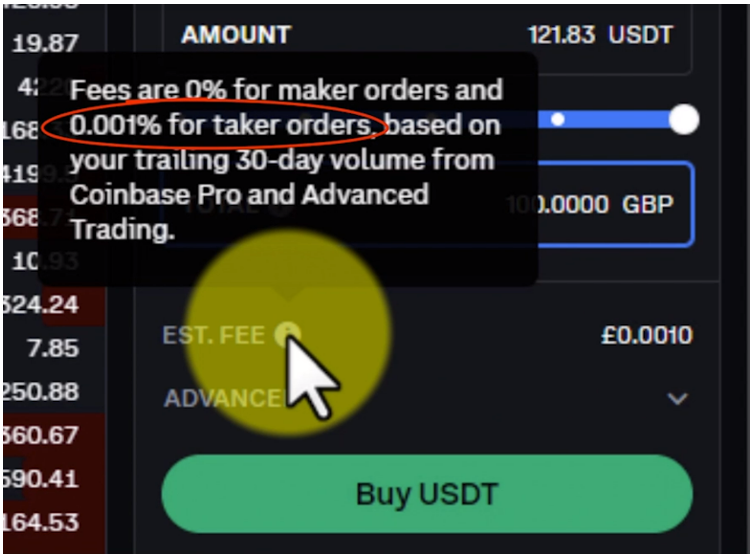

First, we looked back at the Coinbase Advanced Trading interface and noticed that while they wouldn’t let us buy USDC with GBP, they wouldlet us buy Tether (USDT).

And the fee for that transaction was quoted at a much lower £0.25 — or 0.001% — on the £25,000.

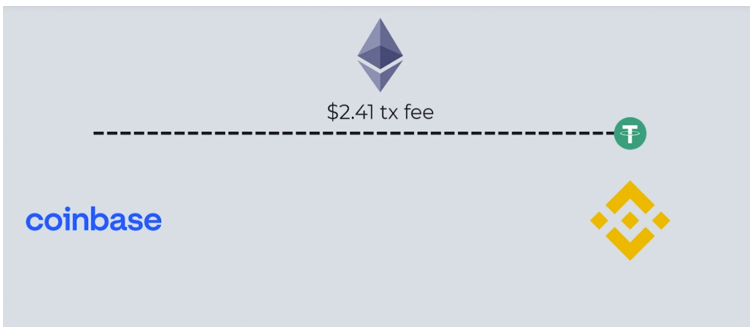

After we went ahead and completed that trade, we generated a receiving address on Binance and sent over all the USDT we’d just bought.

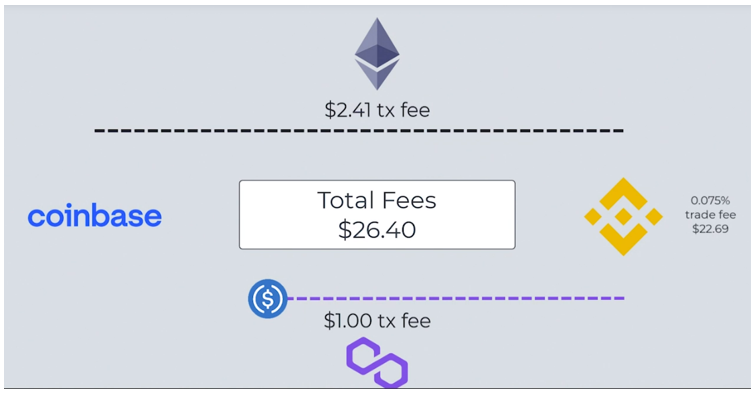

That went across the Ethereum network and incurred a transaction fee of $2.41.

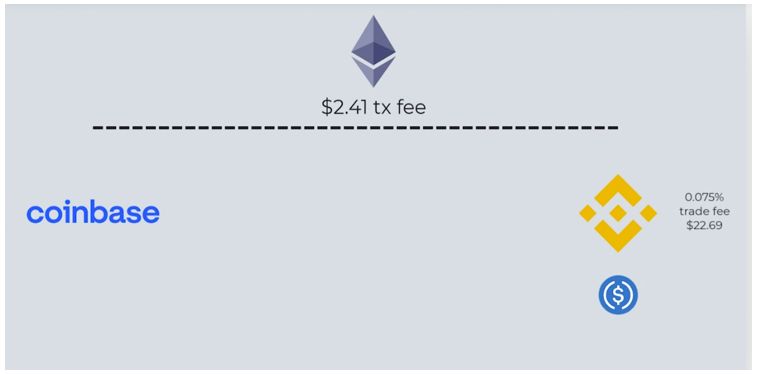

Next, we converted the USDT to USDC on Binance for a low fee of just 0.075%, or $22.69.

Finally, we withdrew our USDC from Binance directly to our Polygon Wallet, which incurred a withdrawal fee of just $1.

In total, the whole exercise from start to finish ended up costing us only $26.40 in trading and transaction fees.

Recall that had we gone through Coinbase in the original way, it would’ve cost us $451.73.

With this method, we saved a whopping 94.16%!

The key to making this strategy work was the incredibly low trading fee offered by Binance at just 0.075%.

Because blockchains are data networks, they don’t really care about the value of a transaction; all they care about is how much data a transaction uses.

The more data it uses, the higher the fee. It doesn’t matter if you’re transacting $1 or $1 million.

When it comes to trading fees, however, it’s the other way around — it’s allbased on the transaction value.

And this is where the trading fee quoted by Coinbase at 1.49% was totally outcompeted by the fee quoted by Binance at just 0.075%.

The thing that really sealed the deal for Binance, though, was that they alsolet us withdraw the USDC directly to the Polygon network.

Now, I’ve created a summary spreadsheet of what happened so you can see all this in a condensed format.

I want you to come away from this with an understanding of the value of planning your route.

Don’t get hooked on the specific exchanges I’ve featured here as if either is the secret to efficiently navigating the crypto space.

Like cooking, the wayyou prepare the dish depends very much on the mood, the occasion and even what’s available to you, rather than one secret ingredient.

So, if you take just a small amount of time up front to plan the route your money’s going to take, you can save almost 95% on fees for an instant ROI on that effort.

That’s all I’ve got for you today. Let me know what you thought of this transaction fee workaround by tweeting @WeissCrypto.

I’ll be back next week with more crypto tips, so stay tuned.

Until then,

Chris Coney